Foreign institutional investors (FIIs) sold over $3 billion (Rs 25000 crore) in Indian equities in the first half of May, with NSDL data showing that more than 90 percent of the selling concentrated in five sectors: Financial, IT, Construction, Oil & Gas, and FMCG.

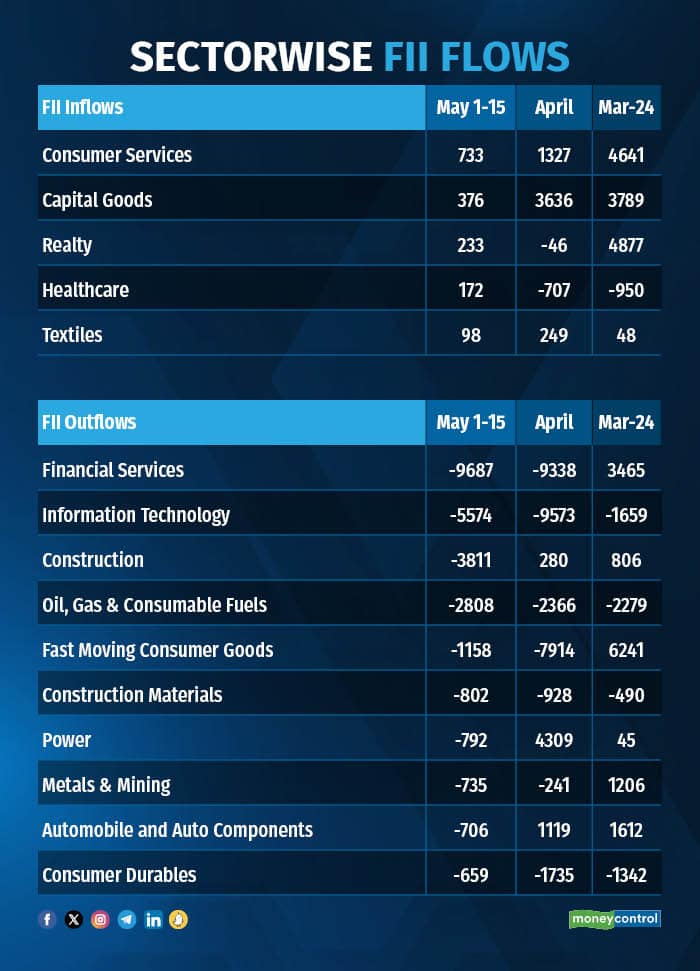

FIIs divested around Rs 9,687 crore in financial services, Rs 5,574 crore in IT (marking the third consecutive month of selling by FIIs), Rs 3,811 crore in construction, Rs 2,808 crore in oil & gas (the fourth consecutive month of selling), and about Rs 1,158 crore in the FMCG sector.

Analysts attribute selling in IT and FMCG to weak earnings in both sectors. FMCG witnessed subdued sales and flat profitability due to high expenses, while the IT sector's FY24 performance suggests caution for FY25.

Additionally, FIIs sold in other sectors: construction materials (Rs 802 crore), power (Rs 792 crore), metals and mining (Rs 735 crore), automobiles and auto components (Rs 706 crore), consumer durables (Rs 659 crore), and telecommunication (Rs 272 crore).

According to analysts, the huge selling was due to election-related concerns, turning risk-averse, and reducing equity exposure to avoid surprises. Some of them speculate FIIs sold due to global selling pressure, while others link it to expectations of a lower voter turnout potentially impacting election outcomes.

A few analysts suggest that FIIs are selling now to buy back at lower levels later, boosting cash reserves.

On the flip side, FIIs were buyers in consumer services (Rs 733 crore), Capital goods (Rs 376 crore), realty (Rs 233 crore), and healthcare (Rs 172 crore).

The consumer services sector witnessed eight consecutive months of buying by FIIs, while the capital goods sector saw 14 consecutive months of buying.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.