Nestle India reported a profit beat, with the bottomline surging 27 percent on-year. This, however, failed to impress brokerages that retained their mixed calls on the FMCG giant.

Nestle India’s standalone net profit came in at Rs 934 crore for the March quarter, up 27 percent from Rs 737 crore a year ago. Revenue rose 9 percent to Rs 5,268 crore, up from Rs 4,831 crore, the FMCG major said in a regulatory filing.

Broad-based growth

All segments supported Nestle India’s headline growth. Motilal Oswal said the milk and nutrition category achieved growth, despite inflationary headwinds, while the Maggi-brand led growth in prepared dishes and cooking aids. Confectionery and beverages also delivered healthy performance during the quarter.

Also Read | Nestle India net profit rises 27% to Rs 934 crore

Volumes might suffer

Prabhudas Lilladher expects Nestle India’s volume growth to suffer in the near term as a result of the negative publicity and FSSAI probe on the higher sugar content in their baby food offerings. The increase in chocolate prices as a result of the 175 percent jump in cocoa prices since December 2023 will also impact volume growth, as chocolate prices have increased.

As a result, Nestle India has decided to expand its portfolio, by launching Nespresso in India and setting up a JV with Dr Reddy’s to offer nutraceutical products, to bring science-backed nutritional solutions to more consumers.

Inflation to suppress margins

Nestle India’s strong pricing power has allowed it to negate inflationary headwinds from coffee and cocoa prices. Gross margins expanded by 299 basis points on-year to 56.8 percent, but dropped 180 bps on a sequential level.

Milk prices will also see a seasonal uptick in the summer and the price of palm oil and sugar have bottomed out. Therefore, experts believe that the firm’s gross margins might be close to peak.

“We believe that gains from soft RM has been derived, and incremental margin expansion will come at a tepid pace given expected inflation in cereals, grains, and coffee, cocoa and milk prices,” said Prabhus Lilladher. Morgan Stanley also added that it foresaw headwinds to growth and margins for FY25.

Also Read | Nestlé India to form JV with Dr Reddy’s for nutritional health solutions

Rural sees pick up

The Maggi maker’s strategy has been centred around its RURBAN concept, and thus, has seen higher growth in those markets. “The distribution penetration has been benefiting Nestle India across most of its categories. Packaged food penetration has improved in the tier-2 and rural markets,” said Motilal Oswal.

Other FMCG players have been battling muted demand from the rural sector, with volumes and revenue facing pressure.

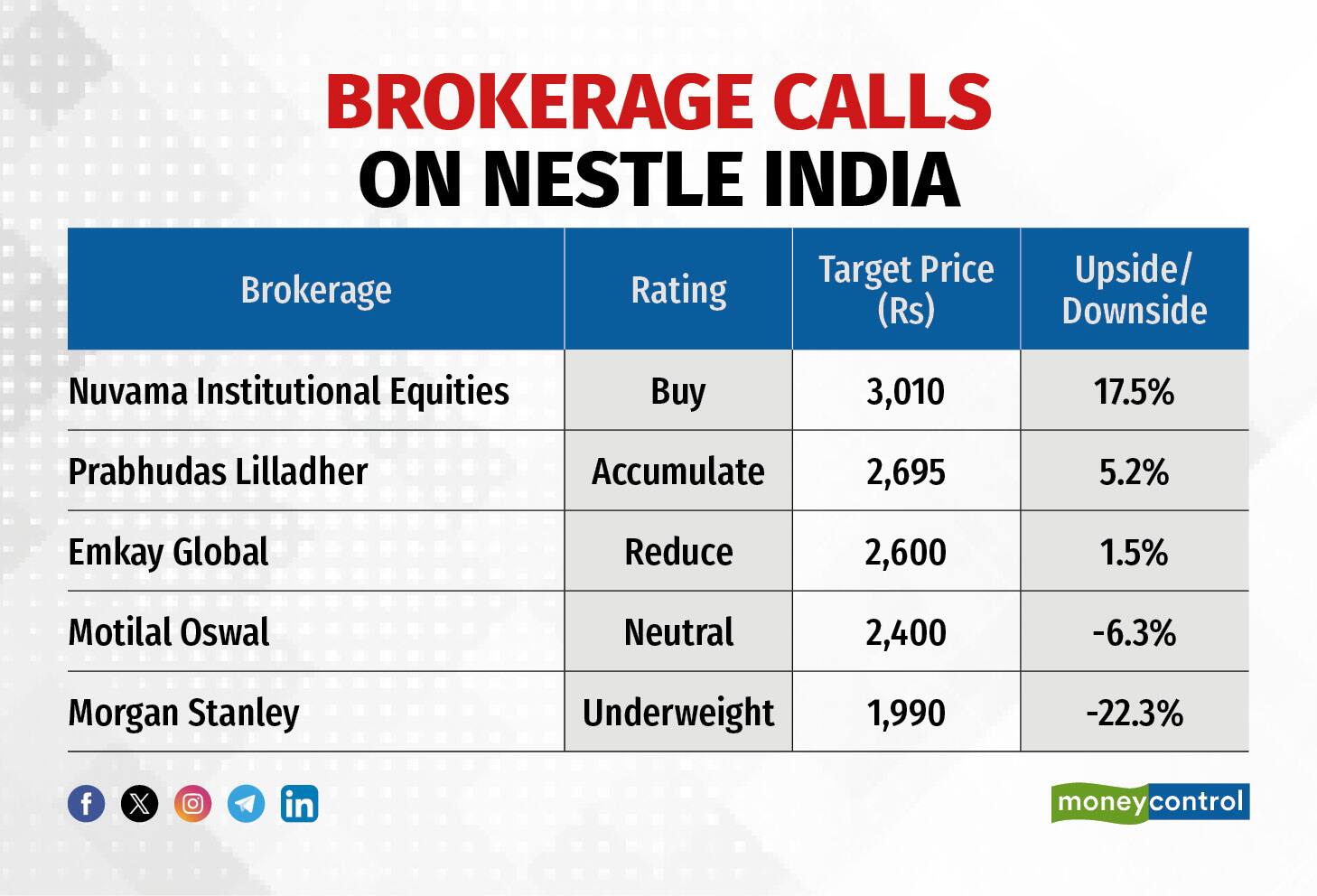

Stock Call: Should you buy, sell or hold?

Emkay Global maintained its reduce call. “Given that the positives are in the price, the stock offers little upside despite the generous valuations. We see any further rerating muffled by pressure on RoCE ahead,” it said.

Prabhudas Lilladher retained its accumulate rating, as it expects headwinds from the Cerelac issue, rising commodity prices and rich valuations of 64.2x CY25 EPS.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!