Hopes of bankers of lesser haircuts along with resolutions of almost half of the 12 stressed assets under the insolvency proceedings, are close to realization in the next two months.

Nearly ten months after the Reserve Bank of India identified 12 non-performing assets (NPAs), estimated to account for 25 percent of the gross NPAs of all banks, for immediate referral under the Insolvency and Bankruptcy Code (IBC), almost five are set to see the light in the next two months.

The assets close to the stage of approval by the committee of creditors (CoC), especially the steel companies, have seen satisfactory interest from strategic buyers.

Haircuts are the potential losses the lenders would have to take in comparison to the debt given by them to the borrowing firms. Experts are anticipating the haircuts to be as low as 25-30 percent from earlier over 50 percent.

“Initially, it (hair-cuts) was estimated to be high but with the kind of bids coming in, it gives confidence and we are hopeful, the hair-cuts will come down. We hope the big accounts get results in the first quarter,” Dinabandhu Mohapatra, MD and CEO of Bank of India told Moneycontrol in an interview.

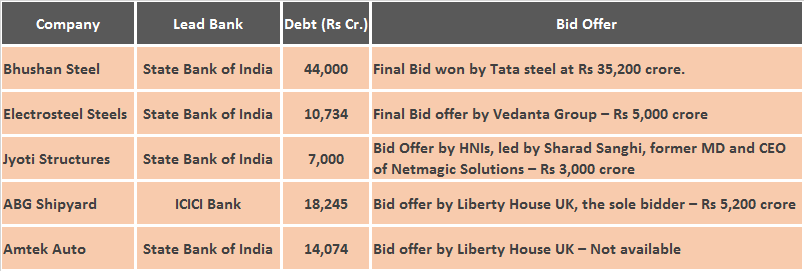

Of the first list, Bhushan Steel has been finalised to be bought by Tata Steel will complete the final process by the end of this month. Similarly, for Electrosteel Steels, Amtek Auto, Jyoti Structures and Monnet Ispat & Energy, the CoC has approved resolution plans as approved by the majority or 75 percent of the lenders. All these accounts are waiting for the final nod before the resolution plans can be implemented.

Under the IBC, once an account is admitted by the NCLT or the National Company Law Tribunal, the corporate insolvency resolution process (CIRP) must be completed within 180 days, which can get an extension of 90 days to 270 days, from admission of a case. During the process, an insolvency resolution professional (IRP) takes control of the management of the firm and calls for bidders to submit a resolution plan.

A CIRP is considered complete when the CoC and the NCLT both approve of a resolution plan. In eight of the 12 cases, the 270-day deadline is set to end by the end of this month.

Udit Kariwala, associate director, financial institutions, India Ratings & Research, said, "I believe the first list of accounts will see lower haircuts because: Firstly, most of the assets are of relatively good quality with technologically advanced and functioning manufacturing plants. Secondly, there are some strategic large buyers who would be interested and willing to pay a decent price and the probability of getting bids from them is high for such assets and thirdly, these could be picked up in large pieces rather than smaller fragmented assets. So these are the first assets and good ones.

In August, the central bank had shortlisted nearly 28-30 accounts as part of the second list to be referred to the NCLT by December.

According to Kariwala, "Secondly, there are some strategic large buyers who would be interested and willing to pay a good price and the probability of getting bids from them is high for such assets bidding and willing to pay a good price and thirdly, these could be picked up in large pieces rather than smaller fragmented assets.. So these are the first assets and good ones."

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.