The Centre can expect a hefty dividend from the Reserve Bank of India (RBI) in the 2023-24 Budget even though the current financial year was bad for the central bank's foreign investments.

The RBI keeps its foreign exchange reserves in the form of assets such as gold, foreign currency, deposits in overseas banks, and bonds of foreign governments. Over $200 billion is invested in US government bonds.

But with US interest rates rising sharply in 2022-23, the RBI may have to make record provisions against losses on these investments. The price of a security – for instance, a US government bond – falls as the yield on it rises.

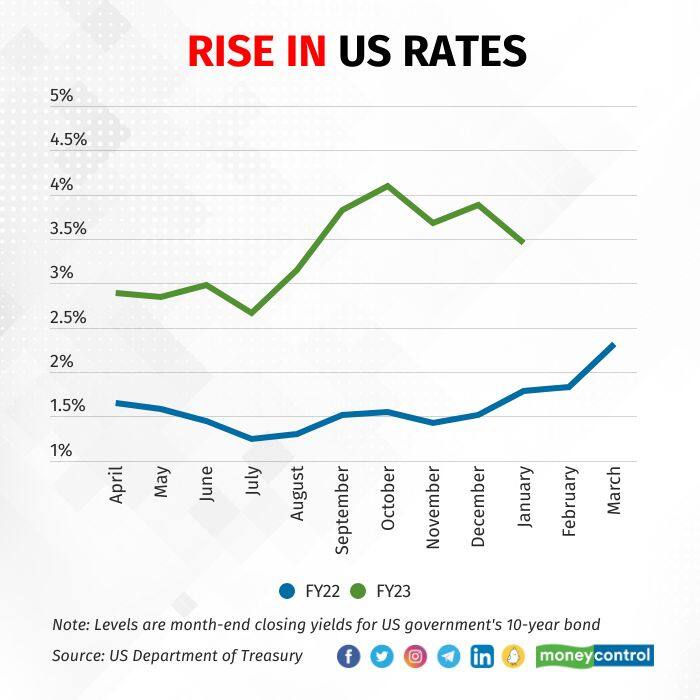

In 2021-22, the 10-year US government bond yield rose to 2.32 percent from 1.65 percent. So far in 2022-23, a rapid tightening of monetary policy by the US Federal Reserve has led to the 10-year paper's yield rising by 114 basis points to 3.46 percent, having come off a high of 4.25 percent in mid-October.

One basis point is a hundredth of a percentage point.

The RBI's holdings of foreign securities are marked to market. Any unrealised gains or losses must be transferred to the Investment Revaluation Account-Foreign Securities. If there are losses, the IRA-FS falls into negative and must be balanced at the end of the financial year by charging a similar amount to the Contingency Fund.

In 2021-22, the central bank made a provision of Rs 1.15 lakh crore towards its Contingency Fund, which is meant to meet unexpected and unforeseen eventualities, including depreciation in the value of securities, risks arising out of monetary and exchange rate policy operations, and systemic risks.

This provision led to the RBI transferring a dividend of only Rs 30,307 crore to the government in 2022-23, well below the budget estimate of Rs 73,948 crore.

The RBI is expected to transfer the dividend for 2022-23 to the Centre in May after its annual accounts are finalised. Since this dividend will be paid to the government in 2023-24, next week's budget will provide an estimate for it.

Big FX gainsOver the years, the RBI's dividend has become a major source of revenue for the Centre. From Rs 33,010 crore for 2012-13, it rose to Rs 1.76 lakh crore in 2018-19, with the central bank also transferring some of its excess reserves.

While the dividend for 2021-22 took a hit, the fact that the RBI had any dividend to give at all was thanks to its forex sales.

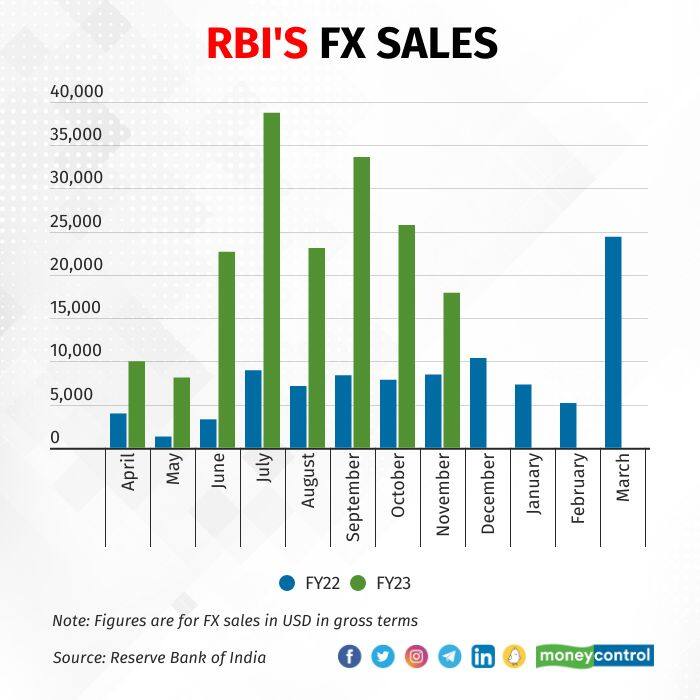

In 2021-22, the RBI sold $97 billion worth of foreign currency. This generated a huge foreign exchange gain of Rs 68,991 crore for the central bank, partially nullifying the provision it had to make.

Foreign exchange gains are set to have come to the RBI's aid again in 2022-23.

The central bank's gross foreign currency sales amounted to $180 billion in the first eight months of 2022-23 as it mounted a defence of the rupee, which hit several new lows against the dollar amid rising global interest rates and elevated commodity prices following Russia's invasion of Ukraine in February 2022.

According to Madhavi Arora, lead economist at Emkay Global Financial Services, the Union Budget 2023-24 could estimate the RBI dividend at as much as Rs 1 lakh crore, thanks to the huge forex sales. Other economists see the dividend in the range of Rs 70,000-80,000 crore.

The RBI generates a profit on foreign currency sales on account of the sale price being higher than the historical average cost. According to IDFC First Bank's Gaura Sen Gupta, the historical average cost of the RBI's dollar holdings is about 62 rupees at the moment.

The rupee's median exchange rate went to 81.7 per dollar in November from 76.3 in April. Every dollar sale over the period generated a substantial profit and forex gains for the full year could be double the Rs 68,991 crore accrued in 2021-22.

To be sure, the RBI has other sources of income and expenditure heads. It is likely to get higher interest income from its holdings of foreign securities due to the higher interest rates. Another plus could be lower interest outgo on its liquidity operations, with surplus liquidity having reduced this financial year.

On the other hand, the RBI's expenditure – excluding provisions – is pretty settled, having averaged roughly Rs 15,000 crore per year over the past decade.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.