Banks are worried that some micro, small and medium enterprises (MSMEs), which are still recovering from the COVID-induced lockdown, may default their loan obligations amid rising inflation, at least six bankers and analysts told Moneycontrol on September 14.

“Although banks have been proactive in providing for the MSME segment, there is a fear that rising inflation will hurt the already embattled firms," said a banker with a state-owned bank, requesting anonymity.

“For these firms, COVID was just about over, and now rising inflation will make things tougher because interest rates will go up further and demand will be compressed,” he said.

“We are expecting some incremental increase in bad loans in the MSME segment in the fiscal second half, but since the loan book is adequately provided for, a major threat to the balance sheet should be avoided,” said the banker.

MSMEs are vital to India’s $3-trillion economy, having contributed over 11 crore jobs and 30.2 percent to the GDP in FY21, as per government data. The government and the RBI, through various schemes and initiatives, have tried to ensure adequate flow of bank credit to the MSME sector.

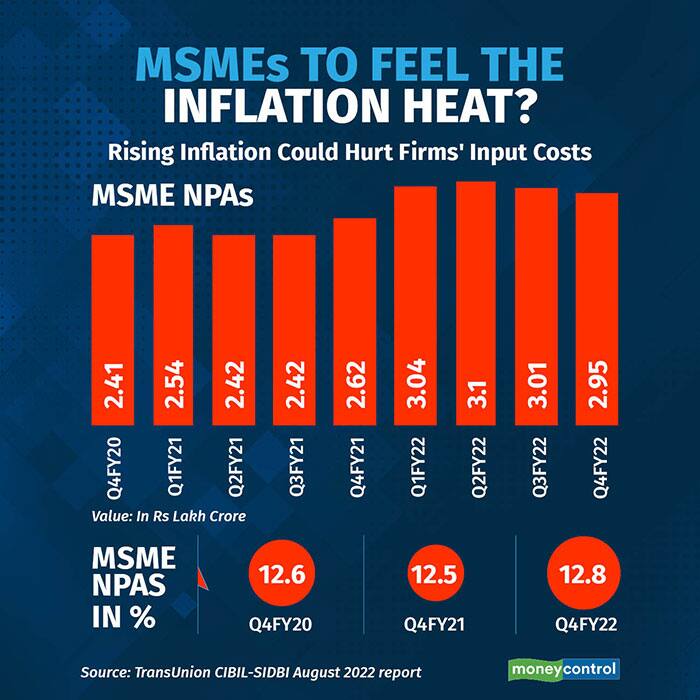

As of March 2022, Indian banks’ total credit exposure to the MSME sector stood at Rs 23.1 lakh crore, up from Rs 21.8 lakh crore a year ago and from Rs 20.2 lakh crore in March 2020, according to a report by SIDBI and credit bureau TransUnion CIBIL.

This indicates that banks’ exposure to MSMEs has been gradually increasing over time, making their balance sheets more vulnerable to defaults and higher non-performing assets (NPAs).

Inflation, the new pain point

MSMEs are just about recovering from the COVID-19 lockdown that rendered millions jobless. Now, rising inflation is the new pain point for a majority of them.

India's headline retail inflation rate, as measured by the Consumer Price Index (CPI), returned to the 7 percent territory in August and has spent 35 consecutive months above the Reserve Bank of India's medium-term target of 4 percent and eight straight months outside the central bank's 2-6 percent tolerance range.

Also read: MC Explains | August CPI at 7%; how high inflation impacts common man?

Consistently higher inflation has raised bets that the rate-setting Monetary Policy Committee (MPC) will continue its rate hike cycle in the coming policies, leading to high borrowing costs for firms. The MPC has already hiked the rate by 140 bps since May. One bps is one-hundredth of a percentage point.

Rising price pressures spike the cost of production of MSMEs significantly as raw materials become expensive. Most firms do not enjoy hefty margins to absorb this cost pressure. Add to that, a steadily rising interest rate means a visible fall in consumer demand, further hurting profitability.

“The current scorching inflation and rate hike might derail the recovery; smaller-sized businesses will face the brunt of these issues,” said Punit Patni, a research analyst at Swastika Investmart.

Patni added that MSMEs are “not completely out of the woods” yet, post- COVID. The upcoming quarters will be “true testing times” for banks’ MSME portfolios and their underwriting quality, he said.

According to Jindal Haria, director at India Ratings, given the rising input cost due to high inflation, the MSME segment continues to remain under pressure. “For FY23, we expect a 10-20 percent increase in MSME slippages over FY22, assuming the inflationary environment does not become extreme,” added Haria.

RBI moratoria end

Making matters worse for the MSME sector, the consistent rise in inflation comes at a time when the RBI’s COVID-related forbearance for the sector is due to end.

Under the second restructuring window, the moratorium period on loans was a maximum of two years, starting soon after invocation till September 30, 2021. The timeline could vary depending on the firms and the banks.

According to the SIDBI-CIBIL report, as of March 2022, 2.7 lakh MSME accounts, with a balance of Rs 35,000 crore, have been restructured. This constitutes around 2.3 percent of the total live accounts and 1.5 percent of MSME outstanding as of March 2022.

Bankers and analysts said that while most of the restructured loans are out of moratorium, there might be some accounts that are still in moratorium and are expected to start paying by October-December. Now that rising inflation threatens to hurt the balance sheets of MSMEs, it could further increase banks’ stress in the second half of the year, they added.

“As far as expectations are concerned, we think 20-to-30 percent of the total restructured loans will slip into NPA,” said Arun Malhotra, founding partner and portfolio manager at CapGrow Capital Advisors. “For large private banks, this will be on the lower side, whereas it could go higher for PSU banks,” he said.

Asset quality stress

Overall, MSME NPAs stood at 12.8 percent, as of March 2022, as per the SIDBI-CIBIL August report. NPAs in the MSME segment have been in an uptrend since March 2021.

The latest round of the bankers’ survey by industry body FICCI and Indian Banks’ Association (IBA) said that 65 percent of respondent banks expect NPAs in the MSME sector to increase in the July-December period.

Even the RBI, in its financial stability report, warned that the restructuring of portfolios to the tune of Rs 46,186 crore, constituting 2.5 percent of total advances under the May 2021 scheme, has the potential to create stress in the sector.

According to Jyoti Prakash Gadia, managing director at Resurgent India, most of the MSMEs are still not out of the woods as far as their financial condition is concerned.

According to Jyoti Prakash Gadia, managing director at Resurgent India, most of the MSMEs are still not out of the woods as far as their financial condition is concerned.

“While the banks have been able to contain their overall NPA book at the aggregate level, the MSME portfolio of banks is still showing stress with limited recovery opportunities,” said Gadia. “The slippages under the MSME sector shall therefore increase substantially during the next two quarters and we may have over 12 percent gross NPAs under the MSME sector by March-end,” he said.

Also read: Room for further reduction in credit costs, NPAs can trend down, says Bank of Baroda MD

Banks well-placed

Even as the MSME sector slippages and NPAs are likely to rise, analysts said that most banks are comfortably placed on the capital and loan-loss buffer front to absorb any unforeseen stress.

“Banks have been proactive in providing for the upcoming stress emanating from the restructured portfolio, ensuring future credit costs to remain stable despite the increase in slippages. Additionally, upgrades and recoveries will keep a check on credit costs,” added Swastika Investmart’s Patni.

“Banks that have stringent underwriting standards on secured MSME lending, and have been very cautious and judicious while extending Emergency Credit Line Guarantee Scheme (ECLGS) and restructuring schemes, are better placed to tackle MSME stress,” said Patni.

CRISIL Ratings’ senior director and deputy chief ratings officer Krishnan Sitaraman said that even though MSME slippages could be higher when compared to other segments, they should still be lower than that envisaged earlier, given the tailwinds of economic activity.

“We expect MSME segment NPAs to rise in the next few quarters, but to a lesser extent than expected earlier, while overall banking sector NPAs should reduce,” added Sitaraman.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.