The market has been bearish for Indian films with the box office declining for one of its major contributors, Hindi movies, along with footfalls and occupancy falling due to a weak content lineup.

The beginning of the financial year 2025 has been no different from how things ended for the multiplex industry in the fourth quarter of FY24. In Q4 FY24, India's top multiplex, PVR Inox, was back in the red after two quarters and had reported a loss of Rs 133 crore, higher than the Rs 118 crore analysts had expected.

Analysts in Q1 FY25 expect the sluggishness to continue once again due to lack of content. A few small surprises did bring cheer to the industry, but there were no big successes.

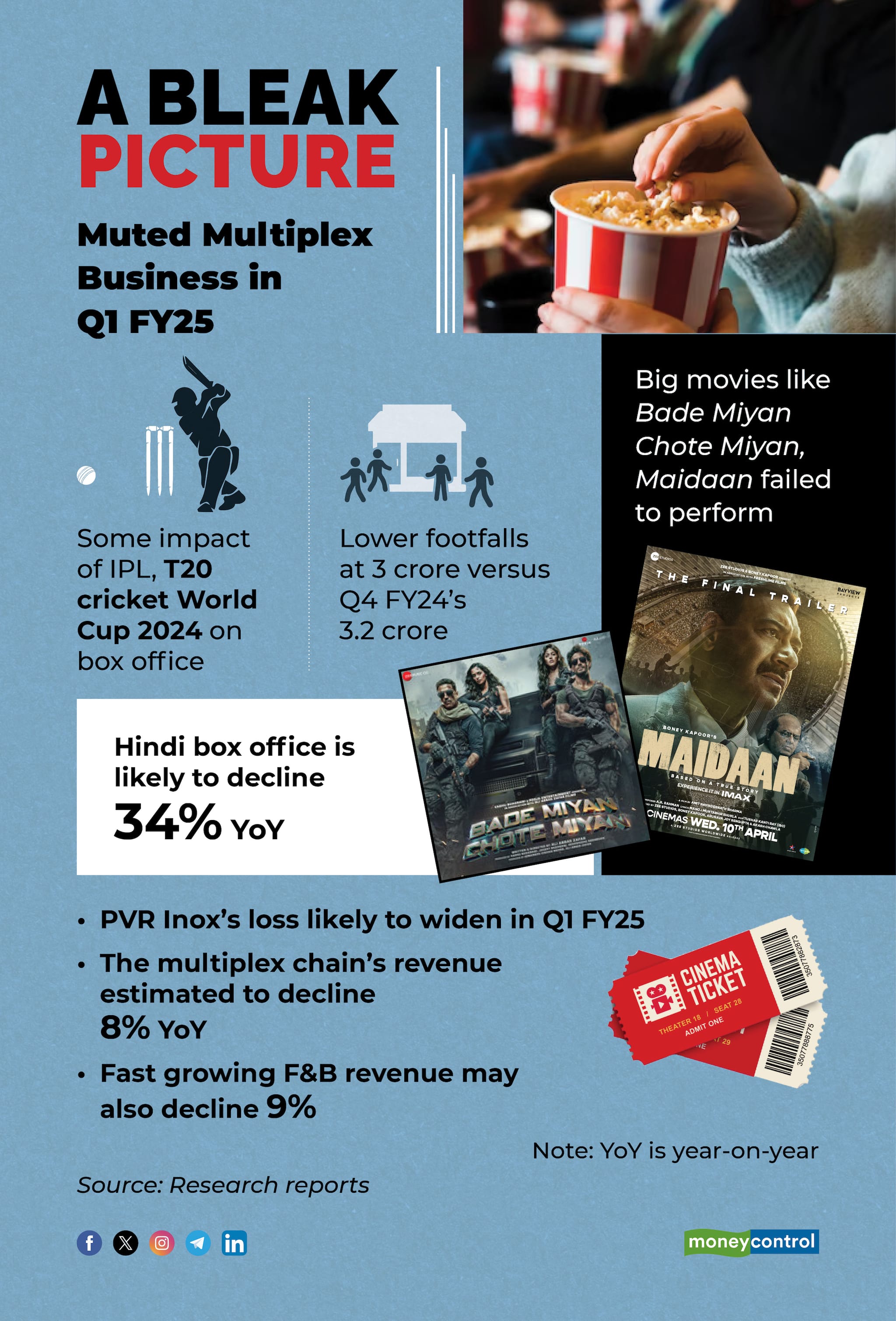

"Q1 FY25 has been challenging for the multiplex industry. The total box office performance for April-May-June seems to be weak. This is likely due to the lack of blockbuster movies and major sporting events like the IPL (Indian Premier League) and the (2024 T20 cricket) World Cup competing for audience attention," said Abhishek Jain, Head of Research, Arihant Capital.

Slow start

Bollywood saw a slow start, with the highly anticipated Bade Miyan Chote Miyan and Maidaan disappointing at the box office, said Pulkit Chawla, analyst, Emkay Global.

Hindi box is likely to decline 34 percent year-on-year (YoY) in Q1 FY25, estimates Karan Taurani, senior vice-president, Elara Capital.

"Some small-to-medium-budget movies did well, but not enough to move the needle, with Munjya emerging as a surprise hit. Hollywood offered few releases. Regional cinema was also slightly muted. Kalki 2898 AD emerged as the highest grosser with Rs 302.4 crore across languages but during only 4 days of Q1," Chawla said.

However, NV Capital's Vivek Menon pointed out that Malayalam continued to perform well in April and May with movies like Aavesham, Guruvayoor Ambalanadayil and Aadujeevitham. "Tamil has also done well with Aranmanai 4, Maharaja and Garudan but Kalki has been the best of the lot for this quarter," he said.

Bleak Bollywood

While May was the highest grossing month of 2024 for multiple languages like Tamil, Marathi, Punjabi and Gujarati, the month turned out to be the period with the lowest collections for Hindi films in 2024, an analysis by media consulting firm Ormax said.

Aranmanai 4, released on May 3, emerged as the top-grossing film of May with collections to the tune of Rs 67.4 crore. This is the first time since the release of Leo in October 2023 that a Tamil film has become the top-grossing film of the month at the domestic box office, Ormax analysis said which further added that Tamil films increased their share in May 2024 compared to the previous month, aided by the collections of the films like Aranmanai 4, Garudan and Star.

The Malayalam film industry continued its strong run at the box office, maintaining its share of 19 percent, due to the steady collections of films like Guruvayoor Ambalanadayil and Turbo. This year Malayalam movies recorded its highest ever business of over Rs 600 crore at the box office and might breach its 2017 record annual business of Rs 712 crore in the second half of 2024.

On the other hand, the contribution of Hindi cinema decreased from 36 percent to 33 percent, due to its weak-performance in May.

"April and May had been muted as compared to the previous quarter, however June has been a much better month especially with the tent pole movie Kalki and to a certain extent Munjiya as far as Hindi films are concerned though there were other good movies like Srikanth, among others," Menon said.

But as exhibitors note that small movies coupled with blockbuster successes like they saw in 2023 with Jawan, Pathaan, Gadar 2 can bring cheer at the box office.

Pangs for PVR Inox

Due to the lack of big successes, Jain expects a significant decline in the revenue of PVR Inox. Their revenue is projected to be at least 20 percent lower in Q1 FY25 compared to the same period last year, he said.

But Chawla estimates the multiplex chain's revenue to decline to Rs 1,197.4 crore in Q1 FY25, an 8.2 percent decline YoY from Rs 1,304.9 crore.

He expects the company to report a loss of Rs 1,74.3 crore in Q1 FY25, widening from the loss of Rs 81.6 crore during the same period a year ago.

"We expect PVR Inox to report a revenue decline of 4.7 percent quarter-on-quarter (QoQ) on account of a lack of sizeable movie releases in Q1. ATP (average ticket price) should see marginal improvement, from Rs 233 in Q4 to Rs 234 in Q1, in the absence of big-budget movies coupled with continued promotional offers for several movies. Also, SPH (spend per head) should see a small uptick, from Rs 129 in Q4 to Rs 134 in Q1. Ad revenue is expected to decline to Rs 100 crore, from Rs 105 crore," said Emkay Global's Chawla.

Footfalls in Q1 are estimated to drop to 3.08 crore from 3.2 crore in Q4.

PVR Inox’s box office revenue is expected to decline 12 percent YoY, according to Taurani.

One of the company's fastest growing segments, food and beverage is likely to see a 9 percent YoY decline in revenue to Rs 389.7 crore from Rs 427.7 crore.

While the multiplex business had a slow start in FY25, analysts expect a pickup from the second quarter.

The outlook for the multiplex business is improving starting from Kalki and a very good set of releases are expected in August, Jain said.

Q2 FY25 is expected to be a strong quarter, led by large ticket releases, such as Sarfira, Indian 2, Stree 2, and the spillover of the collections of Kalki 2898 AD (released on June 27) in Q2, Taurani said. There will be respite in Q2 which may lead to occupancy levels breaching 27-28 percent in Q2 from 22 percent in the first quarter, Taurani said.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.