Information technology (IT) major HCL Technologies is expected to report a tepid Q4, with flattish revenues quarter-on-quarter (QoQ). Its products and platforms (P&P) business is expected to drag down its earnings, even as the services business is expected to provide some succour. The fall in the high-margin P&P business would also hit HCLTech's fourth quarter net profit. The company is scheduled to announce its January-March financial results on April 26.

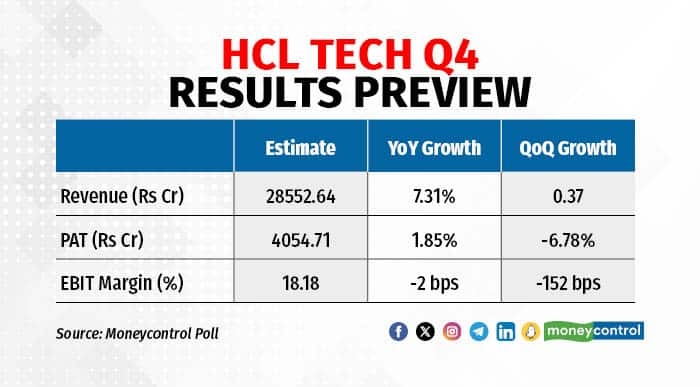

HCL Technologies is expected to report a net profit of Rs 4,054.71 crore in Q4 FY24, down 6.78 percent QoQ, according to the average estimate of seven brokerages. The company is expected to clock revenues of Rs 28,552.64 crore, up only 0.37 percent QoQ. Its EBIT margin may fall 152 basis points (bps) QoQ, to 18.18 percent.

HCLTech Q4 Results Preview

HCLTech Q4 Results Preview

Revenue growth will be driven by the services business, which was boosted by the Verizon deal. In August 2023, HCLTech signed a $2.1 billion deal with Verizon to provide managed network solutions to its global enterprise customers.

“HCLTech's revenue shall grow 0.3 percent QoQ in CC (constant currency) and 0.7 percent QoQ in USD, due to Services (+2.4 percent QoQ) and P&P (-15 percent QoQ, seasonality impact). Services growth shall be driven by the Verizon deal and reversal of furloughs,” said Nuvama Wealth. Motilal Oswal expects its Services revenue to grow 2.7 percent QoQ in CC terms.

The P&P business is expected to decline due to seasonality. According to Motilal Oswal, “The decline in the high-margin P&P business should result in a 120-bps QoQ decrease in profitability during Q4.” ICICI Securities predicts a 12 percent contraction in the P&P business due to a “lack of positive seasonality from Q3FY24.”

Philip Capital noted that margins will be affected by “P&P seasonality, partial wage hikes, and the Verizon deal impact.”

Nuvama expects the company to give a guidance of 4-6 percent YoY growth in CC terms in the Services segment in FY25 , and a margin guidance of 18-19 percent. Motilal Oswal expects a revenue guidance of around 10 percent for FY25.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.