Sumeet Bagadia

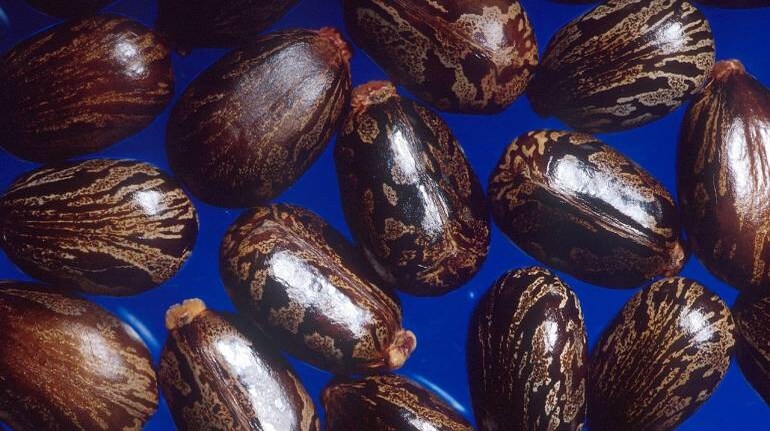

Commonly known as 'Rendee' in Hindi, castor seeds is a kharif crop sown and grown in the monsoon season during the months of July to September.

States growing the crop constitute Gujarat, Rajasthan and Telangana, with the usual fresh crop harvesting period occurring in December in Telangana, and March and April in Gujarat and Rajasthan each year.

Sowing of castor seeds depends on the monsoon season and the distribution of rainfall in various regions. As compared to other kharif crops, it requires relatively less rainfall and can be grown in dry and arid regions. Castor seed is also a nine-month crop - from its sowing till the completion of its harvesting.

Price also plays a critical role, which determines how much sowing the farmers are ready to do in the above period. Higher prices is generally forecasted to increase sowing of castor seed while lower prices can possibly lead to crop switching to other crops such as Cotton and Guar Seed in the earlier mentioned states respectively.

Higher yields in the soil supports the castor seed crop and the crop can grow as tall as 9-10 feet in height. Medium yields can help the castor seed crop to grow to a height of 7-8 feet height, while lower yields in the soil boosts growth upto 5-6 feet in height.

Castor seed is a non-edible oil seed and is used majorly in the industrial sectors after extracting castor seed oil in various industries of India. It is the residual of the castor seed after extraction of oil and it is mainly used for organic fertilizers. Castor Oil and Castor meals are exported outside India especially to countries such as China and the United States, while other export destinations include the European Union.

NCDEX Castor Seed spot price which had been bearish during the month of May so far owing to lower demand in domestic traders and lower export demand from international buyers. Moreover, auctions in the domestic APMCs of Gujarat have not been conducted on a larger scale which has reduced the prices in the futures markets.

But then, lesser domestic stocks available cushioned prices from lower levels bringing prices near to equilibrium. By May 26, NCDEX Castor Seed futures closed at Rs 3,580 per quintal, lower by 1.43 percent compared to Rs 3,632 per quintal reported on May 1.

Fundamentally for the coming weeks, we are expecting NCDEX Castor seed futures to trade bearish as the current year (2019-20) production is estimated to be higher compared to previous year by 10-12 percent in the state of Gujarat and Rajasthan. So far, the worries of crop damage during the lockdown period has eased after the Government of India removed restrictions on farm activities and farm labour in the above states with strict regulations. Pending harvesting has been completed and has brought higher production estimates in the domestic market.

Global exports of castor seed oil and meals is currently lower due to worldwide lockdown, though, there has been a small incline in exports to China which is expected to limit major downtrend in castor seed futures.

Domestic demand for organic fertilizers has shown small increase as farmers have already begun for the summer crop sowing and upcoming kharif sowing. However, the downtrend in castor prices is likely to be witnessed only till the first half of June with arrival of monsoon season; where the farmers are likely to move into peak sowing activities which could possibly reduce supply/arrivals in the domestic markets. Overall, we expect bearish trends in NCDEX Castor Seed futures for the coming weeks.

Technically, one can initiate short positions around Rs 3,670 per quintal and up to Rs 3,730 levels, which can be used as a selling opportunity for the downside target of Rs 3,270. However, the bearish view will be negated if NCDEX Castor Seed (June) closes above the resistance of Rs 3,870.

The author is Executive Director at Choice Broking.

Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.