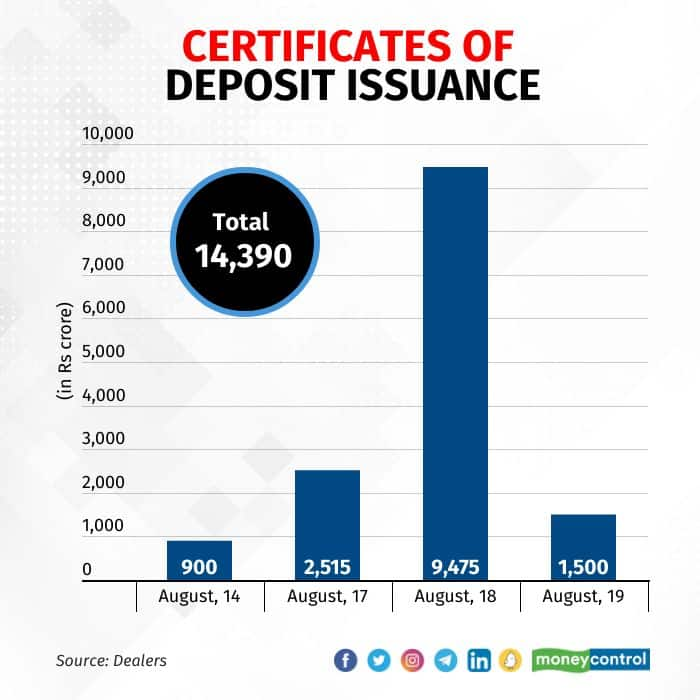

Indian banks have raised around Rs 14,390 crore via certificates of deposit (CD) as surplus liquidity in the banking system declined sharply post the introduction of the Incremental Cash Reserve Ratio (I-CRR) by the Reserve Bank of India (RBI).

According to the data compiled from market sources, of the Rs 14,390 crore raised by banks, of which Rs 900 crore was raised on August 14, Rs 2,515 crore on August 17, Rs 9,475 crore on August 18, and Rs 1,500 crore on August 21.

CD is a money market instrument issued by the banks to raise short-term funds from the debt market.

The rise in CD issuances was witnessed after the liquidity in the banking system narrowed by over Rs 1.42 lakh crore as on August 13 due to I-CRR.

“The CD issuances have picked up as liquidity has been taken out by higher CRR and other RBI measures,” said Ajay Manglunia, Managing Director and head of the investment group at JM Financial.

On August 10, the central bank said that with effect from the fortnight beginning August 12, scheduled banks will have to maintain an I-CRR of 10 percent of the increase in their net demand and time liabilities (NDTL) between May 19 and July 28.

The outflow on account of I-CRR was broadly in line with estimates outlined by RBI Governor Shaktikanta Das and market players, who expected over Rs 1 lakh crore to be sucked out.

Also read: Banking system liquidity slips into deficit for the first time this fiscal

What do numbers say?

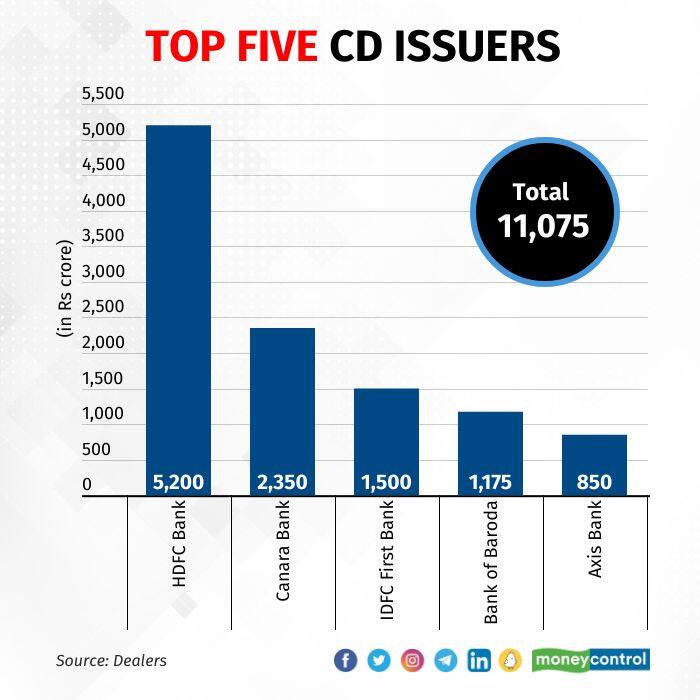

HDFC Bank, Canara Bank, IDFC First Bank, Bank of Baroda and Axis Bank were the top five issuers in the last four trading sessions.

These banks together raised Rs 11,075 crore, which is over 78 percent of the total issuances.

Money markets were closed on August 15 and August 16 on account of Independence Day and Parsi New Year, respectively.

HDFC Bank raised Rs 5,200 crore, Canara Bank raised Rs 2,350 crore and IDFC First Bank raised Rs 1,500 crore.

Impact on rates

Impact on rates

Rates on the CDs maturing in three months rose by 10-20 basis points (Bps) since the announcement of I-CRR by the central bank.

One basis point is one-hundredth of a percentage point.

Also read: Inflationary pressures may stay elevated in coming months, Fin Min warns

Rates on three-month CDs, which were trading at 6.9-7.10 percent range on August 9 before the monetary policy, have now increased to 7.00-7.20 percent on August 21.

Money market dealers expect the rates to further increase as the liquidity in the banking system turn deficit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.