Ruchi AgrawalMoneycontrol Research

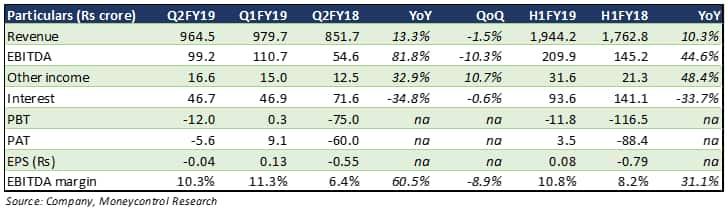

Indian Hotels Company (IHCL) reported an encouraging performance in a seasonally weak quarter. The topline grew 13.3 percent year-on-year (YoY) amid improvement in occupancies and rates. Earnings before interest, tax, depreciation, and amortisation (EBITDA) saw a strong 82 percent YoY growth and margin expansion of 390 basis points (bps) on the back of revival of the international segment and strong growth in domestic food and beverage revenue.

What contributed to the improved performance

The strong growth during the quarter was driven by a substantial uptick in occupancies and rates which led to improved RevPARs (Domestic + 8.1 percent YoY, International +5.4 percent YoY). The international segment has now started contributing positively and facilitated the growth in consolidated EBITDA. Margins in the domestic segment saw strong 240 basis points expansion. However, the 45.3 crore loss on currency derivative impacted the quarter's profitability.

Going forward, the company aims to improve margins by hiking rates wherever possible, increase in management fee income, higher income from new inventory and cost optimisation in payrolls and corporate overheads.

Improving sector dynamics

The supply-demand dynamics are turning increasingly favourable for the company. The supply glut has eased. There has been a parallel increase in the demand owing to increasing disposable incomes and brand awareness. This is helping to improve occupancies and giving pricing power thereby improving rates. With this the RevPARs are now improving.

Clean balance sheet

Post the phase of restructuring, IHCL now has a leaner balance sheet with no net debt. Proceeds from the rights issue in October last year enabled the company to reduce almost Rs 950 crore debt from the books and helped in a substantial improvement in the debt equity profile. Lower debt has led to a cut on the interest cost burden which went down 35 percent YoY in Q2FY19. This helped in improving the overall net profitability with a noticeable reduction in the quarter’s net loss. Low debt and a leaner balance sheet leave scope for expansion, both inorganic and organic.

Brand monetisation

The company is tactically working on monetising its strong brand by expanding via management contract route which is an asset light model. While this would help it in rapidly expanding without much burden on the balance sheet, it also would protect the margins in the downturn periods of the highly cyclical hotel industry.

Flight to branded hotels

Around 25 percent of the Indian hotel industry falls under the branded category, unlike 40 percent in major developed economies. Owing to higher disposable incomes and deeper penetration of technology, awareness and reach, there has been a flight of customers from unbranded to the branded segments globally. IHCL is aiming to capture the branded economy segment through expanding its Ginger brand with several strategically located properties in the pipeline under this segment.

Outlook

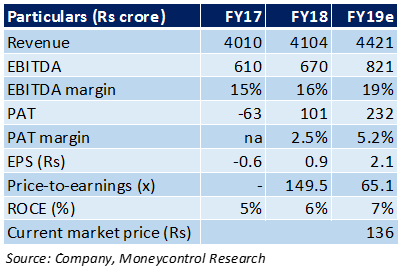

With improving sector dynamics, a revival of the international operations, fast monetisation of the brand via strategic management contract model and improving domestic demand for hospitality services, we stay convinced about the growth story of the company. Moreover, with the weak half gone by, the performance is set to improve in the second half which is seasonally the stronger half and accounts for almost 70 percent of the years revenues.

The stock is currently trading at a 1.15x EV per room which is much lower than that of the international peers. The stock is trading at a 2019e EV/EBITDA of 21x. With strong growth, lean balance sheet and a strong brand, we believe IHCL is positioned to capture the benefits of the segments upcycle.

For more research articles, visit our Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!