Two years after the Reserve Bank of India (RBI) superseded the board of crisis-ridden YES Bank, which was followed by a bailout led by a State Bank of India (SBI)-led consortium, the bank is finally set for a change of guard.

On June 8, the bank said its board of directors, appointed under the YES Bank Reconstruction Scheme of March 2020, has recommended to shareholders the formation of a new board in line with the directions of the scheme.

The board has also recommended that former SBI chief financial officer Prashant Kumar, who had been initially appointed the bank’s administrator, should continue as the lender’s chief for another three years. The bank will seek investors’ nod on these proposals on July 15 during its annual general meeting.

This marks another key chapter in the history of YES Bank, which is arguably the largest bank to be bailed out in Indian banking history.

How did YES Bank plunge into a crisis?

The fall was triggered by aggressive growth coupled with revelations of fraud and gross financial misdealing by its co-founder and former CEO, Rana Kapoor. Investigations showed that Kapoor misused his position and engaged in large-scale rule violations for personal gains.

“Diamonds are forever. My promoter shares of YES Bank are invaluable to me,” Kapoor tweeted on September 28, 2018, nine days after India’s banking regulator rejected the extension of his tenure as the lender’s head.

In a series of tweets, Kapoor said during the leadership transition, he remained fully committed to the interests of the bank and its stakeholders.

“I will be fully guided by the Board of Directors of YES Bank and the Reserve Bank of India,” Kapoor said.

By December 2019, Kapoor’s stake in YES Bank reduced to zero after YES Bank promoter-run companies YES Capital and Morgan Credit sold their remaining 2.04 crore shares for approximately Rs 142.75 crore.

First arrested by the Enforcement Directorate in March 2020 for his alleged role in a scam at YES Bank involving dubious transactions between himself and erstwhile Dewan Housing Finance Corporation promoters, Kapoor is currently lodged in Taloja Central Jail in Navi Mumbai.

Crises

On November 21, 2019, global rating agency Moody’s cut the bank’s credit rating to ‘Ba1’ from ‘Baa3’, citing several issues at the bank. The rating outlook shifted to negative from stable.

“In Moody’s opinion, although the bank’s credit fundamentals remain stable, developments surrounding the transition in leadership as well as governance issues are credit negative because they complicate the management’s effective implementation of its long-term strategy. Furthermore, these developments could constrain its ability to raise new capital,” Moody’s said in a statement.

In particular, Moody’s noted significant divergence in the bank’s reported asset quality metrics compared with the RBI’s assessment of asset quality in two consecutive fiscals. Divergence in classification of non-performing assets (NPAs) between the bank’s and the RBI’s assessment stood at Rs 4,176 crore as of March 2016 and Rs 6,355 crore as of March 2017, the rating agency said.

The bank’s bad loans rose sharply with net NPAs rising to 4.35 percent as on September end from 0.84 per percent a year earlier.

On January 24, 2019, in a press release issued by YES Bank to announce the appointment of new managing director Ravneet Gill, outgoing chief Rana Kapoor was quoted as saying: “I am certain that his diverse, comprehensive experience as a career banker will provide significant confidence and conviction to all stakeholders including employees, customers and investors.”

But as Moneycontrol reported earlier, little did Gill know then that even his three decades of experience at Deutsche Bank as a career banker would not be sufficient to tame the beast called YES Bank.

Kapoor who wished him well in the new job had created an insurmountable task for him. The mess in the bank—on account of years of loose lending and questionable management practices—was too deep. Gill had his task cut out: find an investor(s) to raise as much as $2 billion (around Rs 15,000 crore) of survival capital for the Bank.

On January 10, perhaps the final blow to Gill’s plans at Yes Bank came when Uttam Agarwal—one of the independent directors and head of the bank’s audit committee—quit, raising serious corporate governance issues. In a letter to the Securities and Exchange Board of India (SEBI), Agarwal accused Gill of lack of transparency in sharing updates on fundraising exercises to the board.

Moratorium

The RBI on March 5, 2020, superseded the board of YES Bank and Kumar was roped in as bank administrator.

“This has been done to quickly restore depositors’ confidence in the bank, including by putting in place a scheme for reconstruction or amalgamation,” the RBI said in a statement.

YES Bank was put under a moratorium till April 3, 2020. Withdrawals from the bank were initially capped at Rs 50,000 per depositor, which shook the public’s trust for the second time as the event unfolded in quick succession to similar measures at the erstwhile Punjab & Maharashtra Co-operative Bank.

The government on March 13 cleared the YES Bank restructuring scheme through which SBI was to invest Rs 7,250 crore. SBI was to pick 725 crore shares at Rs 10 each, as per the scheme. Other lenders too joined the rescue act with HDFC Ltd and ICICI Bank investing Rs 1,000 crore each (meaning 100 crore shares each), while Axis Bank and Kotak Mahindra Bank announced Rs 600 crore and Rs 500 crore of capital investment, respectively.

The RBI had reached out to the top management of private financial institutions seeking an investment in YES Bank but there was uncertainty regarding the bank’s future, said a private sector banker in know of the matter.

“People from within the organization were sceptical (about investment going bad) but the investment made by us was in view of securing stability in the overall financial markets, not profit,” said the private sector banker.

As at the end of March 2022, domestic financial institutions including SBI held a 30 percent stake in YES Bank, ICICI Bank held 3 percent and Axis Bank 2 percent, while IDFC First Bank and Bandhan Bank held 1.2 percent stake each. Life Insurance Corporation of India (LIC) also held a 5 percent stake in YES Bank as on March 31, as per data from the National Stock Exchange (NSE).

Even as YES Bank was saved by a clutch of systemically important lenders, its downfall led to significant losses for holders of the bank’s additional tier-bonds (AT-I) as well as equity shareholders as the bank’s shares tanked from their all-time highs of up to Rs 394 in August 2018 to Rs 12.80 apiece as at 1.30 pm, June 14, on the NSE.

Further, Rs 8,400 crore worth of YES Bank AT-1 bonds were written off as part of the SBI-led reconstruction scheme. Since then, those who had invested in these bonds, including retail and institutional investors, have been fighting against this decision in court.

Analysts said demand for AT-I bonds overall fell after the YES Bank crisis but returned post-pandemic with public sector banks leading the chart.

Financials improve

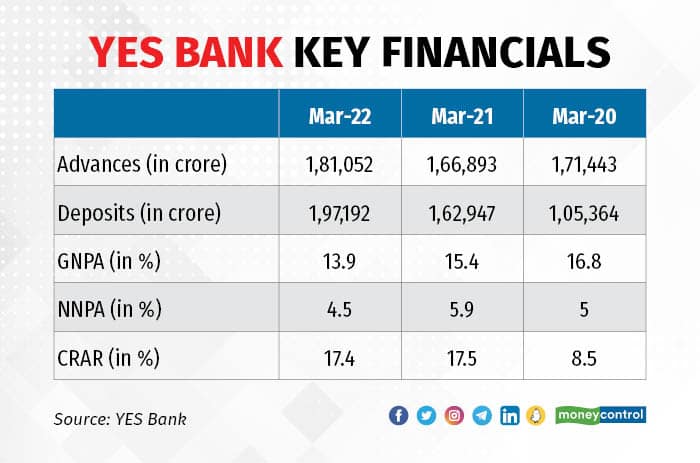

YES Bank reported its first full-year profit in FY22 at Rs 1,066 crore after two successive years of heavy losses in FY20 and FY21.

In an exclusive interview with Moneycontrol on May 3, Kumar said the bank will likely raise Rs 7,500 crore in the current fiscal out of the total board-approved capital raise limit of Rs 10,000 crore, and that the bank was is in a “really advanced” stage of finalising a partner for its proposed asset reconstruction company (ARC) that will house the bank’s over Rs 25,000 crore of toxic loans.

As at March end, YES Bank’s loan book stood at Rs 1.81 lakh crore, up 8.5 percent on a year-on-year basis. Deposits, at Rs 1.97 lakh crore, rose 21 percent compared to March 2021.

The bank’s net interest income (NII) or the difference between interest earned and interest expended grew 84.4 percent on-year to Rs 1,819 crore in Q4FY22. Net interest margin came in at 2.5 percent, up 90 basis points (bps) annually and 10 bps sequentially. Gross and net NPA ratios stood at 13.9 percent and 4.5 percent as on March end, lower than 14.7 percent and 5.3 percent in the previous quarter, respectively.

Slippages at Rs 5,795 crore as of March 2022, halved from Rs 12,035 crore at the end of March 2021.

Outlook

Though lower on a yearly basis, YES Bank’s bad loans are higher compared to its peers including Axis Bank and Federal Bank, which have gross bad loans in lower single digit territory.

“We would be coming down to around 10 percent range on GNPA and net NPA number we will be targeting is 3 percent,” Kumar told Moneycontrol.

“The way we will proceed, in terms of formation of our ARC where we would like to transfer all the NPA pool, there would be hardly any NPAs,” he added.

The formation of ARC is crucial for the bank to offload its toxic assets and focus on growth, experts said.

“Overall, rise in recoveries and upgrade coupled with lower slippages resulted in lower GNPA and reduction in labelled exposure. Although GNPAs are expected to trend downwards with improved recoveries, trajectory will also be contingent on stress pool sale,” ICICI Securities said.

As per Anand Dama, head of BFSI research at Emkay Global Financial services, YES Bank could have tapped existing ARCs including the newly launched National Asset Reconstruction Company for the sale of bad loans.

“The RBI’s approval remains a major challenge as in the past the regulator has not been in favour of private bank-led ARCs, as other banks may make similar demands,” Dama said.

“The prospects of the next round of capital raise to shore up its otherwise subpar core capital base too are tied to balance sheet clean-up and the roadmap to steer the bank into sustainably high growth cum profitability phase,” he added.

The bank’s management is hopeful of RBI approval for the ARC by June end and this will be a key near-term monitorable for YES Bank, analysts said.

“Business models and business strategies of individual entities should be conscious choices that are adopted following a robust strategic discussion in the board, after considering all relevant aspects. Businesses should avoid aggressive short-term reward-seeking culture, without regard for the build-up of excessive risks in the balance sheet,” RBI governor Shaktikanta Das said in his Azadi ka Amrit Mahotsav speech on June 9.

Das said the common characteristics of some inappropriate business models are inappropriate funding structure, building asset-liability mismatches that are highly risky and not sustainable, unrealistic strategic assumptions, particularly excessive optimism about capabilities, growth opportunities and market trends which may lead to poor strategic decisions that imperil business model viability.

Further, over-focus on business considerations with neglect of risk, control and compliance systems are also the common cause of business failures, as per Das.

“As I said earlier, risk-taking is the essence of doing business. What I am now emphasising is the need to carefully weigh the upsides and downsides of every risk before embarking upon it,” Das said.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.