The Rs 920 crore initial public offering of Apeejay Surrendra Park Hotels is open for subscription from February 5 to February 7. The company’s shares are on offer in the price band of Rs 147-155 apiece.

The company operates hotels under the brands of The Park, The Park Collection, Zone by The Park, Zone Connect by The Park and Stop by Zone.

The issue consists of a fresh share sale of Rs 600 crore and an offer-for-sale of shares worth Rs 320 crore by the promoter group Apeejay Pvt Ltd. and investors RECP IV Park Hotel Investors Ltd. and RECP IV Park Hotel Co-Investors Ltd.

The company turned profitable in FY23 and has lower margins than peers Lemon Tree and Chalet Hotels. Despite a relatively higher occupancy rate, the company commands a relatively discounted valuation versus some of its peers.

Here is more about this IPO in 5 charts:

About the company

Park Hotels operates properties through a combination of direct ownership, long-term lease for land and/or buildings, and operation and management contracts, using its brand on hotels constructed by third parties.

Park Hotels has 23 operational managed and leased hotels, representing 1,197 rooms, and 18 under-development managed and leased hotels positioned in the upper midscale category, adding 1,475 rooms to the hotel portfolio.

As the company seeks to expand the hotel portfolio as part of its asset-light business model, it intends to increase the portfolio of managed and leased properties through operation and management agreements and lease or licence deeds with property owners positioned in the upper midscale category.

Financials

Apeejay Surrendra Park Hotels, the eighth-largest in India in terms of chain affiliated hotel rooms inventory, reported losses in FY21 and FY22 before finally turning profitable with earnings of Rs 48 crore in FY23. In the first half of the present financial year, the company reported a net profit of Rs 23 crore.

The company’s revenue from contracts with customers doubled to Rs 506.13 crore in FY23 from Rs 178.83 crore in FY21. This increase reflects the company’s ability to scale up operations and capture market demand.

Apeejay

Apeejay

Shareholding pattern

The Rs 920 crore issue consists of a fresh share sale of Rs 600 crore and an OFS worth Rs 320 crore by the promoter group and existing shareholders. The promoters hold 94.18 percent in the company, which will get diluted after the IPO. The fresh funds raised will be used to repay/prepay high-cost borrowings.

Apeejay shareholding

Apeejay shareholding

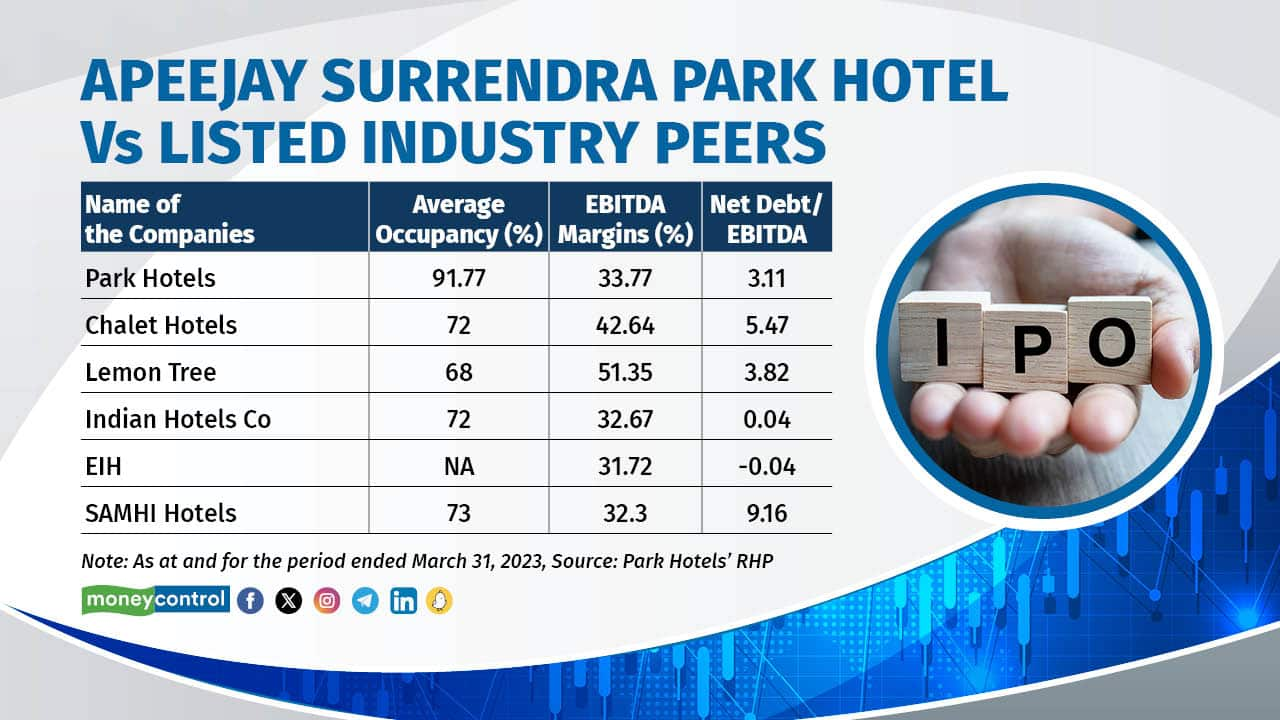

Key metrics versus peers

Apeejay Surrendra Park Hotel’s average occupancy stands at 92 percent versus 65-75 percent for peers.

The company’s Ebitda margins are on the lower side compared with those of Chalet Hotels and Lemon Tree and more or less in line with Indian Hotels Company and EIH.

Apeejay

Apeejay

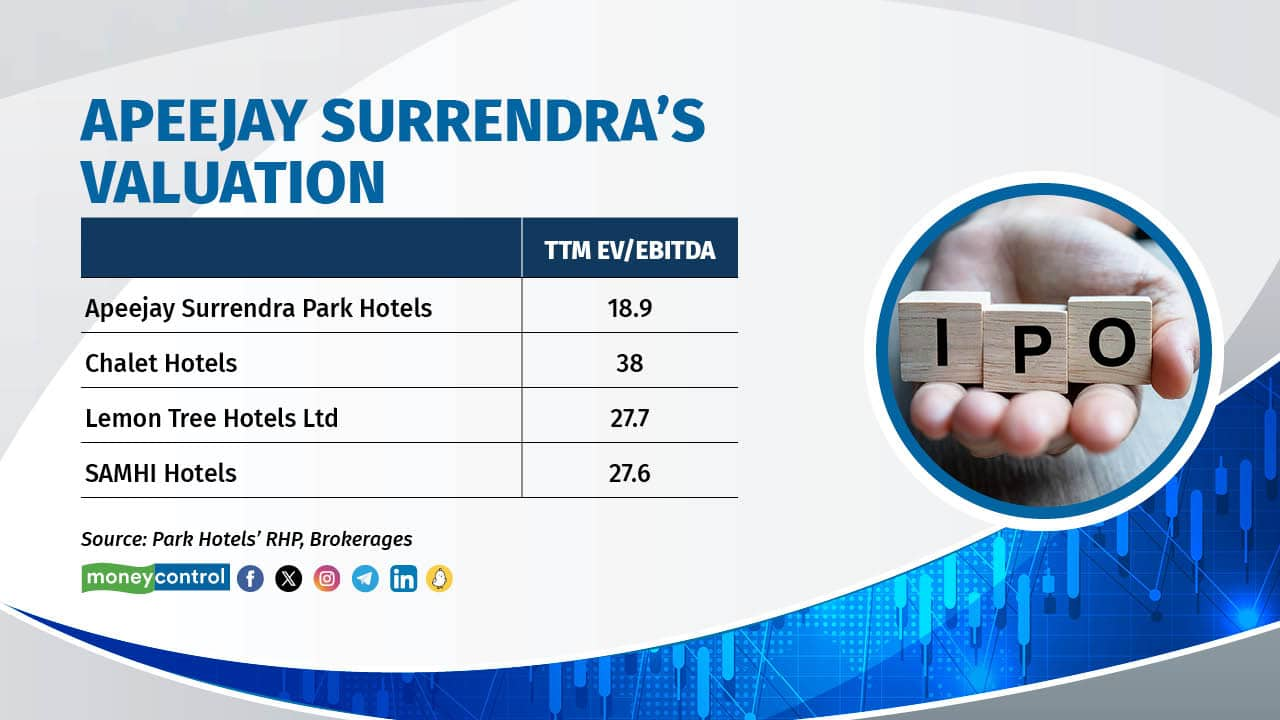

Valuation versus peers

Apeejay Surrendra Park Hotel’s valuation is at a 30-50 percent discount to comparable peers despite better occupancy and return on capital employed.

The company is available at a trailing 12-month enterprise value/Ebitda of less than 19 times versus more than 25 times for peers.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.