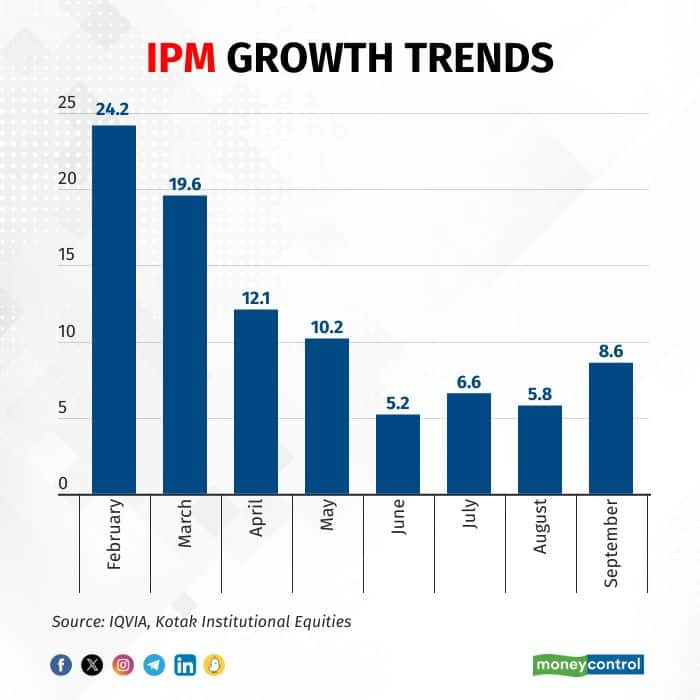

Pharma sales in the domestic market grew moderately in the month of September, rising 8.6 percent on year after a consistent decline in the past six months.

The uptick was, however, not enough to lift the overall second quarter sales, which grew just 7 percent against an 8.5 percent growth in the June quarter.

Brokerage firm Nomura attributed the slowdown in growth during the July-September quarter to both seasonal (low demand) and structural factors (competition from generics). "The market is currently not pricing in a structural slowdown of the branded generics segment, in our view," the brokerage said in a report.

According to data services provider Pharmatrac, volumes dropped for the second consecutive quarter. The slow offtake in viral infections along with increased competition due to rising adoption of unbranded trade generics tinkered with sales growth through the quarter.

Although sales did pick up in September, it is its sustenance in the long term that remains the key monitorable.

“Although we continue to bake in an 8-15 percent organic domestic sales growth in FY24 for (companies under) our coverage—largely driven by pricing, new launches and inorganic forays—the recent weakness can play spoilsport,” highlighted Kotak Institutional Equities.

Sales pick-up in SeptemberMotilal Oswal Financial Services attributed the growth in pharma sales during September to price hikes. Aside from that, the pick-up in sales within the acute segment, which constitutes 62 percent of the overall India Pharma Market (IPM) also helped.

"Sales of acute therapies grew 10.3 percent on year in September, while that of chronic therapies, which makes up 38 percent of the IPM, rose 11.6 percent," MOFSL noted.

In September, IPCA Labs (grew 13.7 percent on year) and Alkem Laboratories (grew 12.5 percent on year) were the top performers, beating growth within the Indian market.

"IPCA outperformed the IPM with double-digit growth across its top five therapies while Alkem's outperformance was led by strong sales in anti-diabetic and gastro-intestinal therapies," stated MOFSL.

Earnings to feel heat of weak domestic sales in Q2The Q1 earnings of pharma companies were marked by strong sales in the domestic as well as the US market. However, with a moderation in sales of the blockbuster cancer drug Revlimid, and a slowdown in domestic pharma sales, earnings for drugmakers are likely to witness some pressure in Q2.

IQVIA data also highlighted that the growth momentum in the domestic market slowed for most pharma companies on a sequential basis. This stands at a stark contrast with the fact that Q2 is usually a seasonally strong quarter for domestic pharma companies.

Within the pharma pack, companies which derive a higher revenue share from domestic sales are likely to witness more pressure on their earnings as compared to those that are more reliant on US sales.

Disclaimer: The views and investment tips expressed by experts are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before making any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.