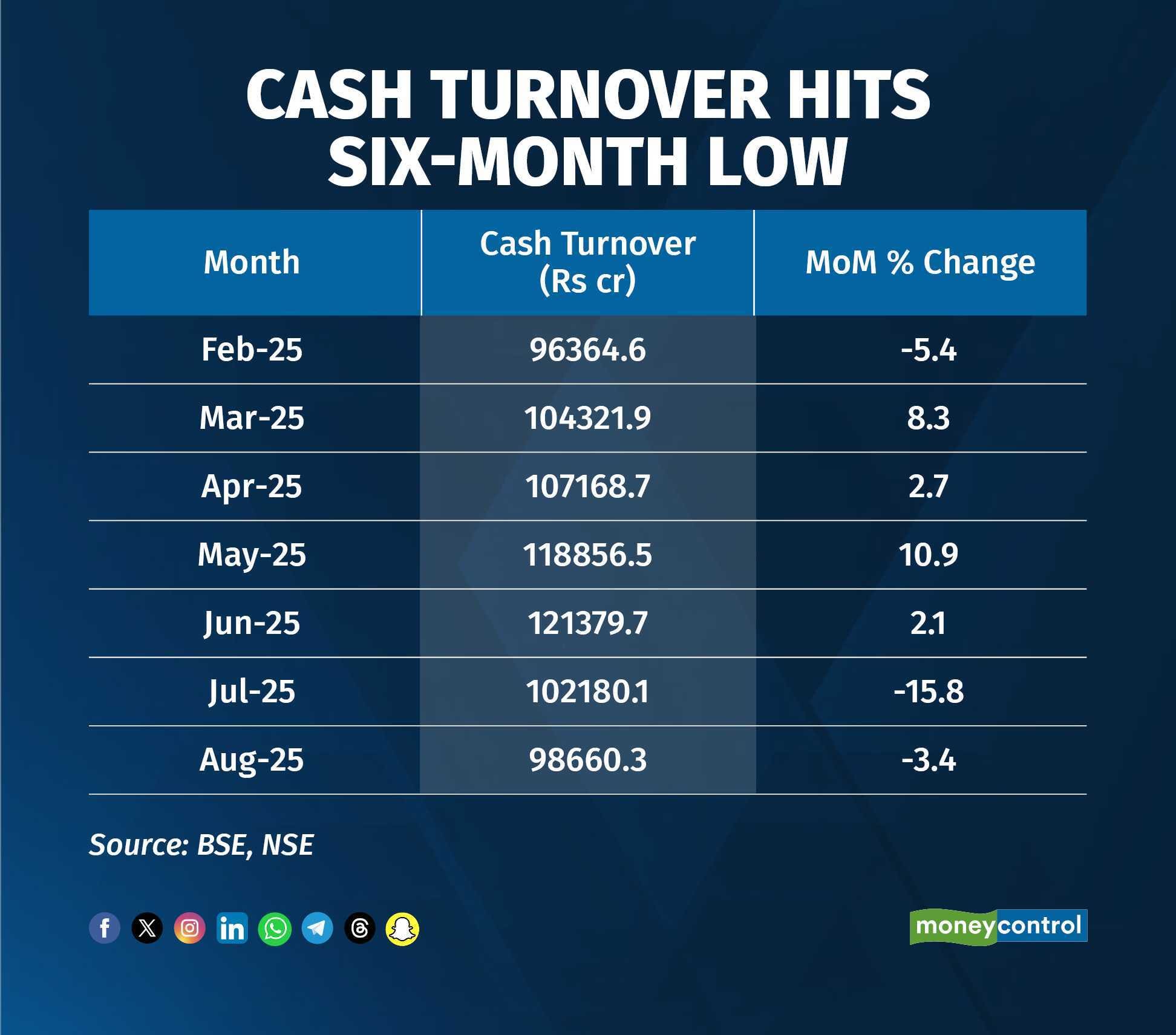

The combined cash market turnover of the BSE and NSE continued to weaken in August, slipping to a six-month low, as volatility in Indian equities kept investor participation subdued.

Exchange data showed that the average daily turnover in the cash segment has dropped below Rs 1 lakh crore so far in August, marking the lowest level since February.

This is also the second consecutive month of decline on a month-on-month basis and down nearly 20 percent from June, underscoring the absence of a strong rally that had previously spurred momentum-driven trading. Instead, benchmark indices have largely moved sideways in recent weeks, leading to muted volumes.

Market sentiment has also been weighed down by persistent global uncertainty, especially around trade and tariff issues. However, domestic liquidity remains resilient. Systematic Investment Plan (SIP) inflows touched record highs, reflecting continued confidence of retail investors in India’s long-term growth prospects.

Puneet Singhania, director at Master Trust Group, said the government must take steps to deepen the cash market and enhance volumes. “The reduction of Securities Transaction Tax (STT) is critical, as higher STT makes cash market trading more expensive compared to options,” he noted.

Experts added that while flows into primary markets and block deals have remained robust, direct investor sentiment in the secondary market has weakened due to lacklustre returns over the past year.

Independent market analyst Ajay Bagga observed that elevated STT remains a key drag on cash segment activity, discouraging participation from ultra-high-net-worth individuals and institutions. He also pointed out that rising transaction charges and taxes are further eroding traders’ returns, while some of the activity has shifted to the booming primary markets.

Meanwhile, turnover in the derivatives segment also eased, with Futures & Options (F&O) turnover slipping marginally to Rs 220 lakh crore in August. Analysts attributed this to the Securities and Exchange Board of India’s tighter norms on F&O trading, aimed at curbing excessive retail speculation.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.