India's largest consumer staples player Hindustan Unilever's earnings show for the three months ended September as falling consumption caused volume growth to slip under brokerages' estimates.

The Street showed its disappointment as HUL shares cracked nearly 7 percent in trade on October 24. Hindustan Unilever recorded its steepest fall in four years, from when it cracked 6.6 percent on March 23, 2020, following the pandemic related sell-off.

At 9.50 am, HUL shares were quoting Rs 2,482 per share, down 6.7 percent on the NSE.

Hindustan Unilever's consolidated net profit for the July-September quarter declined 2.4 percent to Rs 2,591 crore from Rs 2,668 crore in the same quarter a year ago, falling more than Street expectations. The FMCG giant's revenue expanded 2.1 percent on-year to Rs 16,145 crore.

With most analysts penciling in expectations of HUL reporting a volume growth of 4-5 percent for the quarter, volumes grew 3 percent as demand from the urban areas and metro cities was tepid.

Rural demand continued to recover, outperforming urban demand over the past few quarters. International brokerage JP Morgan noted that slowing urban demand casts a shadow on the demand outlook.

However, during the earnings call, the management noted that the trend was visible across the entire consumer staples landscape, not just HUL. The firm plans on undertaking volume-led growth to drive competition, and isn't shying away from planning further price hikes.

Hindustan Unilever's premium portfolio outperformed the popular and mass segments. The upgradation trend, coupled with premiumization, was evident across rural markets as well, with the trend likely to maintain momentum in the near-future.

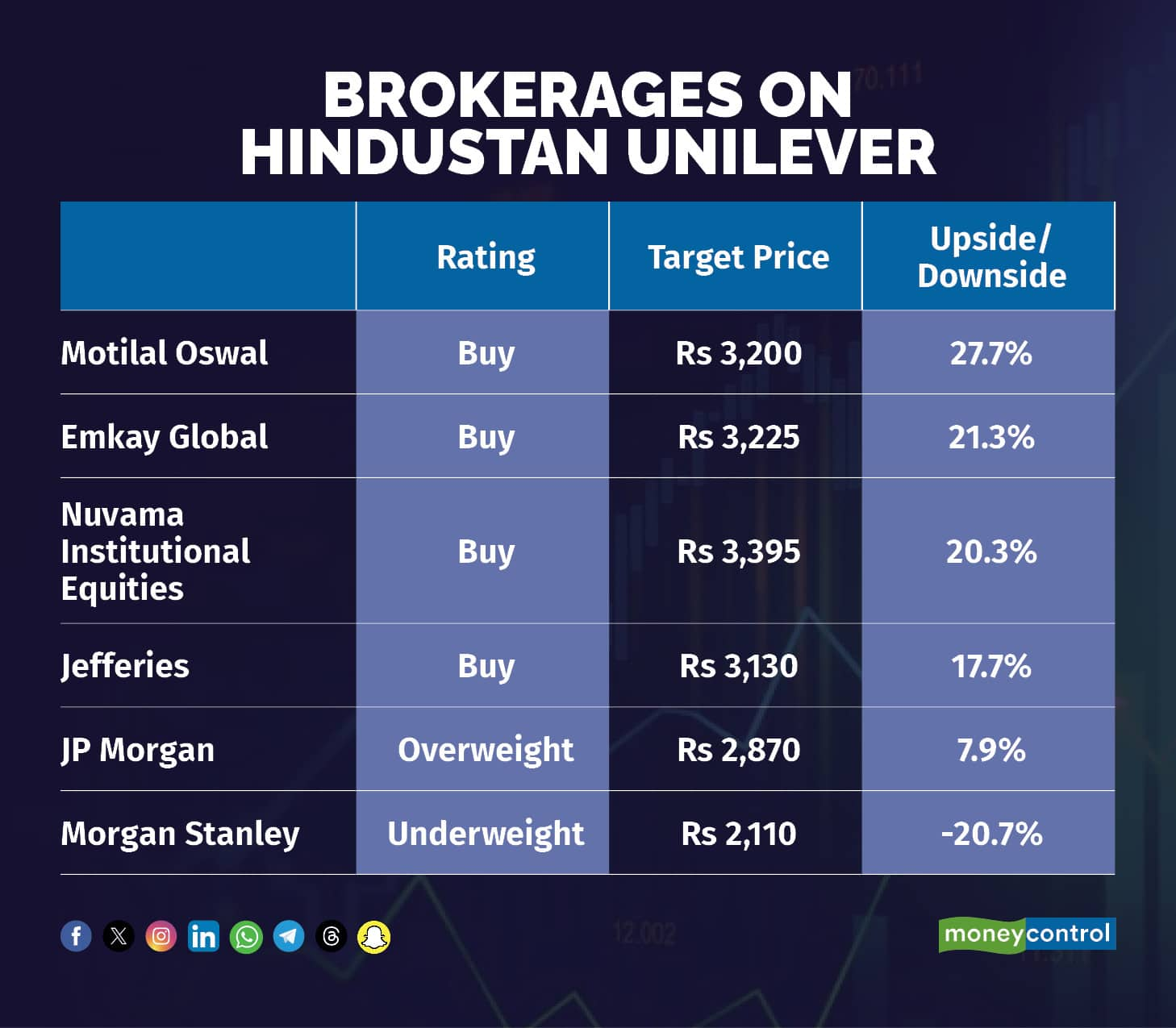

"Despite weakness in overall consumption, we believe Hindustan Unilever can still see an upward growth trajectory," said domestic brokerage Motilal Oswal.

However, international brokerage Investec noted that the lack of margin expansion, as well as no clear demand uptick in the industry, imply that HUL will not see volume growth beyond 4-5 percent in the near-term.

Also Read | Ice cream business is high growth but also high investment & low margin: HUL CEO Rohit Jawa

Separation of ice-cream arm

India's largest FMCG firm announced that its ice cream business, which includes brands such as Kwality Walls, Cornetto, and Magnum, will be separated. The ice cream arm accounted for three percent of HUL's revenues.

Ice cream is a high growth, but equally high investment and low margin business for us, said Hindustan Unilever CEO Rohit Jawa in the earnings call. The ice cream business has always seen limited synergies with the rest of the business, even for a typical kirana store, he said.

The decision follows the announcement, earlier this year, by the company's parent entity, Unilever PLC, about its intention to separate its global ice cream business across jurisdictions.

"In our view, exiting the ice cream business is not the best option. We believe ice cream is a high-growth business, and HUL is a strong number two player," said Nuvama Institutional Equities.

Margins see pressure

During the quarter, gross margins contracted by around 140 basis points to 51.6 percent as a result of rising inflation in the raw material segment. To circumvent pressure on the EBITDA margins, Hindustan Unilever slashed its spending on advertising and promotion by 15 percent, leading to a lower contraction in EBITDA margin by 50 bps to 23.8 percent.

However, in the upcoming quarters, HUL will continue focus on driving gross margins and step up A&P spends to drive underlying volume growth. One of the key methods will be to implement pricing action and bump up prices in low single digits, which will support the topline as well as margins.

"We expect the margin pressure to cease, as HUL has effected price hikes in the Soaps portfolio at end-Q2. The management is also looking to effect calibrated price hikes in the Personal Wash and Tea portfolios, to pass on the inflationary stress," said Emkay Global.

Should you buy, sell or hold HUL shares?

Given the urban slowdown, we are marginally cutting FY25E/26E EPS, said Nuvama Institutional Equities. However, it raised its price target on the firm to Rs 3,395, while maintaining its 'buy' call.

International brokerage Morgan Stanley had a target of Rs 2,110 per share on HUL, as the headline volume growth, of 3 percent, was below its estimates.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.