Madhuchanda DeyMoneycontrol Research

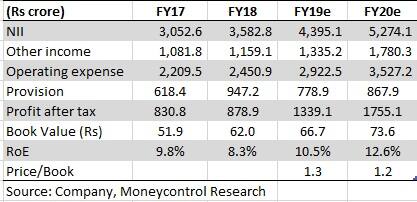

The spurt in Federal Bank’s stock following the announcement of the earnings says it all– it was a good quarter with no sign of asset quality stress which had haunted it in the past. Also, business parameters were steady and to top it all, the outlook and guidance were positive. At 1.2 times FY20 (estimated) book, the valuation looks undemanding even after the near 20-percent rally from its 52-week low.

We had listed Federal Bank as one of our favourites after the disappointing March quarter earnings, and the thesis has played out early enough. However, investors should still look at this mid-sized bank for a longer journey ahead.

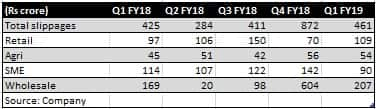

Slippage back to a more normal trajectory

In the June quarter, overall gross slippage fell sharply to Rs 461 crore, compared to the March quarter. More importantly, the management is sticking to its earlier guidance of around Rs 1200 crore of total slippages for this financial year. That is comforting for investors.

Nearly 80 percent of the corporate slippage in the June quarter was from the standard restructured pool whose size thereby has fallen to Rs 581 crore from Rs 792 crore in the previous quarter. So the bank has also reduced its total stressed portfolio (standard restructured, security receipts and net NPA) to 2 percent of advances from 2.28 percent in the previous quarter.

Credit cost has fallen to 71 basis points (from 123 basis points in the previous quarter) and the management expects it to be 70 basis points for the full year.

The confidence stems from the fact that in the standard restructured accounts, there is one large account of Rs 250 crore and the rest are granular exposures and the Special Mention Account (SMA) is at an all-time low.

Quarter at a glance

Federal Bank’s quarterly net profit rose 25 percent year-on-year to Rs 263 crore, helped by a 22 percent growth in net interest income (difference between interest income and expenses). That in turn was driven by a 24 percent growth in loan book. The net interest margin was stable at 3.12 percent.

Non-interest income was impacted by lower treasury gains, and core fees grew 16 percent. Profitability got a boost because of lower provisions on account of stable asset quality. The provision cover (total provision as a percentage of gross non-performing assets), however, declined a bit.

Decent performance on the business front

In the year gone by, Federal Bank’s share in incremental credit and deposit of the system stood at close to 1.9 percent and the bank improved its absolute share in both advances as well as deposits thereby exhibiting success in its efforts to gain market share.

Source: Company, RBI

Business growth momentum remained strong with the advances book growing by 24 percent driven by almost all the three segments with SME growing by 17 percent, retail 20 percent and corporate by 24 percent. The bank is consciously improving the quality of the book with 71 percent of the outstanding wholesale credit rated “A” and above. The stability in the ratio of risk-weight assets to advances stand testimony to the same.

Falling cost of deposits helped Federal Bank maintained its interest margin despite slight decline in lending yields. At present, 96 percent of the deposits are retail. While low cost current and savings account has stagnated in recent times, the contribution from non-resident rupee (NRE) deposits remain meaningful.

The Middle East accounts for a big share of Federal Bank’s NRI deposits, and the management said flows from this part of the world tend to increase in times of geopolitical uncertainty and rupee depreciation.

Source: Company

The bank is mindful of the need to step up CASA and has identified it as a focused strategy in the year with a target CASA of close to 34.5 percent from the current level of 33.47 percent.

The optimistic guidance that we focus on

The guided improvement in CASA and overall efficiency coupled with lower slippages (hence lower interest reversal) has prompted the management to guide to an improvement in interest margin to 3.20% for FY19 from the current level of 3.12 percent. The bank is also targeting to achieve RoA (return on assets) of 1 percent by the end of FY19.

Federal is taking initiatives to counter the falling yields in corporate by foraying into relatively high margin businesses like unsecured retail credit and CV (commercial vehicle) financing.

Non-interest income is another area of focus as that has been lagging the growth in assets so far. To focus on improving the share of core fees, the bank has recently acquired stake in Equirus Capital - a boutique investment firm and has recruited specialists for treasury sales and government business. The company has got a strategic investor Truenorth in its non-banking subsidiary FedFina that should help in scaling up the business. Federal Bank is also considering acquiring a micro finance lender to gain access to high yielding assets and a wider distribution.

Directionally, the bank appears to be making the right moves. Also, it is well-capitalised, which should help it grow its loan book. However, for a convincing rerating to happen, the management has to deliver on the guidance it has given for FY19.

We are comforted by the progress in Q1FY19 and the management guidance and feel that the valuation is still undemanding in the context of the long growth journey ahead.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!