The funds tap of foreign investors is unlikely to go dry soon, analysts said referring to the bullish trend in the market, but pointed out that a reversal in macro fundamentals and rising political political uncertainty may derail the rally any time.

Foreign institutional investors (FIIs) pumped $1.22 billion into local equities so far this month, while their investments stood at $6.72 billion in June. This is the fourth straight month when foreign investors remained net buyers. Since January this year, they invested $11.91 billion into Indian equities, though they pulled out $4.3 billion from the market in the first two months of the year. FII investments reached a significant $16 billion since March.

"We believe the slowdown in the US, lesser-than-anticipated recovery in China and strong likelihood of recession in Europe reinforced India as the fastest-growing economy among large ones. We believe this will result in higher capital flows, both from FDIs and FIIs," said Prabhudas Lilladher in a note to investors.

Given the robust domestic growth, falling inflation in food and fuel prices, a revival in industrial capital expenditure, the government's strong push for infrastructure development, and the demographic dividend, analysts anticipate a continued and sustained increase in foreign institutional investor (FII) inflows.

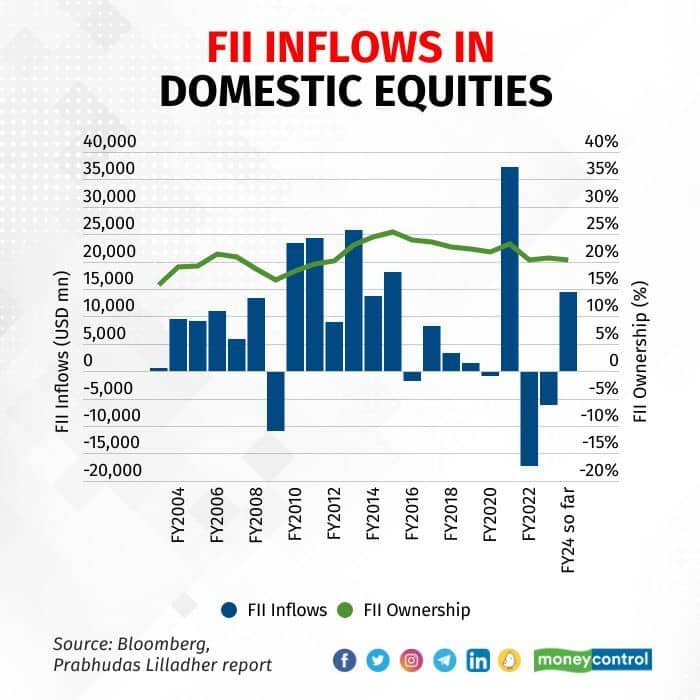

Over the past 20 years, India experienced FII outflows in five of those years. The largest outflows were recorded in FY22 and FY23, amounting to a significant $23 billion and decline in FII ownership by 300bps to 20.3 percent. Analysts highlight that the reversal in FY10 and FY17 resulted in double the outflow compared to FY09 and FY16.

FII ownership of the Indian market reached its highest point at 25.4 percent in FY15. However, since then, it has experienced a decline of 510 basis points (bps). More recently, FII ownership has decreased by 300 bps from the recent peak of 23.3 percent in FY21.

According to Prabhudas Lilladher estimation, based on the current market capitalization of $3.58 trillion in India, FIIs would need an inflow of approximately $35.7 billion to increase their stake by 1 percent. To reach the stake levels seen in FY21, which was 23.3 percent, FIIs would require an inflow of approximately $107 billion.

The steady flow of funds from foreign investors on the back of strong macroeconomic parameters helped the market to scale record highs and sustain the rally for the last four months. But, as the Reserve Bank of India said, the war over inflation was far from over, despite prices cooling off steadily, and it may potentially jeopardise the market rally. The analysts are also taking into account the possible impact of El Niño on the market dynamics.

With the general elections scheduled next year, political parties have begun doling out freebies such as free electricity up to 200 units in Delhi, additional Rs 2,000 for women in Punjab, the reintroduction of the old pension scheme in Himachal Pradesh, and the implementation of an unemployment allowance in Karnataka. Analysts say that the NDA faces a challenging task of replicating its performance from the 2019 elections. It is expected that the BJP-led NDA may find it difficult to resist the temptation of incorporating populist measures into their manifesto, which could have significant negative implications for the overall economy.

"We expect a significant increase in unrest and populist measures in the run-up to the elections. El Niño and inflation can increase the stress on rural India and urban poor and add to the woes for the ruling dispensation. We also expect markets to start looking for political news from the second half. We believe any change in guard at the center can be negative for segments like Infra, Defense, Industrials, banks and NBFC," the Prabhudas Lilladher report said.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.