Rates on commercial papers (CP) maturing in three months eased by 8-17 basis points (bps) in the last one month and dealers are of the view that the sustainability of these rates will depend on further domestic and international cues.

CP rates have taken comfort from the Reserve Bank of India’s (RBI) rate pause decision in its April monetary policy along with huge surplus liquidity in the banking system.

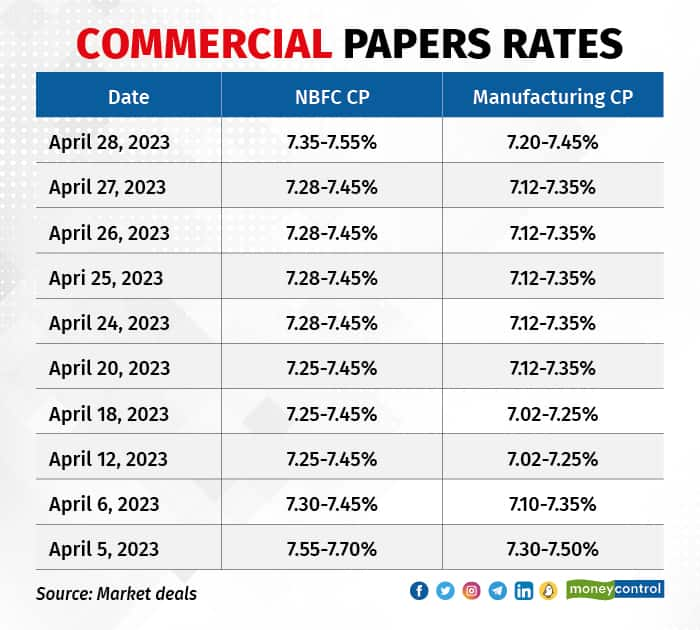

Rates on CPs issued by non-banking finance companies (NBFCs) fell by 17 basis points and those on papers issued by manufacturing companies fell by 8 bps.

One basis point is one-hundredth of a percentage point.

“India’s money market yields went down sharply during April, especially post RBI’s monetary policy committee policy outcome combined with ample liquidity in the system and tracking US treasury yields,” said Venkatakrishnan Srinivasan, founder and managing partner, Rockfort Fincap, a Mumbai-based debt advisory firm.

The market will wait for the US Fed policy outcome and then react accordingly, experts said.

Further, Ajay Manglunia, Managing Director, JM Financial, said with the halt in policy rates and a likely long pause, money market rates in line with yields on T-Bills have moderated as they shrugged off the potential hikes in coming policies.

CPs are debt instruments generally issued by companies to raise funds for up to a year.

Also read: Foreign investors will return to India if Fed rate hikes cease, says Mukherjea of Marcellus

Rate movement

NBFC CP rates, which were trading at 7.55-7.70 percent on April 5, eased to 7.35-7.55 percent on April 28, and rates on manufacturing CPs, which were at 7.30-7.50 percent on April 5, fell to 7.20-7.45 percent on April 28.

Initially, after the RBI monetary policy, rates on these instruments fell sharply, but later in the month moved up a bit after the yield on Treasury bills rose.

The cut-off yield on Treasury bills across maturity fell around 20 bps in the second week of April but later moved up amid coinciding with draining liquidity and continuous supply of short-term debt.

However, rates on certificates of deposit (CD) remained almost flat to marginally up.

The rates on these instruments moved from 7.00-7.20 percent to 7.10-7.30 percent.

Issuances in April

According to the Prime database data, companies raised Rs 1.11 lakh crore in April, as compared to Rs 1.27 lakh crore in March.

Reliance Industries, National Bank for Agriculture & Rural Development, Housing Development Finance Corp, Larsen & Toubro and Reliance Retail Ventures were top issuers of CPs in April, together raising Rs 47,750 crore.

Also read: BharatPe acquires NBFC Trillion Loans

Surplus liquidity and other factors

Liquidity in the banking system remained in surplus mode throughout April, which helped short-term rates to ease.

The surplus liquidity in the banking system fell from a huge surplus of over Rs 2 lakh crore at the start of April, to Rs 40,000 crore at the end of the month.

The narrowing of surplus liquidity can be attributed to goods and services tax payments and other auction-related outflows.

Further, to remove excess liquidity from the banking system, the RBI conducted variable rate reverse repo auctions from time to time.

Meanwhile, in the April monetary policy, the RBI surprised markets by leaving the repo rate unchanged at 6.5 percent against the expectations of a 25 bps hike. Adding to this, they said, it stood ready to act should the need arise.

The central bank expects inflation to moderate to 5.2 percent in 2023-24.

The Monetary Policy Committee is scheduled to next meet during June 6-8.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.