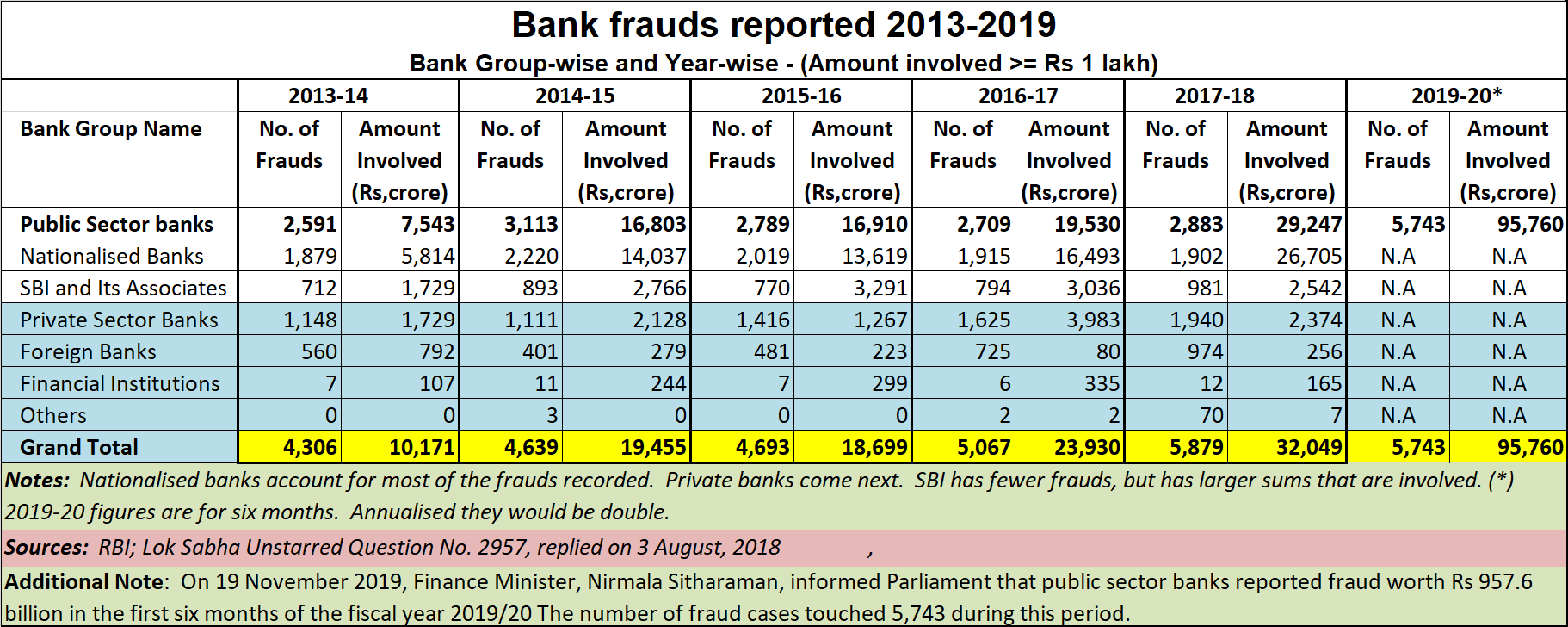

On November 19, 2019, Finance minister Nirmala Sitharaman, in the Rajya Sabha, said, “According to Reserve Bank of India (RBI), frauds as per the year of reporting, as stated by Public Sector Banks (PSBs) from April 1, 2019 to September 30, 2019, is 5,743 and involving a total amount of Rs 95,760.49 crore."

Bank frauds reported 2013-2019

Bank frauds reported 2013-2019

But what was overlooked was that the situation has become extremely alarming. Taken against the backdrop of earlier disclosures by the government, it is clear that the amounts involved in frauds have been increasing year after year. Public sector banks account for nearly 90 percent of the frauds in terms of the sum involved.

Clearly, when instances of fraud keep increasing, and so do the amounts, some urgent steps need to be put into place. The Finance Minister’s statement was related to a six-month period. Annualised, the figures would probably have been more than 10,000 cases, and more than Rs 1.8 lakh crore lost by way of fraud.

Perhaps the first step required to remedy the situation is greater transparency. The Reserve Bank of India (RBI) is still shy of disclosing the names of the defaulters and officers involved. In fact, tainted officers should be cauterized immediately, so that they are not allowed to carry on their creative bank book management elsewhere.

But the government seems reluctant to part with information, the first pre-requisite for transparency. Take two instances.

Consider the statement relating to the unstarred question no 1,447 on bank frauds that was answered on 1 July 2019. Go to the end of the statement and you will find two tables where the related numbers in six columns have disappeared, and are given as run-on sentences. Someone has to be very patient with parsing each line and fixing each number in a tabulation to make any sense of them.

Then try downloading the pdf version and the table does not even appear in its full format. Such unwillingness to let the public gain access to numbers is visible time and again. You cannot solve a problem by concealing numbers.

Second, keep the RBI as the auditor of the last resort. Use third-party auditors, with the clear understanding that the audit firms will lose its licence if its annual audit report shows any sign of concealment. The time to pussyfoot around with auditors is over. The situation is extremely serious. If required, rope in reputed global forensic experts like the SGS to take up a few cases on a random selection basis, so that empanelled auditors can begin losing their licenses if coverups are detected.

Third, allow the RBI to remove its officers from the boards of banks. You cannot be a regulator and a participant. The RBI had suggested this earlier. Even former RBI governor, Raghuram Rajan, is not in favour of having RBI officials on Bank Boards. But the government overruled the RBI. Conflict of interest situations makes staunching the tide of corruption in banks even more difficult.

The current crisis in Indian banks warrants such moves urgently. It won’t help if people put their money with Google or PayTM rather than banks. Foregoing saving interest is better than losing one’s capital, isn’t it?

Will bank reforms begin in full earnest?

The author is consulting editor with moneycontrol.com

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.