AT1 bonds, or additional tier-1 bonds, are back with a bang in the Indian banking industry after being pushed to the back burner two years back when a Yes Bank write-off of such bonds caused massive losses to investors.

At least five banks Moneycontrol spoke to said they are likely to tap AT1 bonds in a bigger way in the coming days to shore up the capital base as credit demand picks up and system liquidity tightens further.

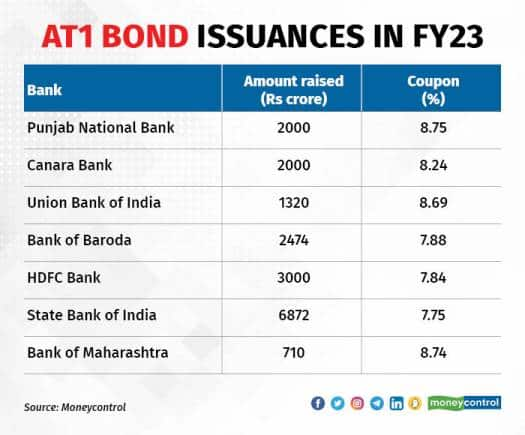

This comes after more than Rs 18,000 crore worth of AT1 bond sales in this financial year, with recent back-to-back issues from State Bank of India, Bank of Baroda, HDFC Bank and Bank of Maharashtra.

AT1 bonds had faced a trust-deficit following Yes Bank's write down of Rs 8,415 crore bonds in 2020. But the market has revived since then, a Moneycontrol analysis showed.

What are AT1 bonds?AT1 are a type of perpetual bonds banks use to augment their core equity base. They carry a higher coupon but are considered risky instruments in the event of a bank collapse.

These bonds were introduced by the Basel accord after the global financial crisis to protect depositors. They do not have a maturity date and banks have a call option that permits them to redeem these bonds after a certain period.

Also read: Banking Central | Sebi penalty on Rana Kapoor strengthens Yes Bank’s AT1 bondholders' case

More banks likely to follow suitAccording to sources, Canara Bank is looking to raise at least Rs 500 crore via AT1 bonds on September 14.

“We can expect Indian Bank, Bank of India, Axis Bank, ICICI Bank to consider issuing AT1 bonds soon besides other fundraising options like Tier 2 and infra bond issuances,” said Venkatakrishnan Srinivasan, founder and managing partner at Rockfort Fincap, a Mumbai-based debt advisory firm. “It is to be noted that few of these banks have a definite requirement to raise more capital due to their ongoing mergers and acquisitions.”

Srinivasan expects banks to raise a minimum of Rs 30,000 crore via AT1 bonds in this fiscal year. The figure can go “much higher” if other lower-rated banks also raise capital, he added.

UTI Mutual Fund’s group president and head – fixed income Amandeep Chopra had similar views.

“The current yields have largely priced in the rate hike expectations in the coming MPC meeting,” said Chopra. “The increased credit growth may result in further issuances of AT1 bonds by the banks to meet their capital requirements.”

Credit demand backCredit to industry grew 10.5 percent in July against a 0.4 percent in the year-ago period, according to data from the Reserve Bank of India (RBI).

“Credit offtake has recovered; it's in double digits. Hence, banks need capital,” said Marzban Irani, chief investment officer – fixed income at LIC Mutual Fund. “Since the equity market is volatile, perpetual bonds are the way out to raise capital for banks.”

On the other hand, net liquidity absorbed by the RBI as on September 11 was just at Rs 1.15 lakh crore, down from above Rs 2 lakh crore a month ago, showed central bank data.

Attractive yieldsIn September so far, HDFC Bank, SBI and Bank of Maharashtra raised funds through AT1 bonds. HDFC Bank raised Rs 3,000 crore at 7.84 percent yield while SBI raised Rs 6,872 crore at 7.75 percent. SBI’s AT1 bond issue was priced at the lowest rate so far in this fiscal year compared to other banks.

According to experts, these are attractive yields for banks to raise funds. At the current level, AT1 bond issuances are comparable to 5-year high-rated senior bonds, prodding banks to raise capital quickly. Further, increasing investor participation from insurance companies besides interest from high net-worth individuals (HNI) is also tempting banks to adopt this route, they added.

“Merchant bankers and investors are pricing AT1 perpetual bond comparable with 5-year AAA-rated senior bond instrument with the strong assumption that the all reputed banks will compulsorily exercise the call option at the end of five years, which is making a win-win situation for the banks to achieve fine pricing,” said Srinivasan of Rockfort Fincap.

Typically, AT1 bonds carry a higher risk as well and are subordinate to all other debt and senior only to equity. If the capital ratios of the issuer or bank fall below a certain percentage or in case of an institutional failure, the rules allow the issuer to stop paying interest or even write down these bonds.

If a bank reaches the point of non-viability, AT1 bonds are typically the first part of the debt that is written down. The market for AT1 bonds took a hit after the Yes Bank AT1 bond write-off, as part of the SBI -led bailout in March 2020.

Since these bonds are not entirely safe, investors demand a certain premium to invest in these securities over and above the G-sec, or government security rate. The difference between the two rates is called the spread. The higher the spread, the riskier the investment.

According to Archita Joshi, fixed income advisor at brokerage Motilal Oswal, the recent AT1 issuances of banks have been priced at very low spreads. For example, compared to a five-year government security, these issues have a spread of around 75 basis points (bps), compared to 100-to-150 bps in the past.

The compressed spreads are a result of less supply of high-quality corporate bonds and that is going in banks’ favour, added Joshi.

Also read: Bankers set eyes on double-digit loan growth in FY23 as credit demand makes comeback

Better financial healthThese bonds are also priced at lower yields because of the improved financial health of the banks post the COVID-19 pandemic. Hence, these instruments may not entail heavy investment risk at present, said bankers.

Banks have cleaned up their balance sheets well and are recovering from the Covid-19 pandemic due to timely capital raising. RBI Governor Shaktikanta Das, in a recent media interview, had emphasised the need for banks to raise more capital to fund the demand for loans.

According to the RBI’s Financial Stability Report released in June, banks’ capital-to-risk weighted assets ratio (CRAR) stood at 16.7 percent in March. This ratio measures a bank's financial strength by using its capital and assets. According to the RBI, scheduled commercial banks are required to maintain a minimum CRAR of 9 percent on an ongoing basis.

“Banks have genuinely worked on their capital base and there is a low possibility that a top-rated bank would collapse. Hence, investors are convinced about the financial health of the banks and are genuinely interested in investing in such securities,” said a treasury official at a private bank, requesting anonymity.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.