On a day that the listed Vedanta announced its much-awaited demerger, S&P Global Ratings downgraded parent company Vedanta Resources’ rating due to a potential bond extension exercise. This is the backdrop in which Vedanta’s demerger exercise is taking place but how exactly it will improve the parent’s funding profile is not clear as yet. The exercise itself is expected to take 12-15 months and $2 billion worth of Vedanta Resources’ loans is maturing in two tranches in 2024.

What has Vedanta proposed? It will demerge five operating businesses—aluminium, oil and gas, base metals (mainly copper and zinc international), ferrous (steel and iron ore mining) and power. The sixth company will be Vedanta itself, which will continue to hold the Hindustan Zinc (HZL) stake and will also fund investments in new sectors such as semi-conductors and display.

Vedanta will, therefore, remain as a holding company. Once the government disposes its stake in HZL, another round of consolidation could take place depending on whether Vedanta is the buyer or not. Vedanta’s current market capitalisation is at Rs 82707 crore while its 65 percent stake in Hindustan Zinc alone is valued at Rs 84660 crore. Apart from a holding company discount, sizeable debt on the books, promoters’ debt woes and challenges in certain businesses could be pulling down its valuation. Thus, post-demerger it may actually benefit by having a leaner balance sheet, subject to the capex commitments for capital-hungry businesses such as semiconductors.

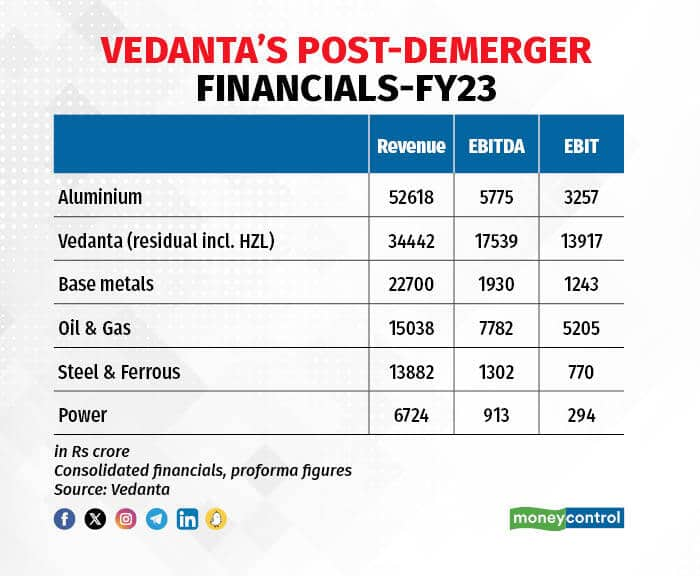

Among the demerged businesses, the largest by revenue and also in a relatively strong position is aluminium (see chart). The metal has a bright long-term demand outlook and Vedanta’s plans to increase capacity and proportion of value-added products should see it continue to be a significant contributor. The oil & gas business is a sizeable contributor to Vedanta’s consolidated EBITDA but faces challenges in increasing its output and that could be a concern for investors.

Vedanta's post-demerger financials-FY23

Vedanta's post-demerger financials-FY23The steel and ferrous company is one where Vedanta had initiated a strategic review sometime ago, to contemplate an exit by selling Electrosteel Steel. News reports said the deal was stuck due to a high asking price. Even if it is sold, Vedanta may still retain the iron ore mining business, which was earlier run as Sesa Goa and is a large and very profitable business. But, here the Goa iron ore mining operations have been affected, and till fresh mining leases are signed that’s an uncertainty that will affect the output of this business.

The base metals company too faces challenges as it will own the shuttered Tuticorin copper plant and while Vedanta expects it to restart operations in 2024, its valuation really depends on whether the plant restarts by the time it lists. If it does not, it’s likely to languish.

But the thing to note is that the overhang of these underperforming businesses that may be offsetting the profitable or growing businesses of Vedanta will be removed post-demerger. While uniting multiple businesses was supposed to provide a hedge, it actually turned into a millstone in some cases. The demerger should lead to a significant unlocking of value in its aluminium business as things stand now. What’s important to see is how the debt is apportioned among companies, as that will determine the liability each company will have to service.

But one big question remains. What do the promoters gain out of this? Their need of the hour is to ensure there is enough money to service Vedanta Resources’ debt liabilities not just in 2024 but also to ensure they don’t face this trouble in future. How that problem is being solved is not clear right now as nothing really changes on that front. If it takes upwards of a year to complete the demerger, till then other than the normal practice of paying dividends, where will the money come from?

An increase in Vedanta’s valuation, if investors factor in the expected unlocking of value and factor it in Vedanta’s current share prices, can be a boon. Its shares have risen by 7 percent on September 29th on news of the demerger. Since the promoters have pledged Vedanta’s shares to raise money, a higher market value will give more comfort to lenders and if the upward trend sustains, open up the possibility of raising more funds too.

Once the companies are split, if the sum of their separate valuations is much higher than the current valuation, the promoters will enjoy higher funding limits based on their individual holdings. Lastly, they have the option of selling off one of these demerged entities and raise money, either partially or a 100 percent exit. There is also the proposed HZL demerger of its silver and recycling businesses, which does not make sense unless they plan to sell the silver unit. Read more here.

A lot rests on what may prove to be the final gambit of the group to overcome its debt-related challenges and even for its minority shareholders to earn good returns.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.