Sachin Pal

Moneycontrol Research

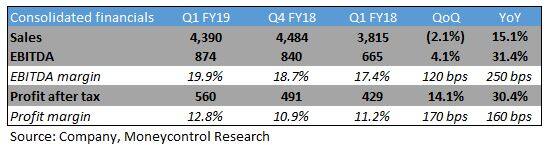

Asian Paints reported a very healthy set of numbers in Q1 FY19 as it delivered strong double-digit volume growth. Margin recovered as the recent price hikes and cost control measures offset inflationary cost pressures. Consolidated net sales increased 15 percent year-on-year (YoY) to Rs 4,390 crore in Q1 FY19. Profit rose 31 percent to Rs 874 crore from Rs 665 crore in Q1 FY18 as margin improved on account of recent price hikes, lower employee costs and other expenses. The bottomline surged 30 percent to Rs 560 crore.

Second successive quarter of double-digit volume growth

Volumes grew in double-digits (12 percent) in the quarter gone by. Low base in Q1 FY18 on account of Goods & Services Tax rollout amplified volume growth in Q1. The demand environment seems to be on an uptrend as the company has delivered the second successive quarter of double-digit volume growth.

The sector is showing signs of a recovery as the economy is gradually recovering post-GST. The industry is witnessing a volume uptick in rural areas while urban areas continue to remain stagnant.

Domestic operations on track

The domestic decorative business continues to do well. The industrial paints business witnessed strong growth in both protective and powder coatings segments. The home improvement business (Sleek and Ess Ess) is in expansion mode and reported a sharp jump in revenue to Rs 91 crore in Q1 FY19 from Rs 63 crore YoY.

Capacity expansion in Visakhapatnam and Mysuru (both having 3 million KL per annum capacity) is on track and is expected to commence production in FY19.

International operations facing some headwinds

While the domestic business seems to be on track, the international business (which constitutes around 10-12 percent of total revenue) is facing a challenging environment. Operations in Africa (Ethiopia and Egypt) and Middle East are facing some challenges on account of adverse currency fluctuations and increased competitive intensity. Business in Asia (mainly Bangladesh and Sri Lanka) was impacted by incessant rains in the quarter gone by.

Delay in price hikes to put pressure on margin

The company witnessed some margin pressure in the past few quarters as key raw materials linked to crude continued to move northwards. A large portion of these raw materials (30-35 percent) are imported. Hence, adverse movement of the rupee against the dollar is adding to industry woes.

Asian Paints has been tackling persistent input cost pressures with gradual price hikes. As input costs continue to inch up, the management is gradually raising prices to pass it on to customers. After the 1.5 percent hike announced in March, it had announced another price hike of 1.9 percent, effective May.

The company was contemplating another price hike in Q2 FY19 to mitigate rising cost pressures. But this has been delayed on account of recent reduction (revised from 28 percent to 18 percent) in GST for paint companies.

Asian Paints is planning to pass on the tax benefit to customers and will now look forward to increasing prices in the second half as billing in distribution channels needs to be adjusted to account for the revised GST rate. On account of the delay in raising prices, the management expects a dip in Q2/Q3 margins as the input cost basket has increased by 10 percent YoY.

Outlook and recommendationAlthough the company has reported a pick-up in volume growth in the past two quarters, the management has a cautious view as demand is yet to witness a broad-based recovery. Competitive intensity also continues to remain at elevated levels. Reduction in the GST rate bodes well for the industry and should help shift entry-level demand from unorganised to organised players. However, delay in price hikes will impact near term margin.

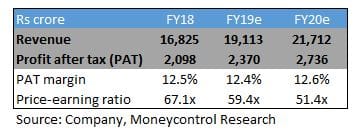

Asian Paints commands premium valuation on account of its market leadership position. The stock is trading near record highs after the recent rally of 15 percent in the past one month. It is now valued at more than 50 times FY20 earnings. We maintain a cautious view on the stock as current valuations offer limited upside considering Asian Paints' trading multiples are near to consumer sector leaders.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!