Ruchi AgrawalMoneycontrol Research

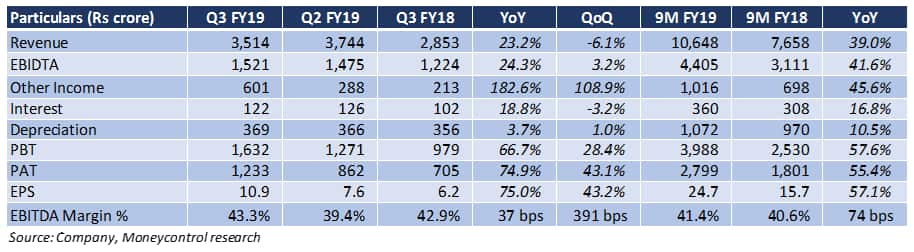

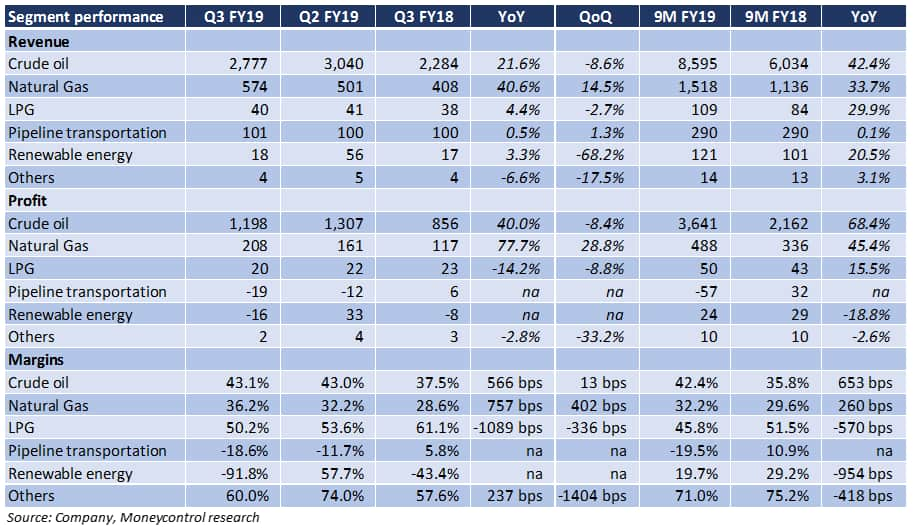

Amid talks of government planning to divest 10 percent stake, Oil India (OIL) reported a decent performance year-on-year (YoY), though there was some contraction sequentially. The performance was majorly driven by a healthy uptick in natural gas and crude oil segment, even though the performance from the LPG, pipeline and renewable energy business remained largely muted.

-Healthy 23 percent YoY uptick in the revenue driven by strong growth in crude oil and natural gas segments.

-Overall margin growth remained largely flat on the YoY basis; however, there was a healthy growth sequentially.

-An upward revision of natural gas from October 2018 led to better realisations in the segment improving the segment revenue as well as margin (+757 basis points YoY). Crude oil margins also saw a 566 basis point (bps) YoY uptick. However, margins in the LPG segment saw a sharp 1089 bps YoY contraction.

-There was an inventory loss of around Rs 12 crore as against an Rs 19-crore inventory gain in the same quarter last year.

-While the natural gas prices would remain at $3.36/mmbtu until March 2019, given the softness in natural gas and crude oil prices in the last few months, any further upside to the price could be limited.

-Sharp volatility in the global crude oil prices has brought in the margins of oil companies under the scanner. While higher crude prices bode well for the realisations, there comes an added risk of imposition of oil subsidies on oil PSUs.

For more research articles, visit our Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.