It has been 18 months since the restart of scheduled civil aviation in India following a two-month hiatus in 2020. International flights, however, are still operating selectively. With Omicron, the new variant of COVID-19 being classified as a variant of concern, the plan of opening up on December 15 may or may not go as planned. The domestic market, meanwhile, is surely recovering — on many days in November, passenger numbers touched 90 percent of their pre-Covid levels while the average has been 81 percent.

But with this growth, traffic patterns are changing and this is an indication of a return to normalcy. After being below 50 percent of pre-Covid levels and now coming close to recovery, metro cities are catching up.

What do the numbers say?

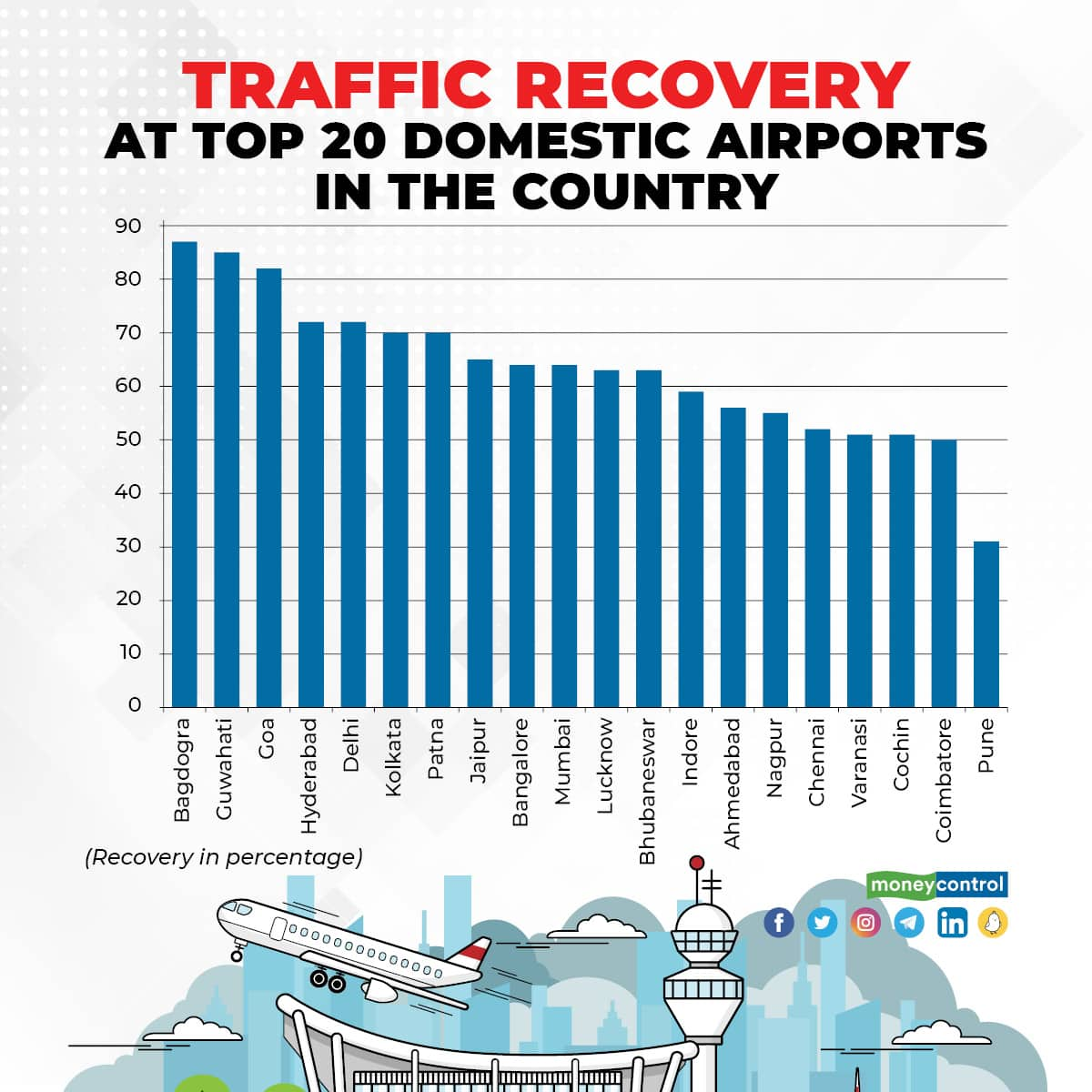

Delhi, the largest airport in the country, saw 72 percent of its pre-Covid domestic traffic. Ironic as this may seem, the airport has been bursting at the seams with regular complaints on social media about delays at security and other bottlenecks.

Mumbai and Bengaluru each saw 64 percent recovery. Kolkata and Hyderabad saw better recovery rates of 70 percent and 72 percent, respectively. The airport that continues to be the worst hit among the metros even now is Chennai, where the recovery is only 52 percent.

In Tier-I cities, Goa stood its ground as the party capital of the country with traffic returning to 82 percent of pre-Covid levels. Indeed, the airport saw higher traffic in November due to the holiday season.

Among major airports, only Srinagar and Chandigarh have recovered completely, with traffic being more than what it was pre-Covid.

Air traffic recovery (Moneycontrol)

Air traffic recovery (Moneycontrol)

Weren’t the numbers different earlier?

For many months since the re-start of civil aviation, the numbers were heavily tilted in favour of Tier II and Tier III cities. This was primarily because airlines had incentives to fly on the RCS-UDAN routes, where they had subsidy backing from the government. In addition, passengers were flying to their hometowns and away from the metros, which were seeing a high COVID-19 caseload. Another factor was that small and medium enterprises (SMEs) and micro, small and medium enterprises (MSMEs) based in smaller cities had restarted travel before large corporations.

This phase saw airports such as Patna, which had seen migration from cities, move up many notches in leading the airports table. A mix of lack of railways, elections in the state and migrant labour taking to air had led to this increase, making Patna the star airport in the country.

Likewise, airports such as Belagavi and Hubballi (formerly Belgaum and Hubli), on a lower base, were doing better than ever. As things stand today, Belagavi and Hubballi saw 72 percent and 49 percent of their pre-Covid traffic in October.

Capacity addition

The Indian market is unique. Even in this melee, the growth rate could still be linked to capacity deployment.

Rajkot, for example, has seen an increase of 80 percent over pre-Covid traffic. The airport had seen a slew of flights being added by IndiGo.

The story is similar for places such as Agra, Prayagraj, Tezpur, Pasighat, Leh and Shillong, where traffic has doubled.

What next?

Indian air traffic has been very elastic. People took to the air the moment the effects of the second COVID-19 wave started waning. Call it revenge tourism or anything else, people movement has been on the rise.

Last year, as the first wave plateaued, passengers rushed to Goa to celebrate the New Year. Likewise, with the opening up of the Maldives, flights from every airport in the country to the island nation were packed.

The looming threat of the new variant notwithstanding, the opening up of international travel is likely to see traffic at major airports go up further. There is a distinct travel profile at airports across the country.

For instance, Bengaluru airport will pick up steam only when the IT companies get back to work from the office. The service industry has been the slowest of the lot, and for the right reasons. Until then, a mix of leisure and business will dominate travel in India.

While a new peak will be achieved in November in terms of passenger numbers and flights deployed, the recovery in December will hinge on how the new coronavirus variant Omicron behaves.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!