The stock market rallied as Finance Minister Nirmala Sitharaman presented Budget 2023-24 on February 1 but the gains in the Indian benchmark indices soon fizzled out, with the Nifty 50 ending 0.3 percent lower and the Sensex settling 0.3 percent higher.

Ahead of the budget, Moneycontrol had polled 30 market experts, including fund managers, analysts, heads of research and chief investment strategists, on some important questions relating to the budget.

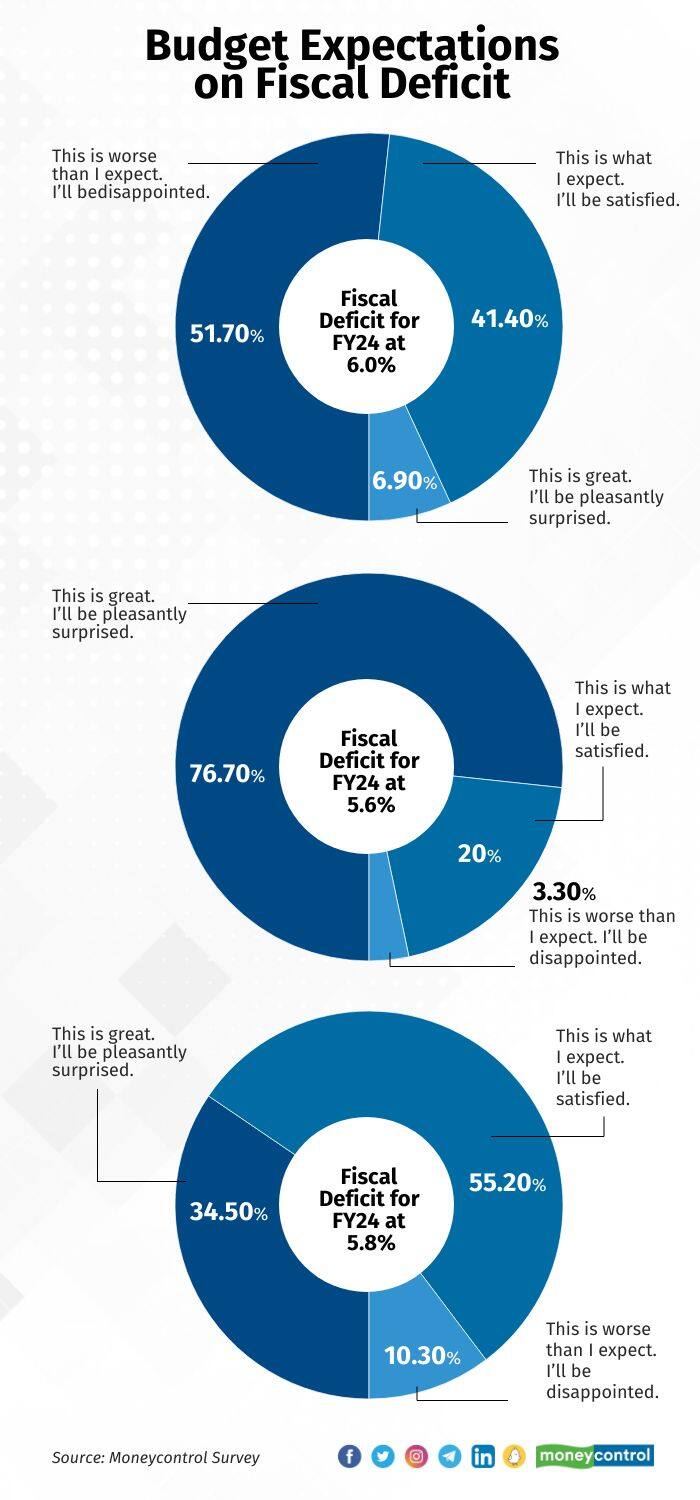

The fiscal deficit, which reached 9.2 percent of GDP during the pandemic year of FY21, moderated to 6.7 percent of GDP in FY22 and is further budgeted to reach 6.4 percent of GDP in FY23, the Economic Survey had pointed out.

“The budget has once again reinforced its aim of tuning it down to 4.5 percent in FY26. This will be an achievement if they are able to meet this target. This figure is near the fiscal deficit of the US, and a developing market having a fiscal deficit closest to a developed market is commendable,” said Divam Sharma, founder, Green Portfolio, a SEBI-registered portfolio management service provider.

Also Read | Union Budget 2023: Positive for capex but neutral for consumption, says market veteran Prashant Jain

The Moneycontrol survey showed that half the participants believe a fiscal deficit for FY24 at 6.0 percent is worse than what they expected.

Asked what their reaction would be if it came in at 5.6 percent, little over 75 percent of respondents said it would be a pleasant surprise. A fiscal deficit for FY24 at 5.8 percent would satisfy the market, the survey suggested.

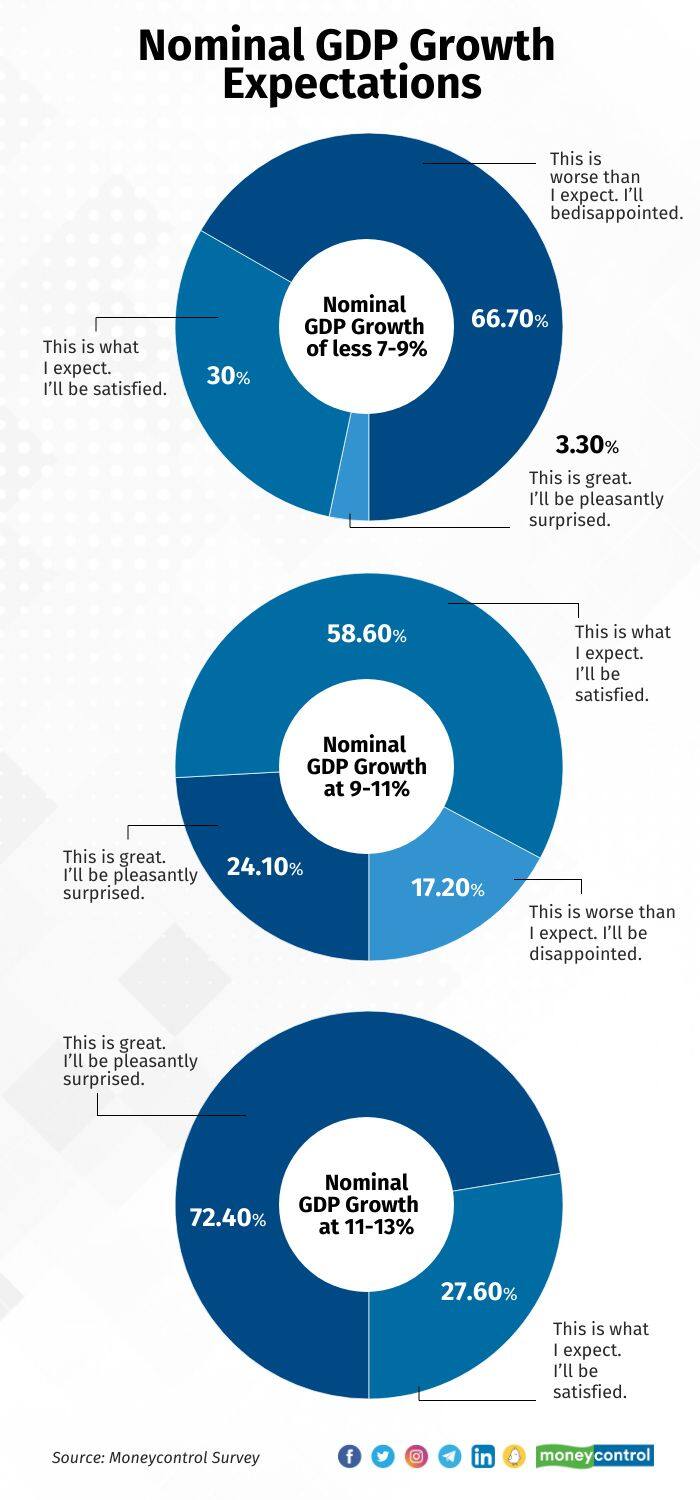

Around 67 percent of participants surveyed by Moneycontrol had said a nominal GDP growth of less than 7-9 percent would be worse than expected. While a large section said they would be satisfied if the nominal GDP growth is at 9-11 percent, 72.4 percent said 11-13 percent would be considered as great.

“The clear take away from this budget is its focus on India (domestic focus). Consumption (on account of higher disposable income) and capex sectors (capex up by 33 percent), both will see strong tailwinds along with a focus on railways, ports and airports, and tourism,” said Azeem Ahmad, principal officer and head, PMS, LIC Mutual Fund.

A large chunk of the Moneycontrol survey participants believe capex growth above 30 percent for FY24 is great and is definitely a pleasant surprise.

The budget has left long-term capital gains tax untouched, thereby allaying concerns of equity investors. In the Moneycontrol poll, 79 percent participants had said that there would be no change in capital gains tax.

“Furthermore, the market's concerns regarding capital gains tax have been put to rest. The budget leaving capital gains tax untouched means that investors can continue to benefit from capital growth without worrying about higher taxation,” said Mohit Batra, founder and CEO, MarketsMojo.

From the capital market perspective, any expectation of changes in the capital gains tax structure could create immediate volatility in the market.

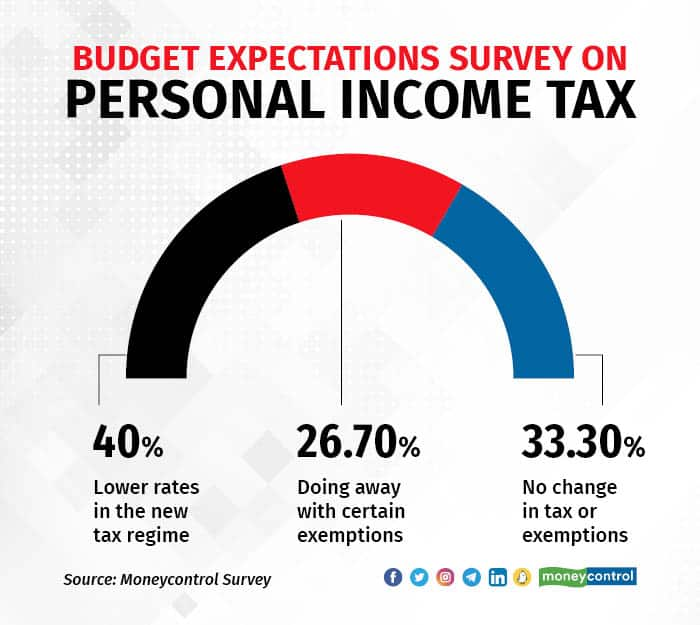

- Personal Income Tax

On the other hand, there were a few announcements with respect to personal income tax. The most important one, rather very closely eyed among other announcements, was about tax slabs.

In 2020, Sitharaman had introduced the new personal income tax regime with six income slabs starting from Rs 2.5 lakh. She proposed to change the tax structure in this regime by reducing the number of slabs to five and increasing the tax exemption limit to Rs 3 lakh.

A reduction in the personal income tax rate is seen delivering more disposable income in the hands of people and, hence, improving consumption.

As per the survey conducted by Moneycontrol, regarding personal income tax rates, 40 percent felt the new tax regime would mean lower rates, while 26.7 percent thought the government would do away with certain exemptions, and 33.3 percent were of the view that there would be no change in tax or exemptions.

Another important announcement was about rebates. Sitharaman said, “Currently, those with income up to Rs 5 lakh do not pay any income tax in both old and new tax regimes. I propose to increase the rebate limit to Rs 7 lakh in the new tax regime. Thus, persons in the new tax regime, with income up to Rs 7 lakh will not have to pay any tax.”

Read more about personal income tax here

The budget also entailed a reduction in the surcharge rate to 25 percent from 37 percent. “The budget also provided some relief to HNIs (high net-worth individuals) and the highest taxpayers with the surcharge reducing from 37 percent to 25 percent in the new regime, giving citizens higher consumer spending power that will drive the growth of the economy,” said Sumit Chanda, founder and CEO, JARVIS Invest, an AI-based investment advisory platform.

Divestment Target

The government has set a disinvestment target of Rs 51,000 crore for FY24, on the back of unfavourable market conditions and a sluggish privatisation drive in 2022.

In FY23, the government had budgeted to raise Rs 65,000 crore through divestments, but the revised estimate for disinvestments in FY23 stood at Rs 50,000 crore.

“Despite public listing of LIC (Life Insurance Corporation of India), disinvestment proceeds for FY23 are expected to fall short of budget estimates at Rs 35,000 crore,” ICICI Securities had said in a report.

Also Read | Budget 2023: What FM Sitharaman missed on banking in her 87-minute speech

It pointed out that Rs 31,106 crore had been received as proceeds till December 2022 with major deals including stake sale in LIC at Rs 20,516 crore, ONGC at Rs 3,058 crore, Axis Bank at Rs 3,839 crore and IRCTC at Rs 2,723 crore. This time, ICICI Securities expects a more realistic disinvestment target for FY24 with several deals nearing closure. “We estimate disinvestment target at Rs 80,000 crore for FY24E,” the brokerage firm said.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.