Institutional Investor Advisory Services

An IiAS study finds that pay levels for CEOs vary considerably across industries. This is not surprising. Several factors contribute to the differential including, among other things, the nature and complexity of operations, ownership patterns, stage of growth, general size of companies, experience and skill sets required, and geographic footprint. The degree of difficulty in finding well-qualified candidates also has an impact on the final pay grades.

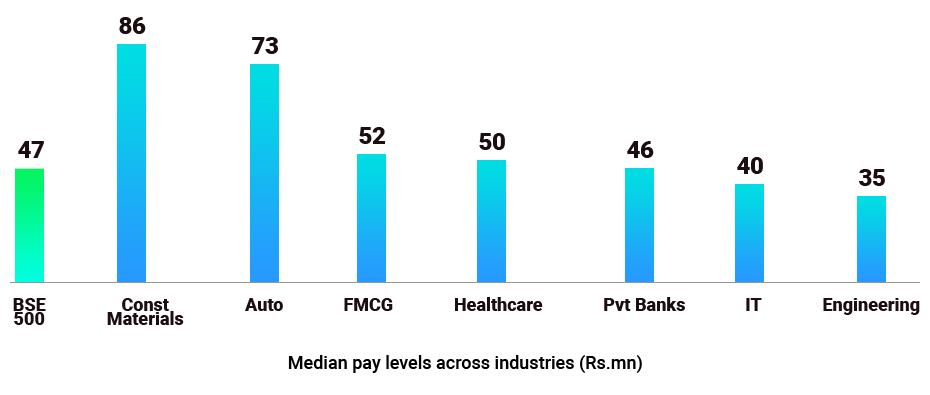

Median pay is high and has outpaced performance in most industries

The highest median pay is observed in the construction materials sector, part of which is attributable to the sizeable presence of controlling shareholders on the boards. This is also the industry where the median CEO pay has grown the fastest over the past five years. In fact, barring the auto sector, growth in CEO pay has outpaced growth in profitability across all the other sectors. This is a worrying sign as it signals a weak linkage between pay and company performance.

(Note: For conciseness and easier understanding, the study highlights data only from the top paying industries which include Construction Materials, Automobile and auto components, FMCG, Healthcare and pharmaceuticals, Private banks, IT services and consulting, and Engineering.)

CEOs in most industries rely on a high component of fixed pay

Across the market, Indian CEOs are paid more than 70 percent through fixed pay. In contrast, as per an Equilar study, the fixed component in the S&P 500 companies constitutes only 12.3 percent, with the remainder being in the form of a cash bonus, stock and ESOPs. One of the reasons why the auto industry has the best pay-vs-performance alignment is because CEOs in the industry have the highest proportion of variable pay.

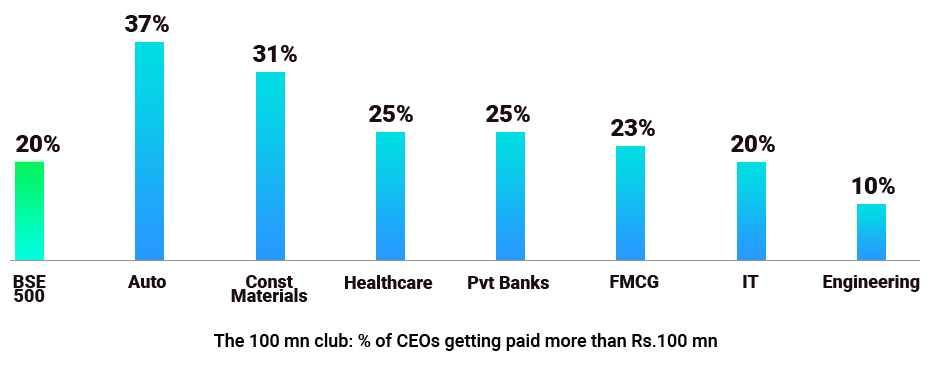

Most industries have a sizeable ‘Rs 100 mn’ club

In FY18, one-fifth of the CEOs earned more than Rs.100 mn. This is a concern, especially for industries where CEOs earn primarily through fixed pay and there is no linkage of CEO salary with company performance.

Pay disparity is a recurrent theme

CEOs in the BSE 500 are getting paid more than 100 times that of the median employee pay. And in businesses where there are large factory workforces with a lower median pay, the multiples are comparably higher.

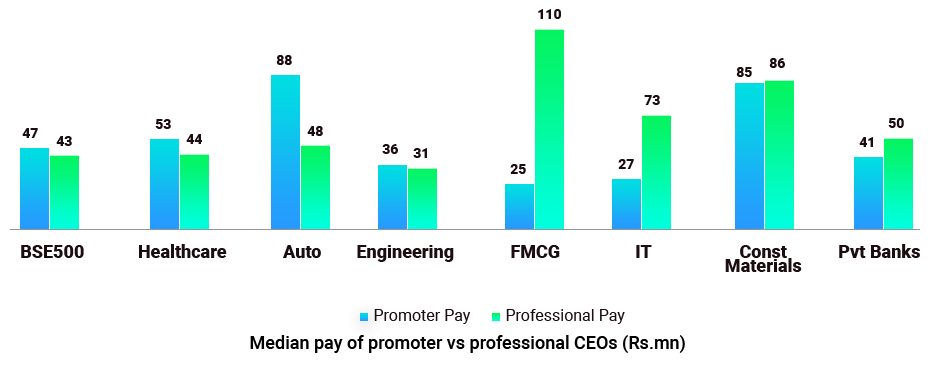

Many sectors characterized by high promoter presence

Most sectors are characterized by very high promoter presence, with few CEO positions being held by professional executives. The only notable exceptions are the private banks, where more than 80 percent of the CEOs are professionals.

In the IT, banking and FMCG sectors, the pay levels of professional CEOs are higher than those of promoter CEOs. But in other sectors with high promoter concentration, there is a wide pay gap between promoter and professional CEOs.

Conclusion

CEO pay is largely fixed in nature across industries, which limits incentivization for performance. On the other hand, having excessive reliance on variable pay could lead to exorbitant CEO remuneration and a push towards short-termism. Boards need to balance the long-term and the short-term agenda and devise a remuneration structure that is optimal. Sectors like IT and FMCG are better placed to strike this balance early. For other sectors, the challenges are much greater.

Note: Data for this report has been sourced from IiAS’ proprietary pay analytics platform, comPAYre, which contains historical remuneration and performance data for executive directors across BSE 500.

Disclosures:

Data pertains to CY2017 or FY2017-18 (depending on financial year-end for respective companies).

PSUs have been excluded from the analysis.

Fair value of stock options granted has been included while calculating overall pay.

This is the last of a three-part series on CEO pay by IiAS. Click for reading part 1 and part 2.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.