Indian equities continued their winning streak for a sixth straight session on Wednesday, buoyed by strong liquidity inflows. However, beneath the rally lies a growing concern: valuations are running extremely high.

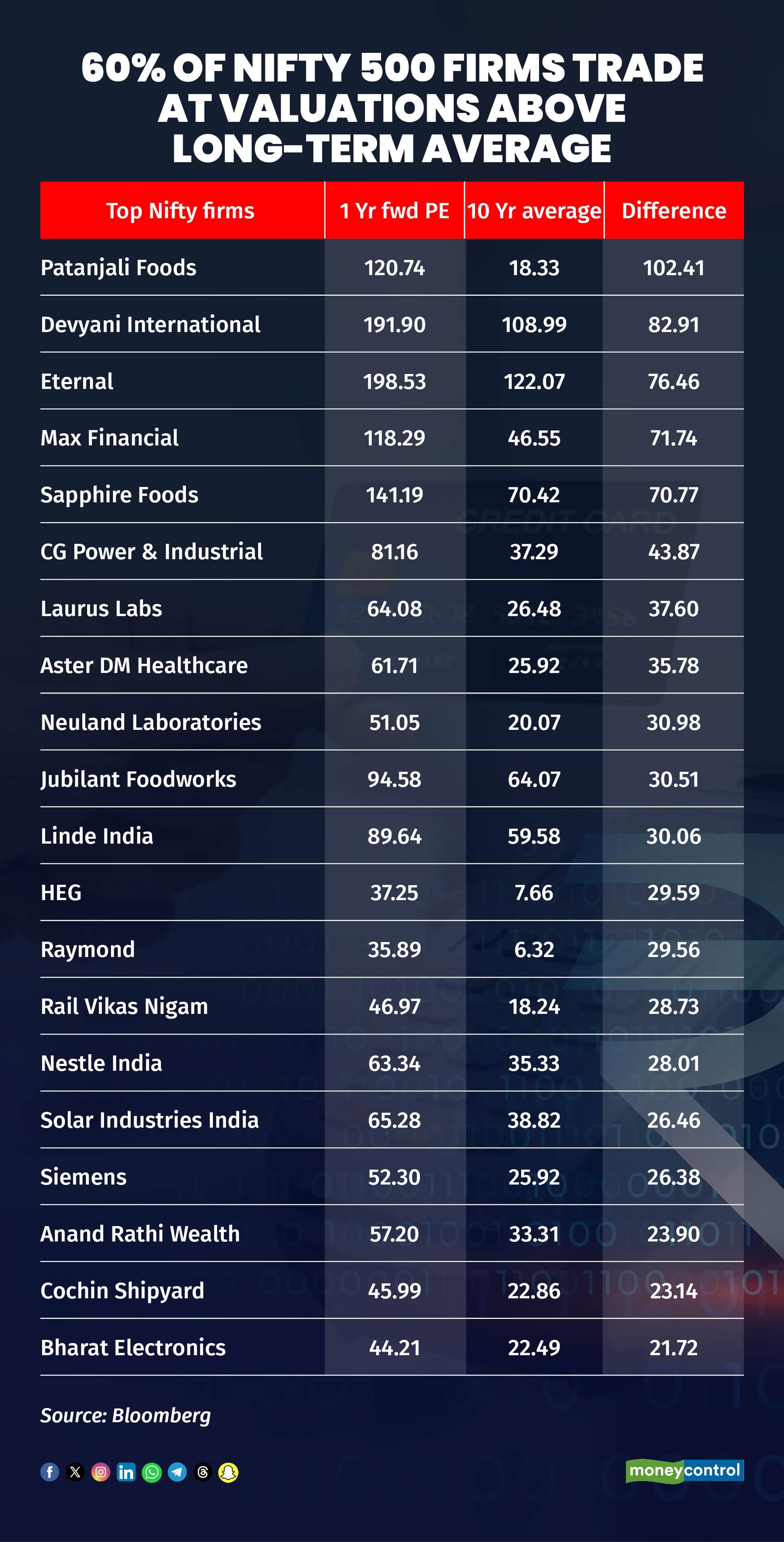

Nearly 60 percent of Nifty 500 companies are trading at forward price-to-earnings (P/E) multiples above their 10-year average. The index itself is valued at 21.92 times one-year forward earnings, significantly higher than its long-term average of 19.6.

Siddharth Bhamre, Head of Research at Asit C. Mehta Investment Intermediates, noted that valuations remain a concern. “Expensive is never fine. Even before this rally, many stocks were overpriced. I am not comfortable with markets at these levels,” he said.

Analysts noted that last year, markets absorbed negative developments such as the NDA falling short of a majority with relative ease. In contrast, despite positive triggers like interest rate cuts or GST reductions, the current rally appears harder to sustain. Experts argue that valuations are pricing in earnings growth that has yet to materialise, leaving equities vulnerable.

Among the priciest names in the Nifty 500 index, Patanjali Foods is trading at a one-year forward P/E of 120.74 times versus a 10-year average of 19 times. Devyani International and Eternal command valuations of 192 times and 198 times, compared with their long-term averages of 109 times and 122 times, respectively. Other richly valued counters include Max Financial, Sapphire Foods, CG Power & Industrial, Laurus Labs and Aster DM Healthcare.

Despite concerns, India’s Nifty has continued to rally, driven by strong macroeconomic indicators such as GDP growth, robust GST collections, recent GST cuts, and renewed US-India trade dialogue. Market watchers suggest the uptrend is being driven more by sentiment and liquidity than by fundamentals.

Independent analyst Ambrish Baliga acknowledged the expensive valuations but highlighted the role of liquidity. “From a long-term perspective, stocks are indeed pricey. But if earnings show improvement in Q2 or there are signs of a better Q3, that would be sufficient to sustain markets. Liquidity is driving this momentum, and when liquidity speaks, valuations often take a back seat,” he said.

Experts added that India’s domestic-oriented economy provides a cushion against global risks. Policy measures such as income-tax relief, GST cuts and the upcoming pay commission hike for central government employees are expected to boost disposable incomes, spur consumption and support growth in the months ahead.

Globally, the Nifty 500 tops peers in terms of the proportion of stocks trading above long-term valuation averages. About 45 percent of S&P 500 constituents trade above their historical forward PE, compared with 39 percent for China’s CSI 300, 38 percent for Europe’s Stoxx 600, and 31 percent for the Nasdaq.

On absolute terms, however, the S&P 500 is the costliest, trading at 22.39 times 1-year forward earnings versus its long-term average of 18.68. India’s Nifty 500 follows at 21.92 compared with 19.6, while China’s CSI 300 trades at 14.33 against a 12.6 average.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before making any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.