Even as foreign institutional investors (FIIs) continue their selling spree and have seen a decline in their assets under custody (AUC) in equity holdings amid Indian market corrections, other institutions and investor categories have experienced even steeper portfolio erosion in percentage terms.

These include Hindu Undivided Families (HUFs), brokers, partnership firms, Foreign Currency Convertible Bonds (FCCBs) holders, and financial institutions. This sharp decline in assets under custody may be due to a drop in stock prices or investors cashing out amid the market turmoil.

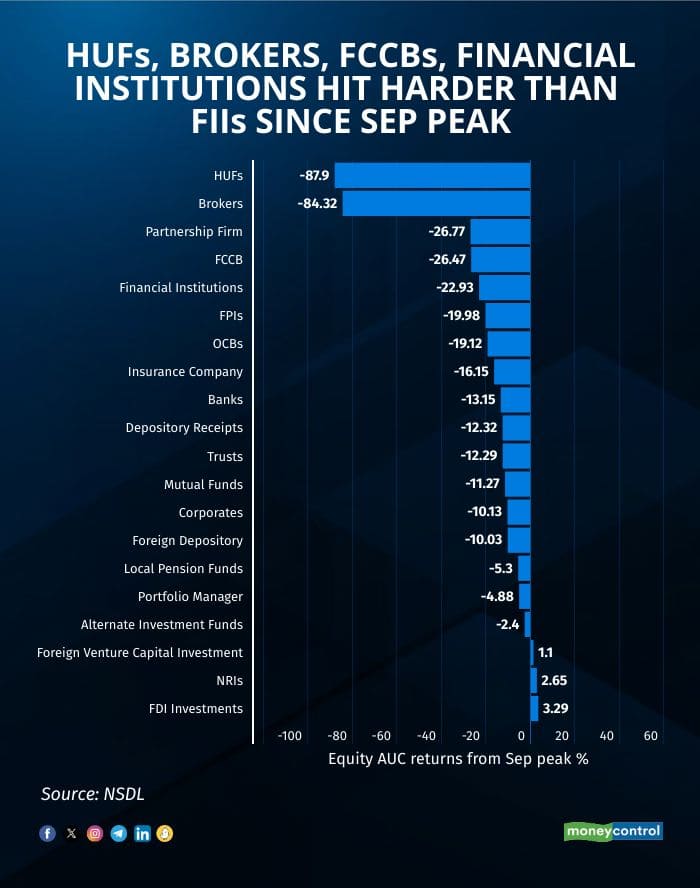

Since the September peak, HUFs saw the sharpest decline, with their equity holdings dropping over 87 percent from their September peak, followed by brokers and partnership firms, which recorded declines of around 85 percent and 27 percent, respectively. FCCB holders and financial institutions also faced significant erosion, with their equity portfolios shrinking by over 26.5 percent and 23 percent, respectively.

While FIIs saw their AUC in equity decline nearly 20 percent from the September high, their absolute losses remain substantial. However, in percentage terms, FIIs rank sixth in terms of erosion.

Foreign investors have remained net sellers in Indian markets, offloading over Rs 2.5 lakh crore since the start of September amid concerns over elevated valuations, a slowing economy, and escalating global tariff wars. Benchmark indices Sensex and Nifty have lost around 4.5 percent each year-to-date, while broader indices BSE MidCap and SmallCap have declined over 14 percent and 17 percent, respectively.

Apart from these, insurance companies, banks, depository receipts, trusts, and mutual funds saw their AUC in equity erode between 11-16 percent. Corporates, foreign depositories, local pension funds, portfolio managers and alternate investment funds witnessed equity holding erosion ranging from 2-10 percent.

Despite the broader market correction, foreign direct investment (FDI) portfolios in equity rose by around 3.3 percent, while NRI and foreign venture capital investments increased by around 2.6 percent and 1.1 percent, respectively.

With Indian markets showing no clear signs of recovery, investor sentiment remains divided. At the recently held Moneycontrol Global Wealth Summit 2025 in Mumbai, ace investor Shankar Sharma expressed a bearish outlook, predicting that the Nifty 50 index would deliver zero returns from its September 2024 highs over the next four to five years. Meanwhile, fellow investor Sameer Arora held a more optimistic view, suggesting that the market could bottom out in the next one to two months and potentially rise by 5-10 percent.

According to analysts, Nifty's persistent decline since September, despite no global risk-off, is rare. The correction stems from weak earnings amid high valuations. With India's valuation premium to EM now at its 10-year average, de-rating seems priced in. RBI easing may offer short-term relief, but global risks—US growth slowdown and MAGA-driven volatility—could trigger further downside, analysts warn.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.