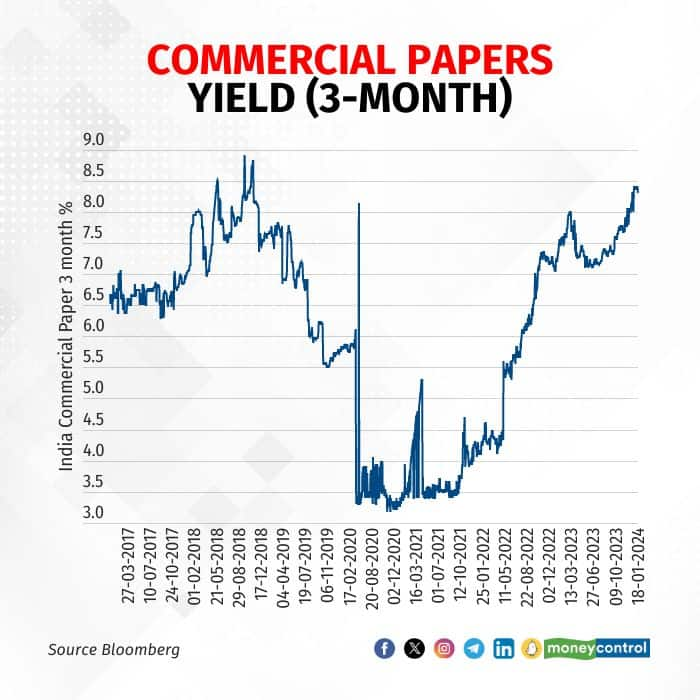

Short-term rates in the money markets shot up to an over five-year high on account of tight liquidity in the banking system.

The yield on commercial paper (CP) maturing in three months rose to near levels seen during the Infrastructure Leasing & Financial Services (IL&FS) crisis in 2018. The yield on CP traded at 8.40 percent on January 18, which was the highest since November 6, 2018, when the yield was 8.83 percent.

“Normally, a cash squeeze can happen in the market driven by central bank action or lack of government spending,” said Abhishek Bisen, head of fixed income at Kotak Mutual Fund. “When such a situation arises, this can lead to credit stress and therefore yields shooting up in the market.”

Karan Mundhra, AVP - fixed income investments at DSP Mutual Fund, said banks’ borrowing rates have also increased and this has percolated to CPs.

“With liquidity drying up, banks compete aggressively on commercial terms to fund the high credit growth,” Mundhra said.

Also read: RBI AIF deadline ends today: Most lenders are making provisions on investments, say experts

The yield on CP has been on an upward trend in January and rose 5-15 basis points this week. Paper issued by non-banking finance companies saw an uptick in yield of 10-15 bps and those by manufacturing companies rose 5-10 bps. One basis point is one-hundredth of a percentage point.

The yield on paper issued by NBFCs maturing in three months rose to 8.20-8.50 percent this week from 8.10-8.30 percent last week, and those on manufacturing companies’ paper rose to 7.70-7.90 percent from 7.65-7.75 percent last week.

Traders said three-month CP is very liquid and active in the market.

Tight liquidity

Liquidity in the banking system has remained tight over the past few months and remained so in January too. However, the liquidity deficit widened over the past week.

According to the Reserve Bank of India, liquidity was in a deficit of about Rs 1.29 lakh crore on January 1, and this increased to Rs 2.14 lakh crore on January 18. Experts attributed this to the expected outflows from excise tax collections and currency in circulation.

During the IL&FS crisis, which was followed by the DHFL turmoil, bond yields went up as high as 9 percent due to a liquidity crunch in the NBFC segment and the risk-averseness of investors.

Bisen said the increase in yields during the IL&FS crisis was issuer-specific and not one driven by broad-based liquidity tightening. There were spillover effects as well such as mutual fund redemptions, which widened the term spread and credit spread. However, conditions are different right now and it is not credit stress, Bisen said, adding that now it is liquidity stress.

“In liquidity stress, there is a tight liquidity condition, which helps short-term rates to rise, and in credit stress, the stress in certain issuers gets reflected in short-term rates,” Bisen said.

IL&FS defaulted on payments and failed to service its CPs on the due date. The company piled up too much debt to be paid back in the short term, while revenue from its assets was skewed towards the longer term. The company's default created trouble for its investors including banks, insurance companies, and mutual funds.

Also read: Sebi probing mule accounts, faulty IPO applications, 3 cases under scanner, says Buch

Will issuers tap the market?

Experts said that issuers may tap the market as there is a need for funds for working capital and funding needs.

“With such strong credit growth, we do not anticipate the issuers will stay away. There is a strong need for capital, which has led to borrowing at elevated levels,” Mundhra said.

Bisen said this would depend on the absolute cost of borrowing, the alternatives available, and the opportunity/threat to companies.

“If the issuer is confident of its balance sheet strength, it may stay away from the market and manage its requirements with internal accruals,” Bisen said.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.