The board of Tata Sons decided on February 11 to extend the tenure of chairman N Chandrasekaran for a period of 5 years.

"Mr. Ratan. N. Tata who was a special invitee to this meeting expressed his satisfaction on the progress and performance of the Tata Group under the leadership of Mr. N Chandrasekaran. He recommended his term be renewed for a further five-year period. The Board members commended the performance of the Executive Chairman and unanimously approved the reappointment of Mr. N Chandrasekaran as the Executive Chairman for the next five years," the company said in an official statement.

Chandrasekaran’s present term as the chairman was scheduled to come to end this month.

“It has been a privilege to lead the Tata Group for the last five years and I am delighted at the opportunity to lead the Tata Group for another five years, in its next phase,” Chandrasekaran said.

Sources had earlier told Moneycontrol that the board is likely to extend Chandra’s tenure and make new appointments.

N Chandrasekaran took over the reins of Tata Sons in 2017. He became Chairman at a time when the group faced a leadership crisis and a trust deficit after the ouster of his predecessor, Cyrus Mistry, by the board. Until then, Chandra, a trusted lieutenant of the Tatas, had helmed TCS, the crown jewel and cash cow of the group. He soon became the face of stability for Tata Sons.

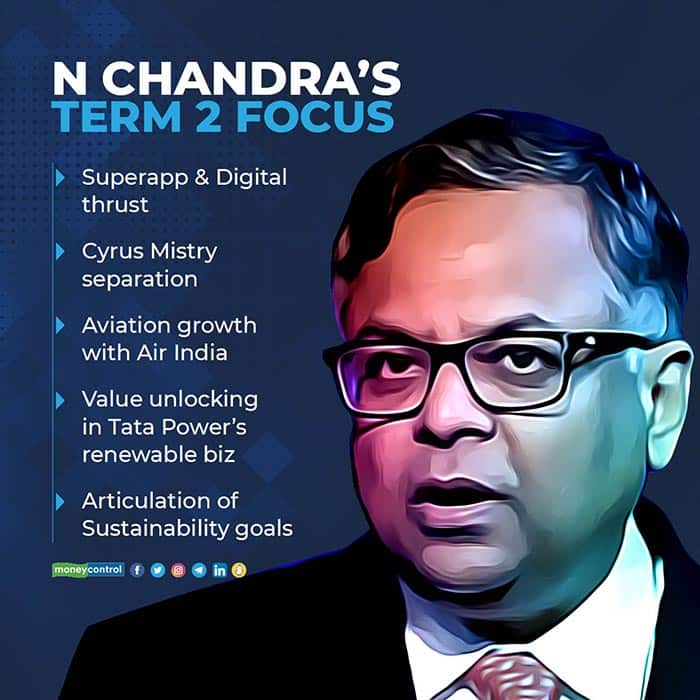

A large part of Chandra’s tenure as the Chairman and CEO of Tata Sons was spent fighting the legal battle against Cyrus Mistry, which led to public mudslinging never experienced before by Tata Sons. Restoring faith from investors and business partners and redeeming the Tata name was the most important task for Chandra, and he was able to do this effectively due to his market acceptability and performance at TCS.

The Air India bid win at the fag end of his tenure was one of the biggest achievements for Chandra besides the victory against Cyrus Mistry in the Supreme Court. Support for the government’s disinvestment efforts and bringing Air India back into the Tata fold will give additional thrust to the group in its aviation ambitions over the next phase of its growth.

Also read: How Air India got its name 75 years ago

Some hits, some misses

Coming from a tech background with little knowledge on manufacturing and capital-intensive sectors, Chandra’s biggest task at Tata Sons was to solve the debt woes of several listed companies, primarily Tata Steel. Several M&A efforts were personally handled by Chandra to resolve Tata Steel’s debt burden but failed to go through. Nevertheless, an uptrend in the commodity cycle, climate thrust and structural shift from Chinese dominance helped Tata Steel rise during the pandemic.

Selling Tata Tele to Bharti Airtel at a pittance while keeping debt on its own books was seen as an awkward compromise for Tata Sons under Chandra. Even the big attempt to buy Jet Airways did not pass the muster of the board. Many failed M&A attempts also took the sheen off Chandra’s first term at the helm of Tata Sons.

Tata Power has been working to unlock the value of its renewables business for over two years but missed the bus when renewables got a premium valuation.

Tata Motors stabilised under Chandra’s leadership and his strong statement on being self-reliant during the peak of the chip shortage reinforced his position as the leader of India Inc.

The Tata group’s digital thrust has been the cornerstone of Chandra’s personal efforts to create a Superapp. Some key acquisitions, including Big Basket and 1mg, put the Tatas on the map in the new-age sector boom but the industry expected a lot more from the group in this direction given Chandra’s tech expertise.

The way forward

During his second term, it will be critical for Chandra to complete unfinished business around the Tata-Mistry saga; the final separation from Cyrus Mistry could be a complicated affair that the leadership team will have to handle effectively.

Chandra will also have to articulate Tata Trusts’ focus on sustainability at the group level and the group’s digital initiatives will need to be strengthened to take on stiff competition from other large business conglomerates.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.