The Reserve Bank of India (RBI) is responsible for the management, regulation, and supervision of various aspects of the economy. It is also a key source of funds for the government.

In the course of performing its duties, the RBI generates revenue. While it also has certain expenditures such as those incurred while printing currency notes and to provide for any losses on its investments, it is left with a pile of surplus money at the end of its accounting year. This surplus money is transferred to the central government in the next financial year as a dividend. And this dividend can be massive.

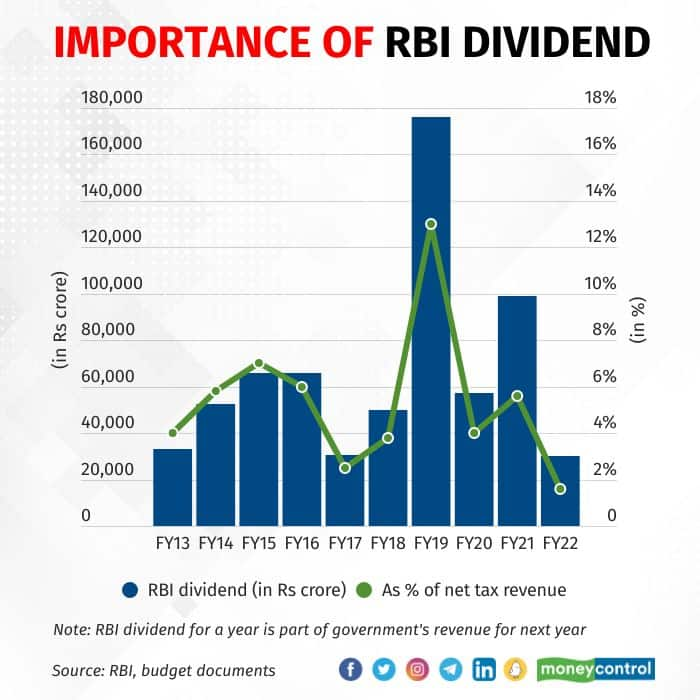

As shown in the chart above, the RBI's dividend to the Centre dipped to Rs 30,659 crore following demonetistion. One of the reasons for this was the central bank having to rapidly print new notes to replace the banned ones. But things took a turn for the better in 2018-19, when the dividend was a colossal Rs 1.76 lakh crore. Transferred in 2019-20, this dividend included the transfer of the RBI's 'excess reserves.

Also read: In Graphic Detail | Cess and surcharge prop up Centre's fine fiscal balanceOver the last decade, the RBI has, on average, transferred an annual dividend of Rs 66,066 crore to the Centre. Again, on average, this amounts to over 5 percent of the Centre's net tax revenue — a tidy sum when one considers the optics of missing the fiscal deficit target by even 10 basis points.

Given the importance of the RBI's dividend — the size of which does not influence its policy actions — it can come as a rude shock to the government when budget estimates are missed.

Like in 2021-22, for instance. In May 2022, the RBI transferred a dividend of Rs 30,307 crore to the Centre for the year 2021-22. This was less than half the Rs 73,948 crore the government had estimated it would get from the central bank and public sector banks, with most of it coming from the RBI.

How much dividend the RBI will transfer to the Centre for 2022-23 will be keenly watched.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.