Madhuchanda DeyMoneycontrol Research

The monthly auto numbers captured our attention for several reasons. First, coming within a couple of months of the remonetisation exercise, it is an early pointer to the success of that effort. Second, the Supreme Court recently banned the sale of BS III Vehicles (vehicles that are not compliant to the latest emission norm BS IV) from FY18 thereby forcing companies to liquidate their inventory in March. Finally, the numbers for FY17 are a good starting point to ascertain the way forward for these automobile companies.

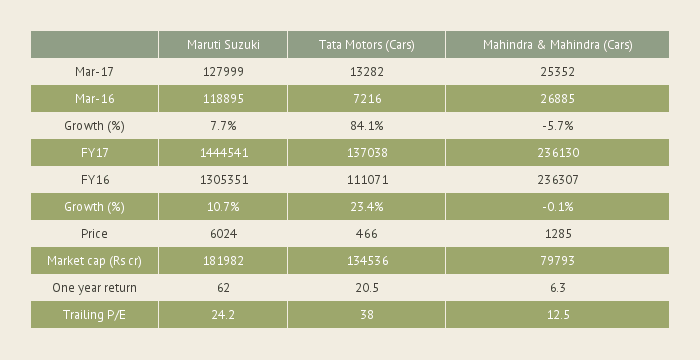

For passenger vehicles, at 3,043,201, the industry volume exhibited a rather impressive 9 percent growth, the highest in the past six years. The market leader Maruti’s overall domestic volume growth at 10.7 percent closely tracked the industry. However, a more segmental analysis suggests that the traditional ‘small car’ did not capture the buyers’ fancy any more – the segment in fact shrank in recent months. The ‘crown jewel’ for the company has been the ‘Compact SUV’ segment featuring Ertiga, S Cross and Brezza that grew by 107 percent.

M&M’s inability to provide the market with the right product is reflected in its sluggish numbers. For Tata Motors, the revamped product pipeline with a value-for-money proposition like Tiago, did wonders for the volumes, as expected. With a robust launch pipeline in the coming year, Tata Motors will be an interesting company to watch out for, although the stellar performance of the car division is too small to move the needle (EBIDTA contribution less than 1 percent). The company will continue to be driven by fortunes of Jaguar Land Rover, and so is a bit more volatile than its Indian peers.

For Mahindra, while the share of rural at 56 percent remains a near-term concern (given the forecast of sub-par rains), the company’s leadership position in agri equipment, ability to leverage Ssangyong’s expertise in launching new products and an extremely reasonable valuation makes it an interesting long-term idea. Maruti, with over 20 percent CAGR in earnings growth in the coming two years (driven by exciting product launches and capacity expansion), will continue to to be a candidate to be accumulated on any correction.

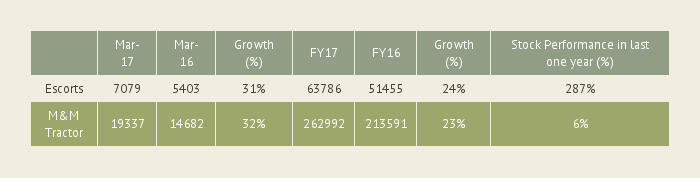

In sum: With the high performers in the automobile sector (that are relatively unscathed due to demonetisation or BS III ban) priced to perfection, investors should look for long-term opportunity at a deep discount. For long-term investors, M&M’s current valuation lends comfort. Maruti, whose superior growth outlook is priced to perfection may provide entry opportunity only on a correction. Hero Motocorp may provide a window on tactical gain on disappointing numbers. For Ashok Leyland, the financial hit on account of BS IV judgement can present investors with a deep discount opportunity. The robust volume performance of the two-listed agri machinery (tractor) player should silence critics of demonetisation. However, the valuation of Escorts appears to have already rewarded the superior performance.

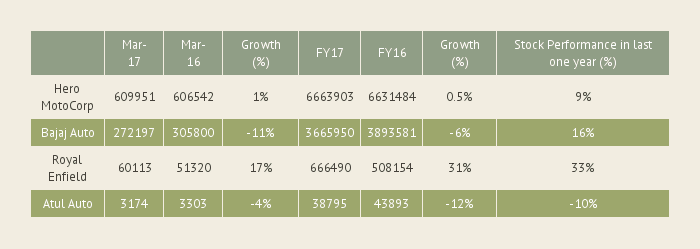

For the two-wheeler players, volume clearly is on the slow lane. Bajaj Auto at 20.1X and Eicher Motors at 46X trailing earnings will therefore do not appear to be exciting ideas.

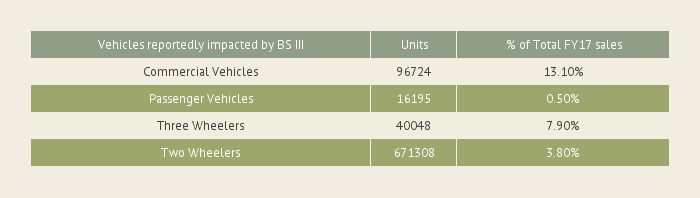

Interestingly, out of the reported inventory of close to 824,275 vehicles that are reportedly impacted by the ban on sale of BS III vehicles, a majority belongs to the two-wheeler segment. Of the 671,308 two-wheelers impacted by this ban, around 250,000-300,000 belongs to Hero Motocorp. Looking at the monthly numbers, it is difficult to make a conclusion on the extent of inventory liquidation; however, it is unlikely that the sector has exhausted its inventory.

However, not all is lost for the two-wheeler companies. Two-wheeler manufacturers may need to install catalytic converter in BS-III vehicles to make it BS-IV compliant at the cost of Rs 500/vehicle plus also bear the freight cost of Rs 1,300/vehicle. The total cost of conversion of BS III vehicle to BS IV, may still be less than Rs 5000. Hence, the total loss for the two-wheeler sector will be a moderate Rs 270 crore. If we assume Hero Motocorp does retrofitting of around 2 lakh vehicles it would incur an incremental cost of around Rs 90 crore. Considering a worst case scenario of the company’s inability to sell 2 lakh odd vehicles – it impacts revenue to the tune of Rs 866 cr or 3 percent of Hero’s annual sales. So any significant correction due to excessive discount or one-time provision can provide tactical entry opportunity.

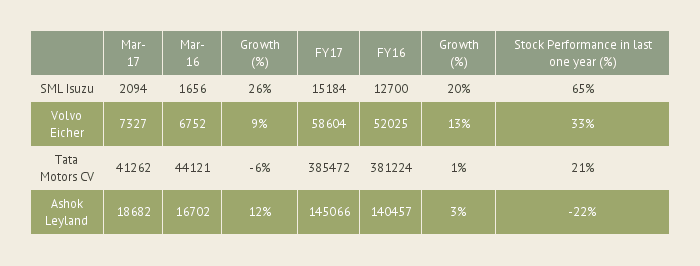

Turning to the commercial vehicle manufacturers, the sequential improvement in volumes for Volvo Eicher and SML Isuzu does give us confidence that the BS III inventory concerns may be largely behind us.

However, for Tata Motors even if there is unsold BS III inventory, the quantum won’t be significant and it can tap export markets without taking much of a hit on financials. Ashok Leyland, according to press reports, has unsold inventory of close to 17,500 vehicles. Looking at the monthly number, it doesn’t appear that the company had much success in selling a large part of it.

For commercial vehicles, the BS-IV engine is different from the BS-III engine. Hence the engine of BS-III vehicles will need to be replaced. Commercial vehicle (CV) manufacturers can sell BS-III vehicles in export markets as SAARC countries and African countries are still BS-III. But the export market isn’t large enough to absorb the reported inventory.

In case Ashok Leyland cannot find markets for nearly 15,000 vehicles, the revenue hit will be close to Rs 2,025 crore – close to 10 percent of its annual revenue. Should Ashok Leyland report a one-time hit on account of such a loss, it might give long-term investors an opportunity to gradually build positions, considering that the company has already started producing BSIV vehicles.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.