Indian Information Technology (IT) companies experienced a dismal last quarter in the financial year ended March 2023 as they coped with challenges ranging from recession fears and high inflation to ripples from a banking crisis in the West.

The top five IT companies did report double-digit revenue growth in constant currency terms for the full fiscal year 2023.

Even so, it’s anyone’s guess how long the impact of a recession in the US and Europe and the banking crisis that has laid low Silicon Valley Bank and Credit Suisse will continue to take its toll on an IT services industry that depends on banking and financial services for a major chunk of sales.

If we were to look at hiring as an indicator of demand, it doesn’t look too promising. After the pandemic-fuelled demand of the previous year, India’s top five companies reported a 65 percent slump in net additions to their workforce in FY23.

According to HFS Research Chief Executive Officer Phil Fersht, 2023, too, will be challenging although the industry is holding up well. Times will get tougher, he says, because of pressure on margins and clients demanding pre-inflationary pricing.

“The winners will be those that can win deals with performance pricing baked in and less focus on people costs,” he says.

How they fared in FY23

FY23 had started on a positive note and everyone in the IT industry was preparing for high growth and digital deals. At the time, the only concerns were the supply-side challenges and the Russia-Ukraine war, according to Pareekh Jain, founder and CEO of EIIRTrend. These supply-side challenges too eased.

“But in H2FY23 the challenges started coming in, first with tech company layoffs and then in the latest quarter, tech and BFSI sectors got hit,” Jain said. BFSI stands for Banking, Financial Services and Insurance.

“Suddenly, there was oversupply in the market. All plans of hiring had to be stalled as more people were on the bench. And demand too started to subdue because of these banking and tech crises,” Jain said.

The fond hope had been that the fourth quarter of FY23 would be spared and the effects of the negatives would be visible only in FY24, but that wasn’t the case. At a time most segments of IT business were impacted, pockets such as engineering services did see growth, Jain said.

Ray Wang, CEO of Constellation Research, told Moneycontrol that despite the slowdown, IT services firms that can move the quickest will do the best.

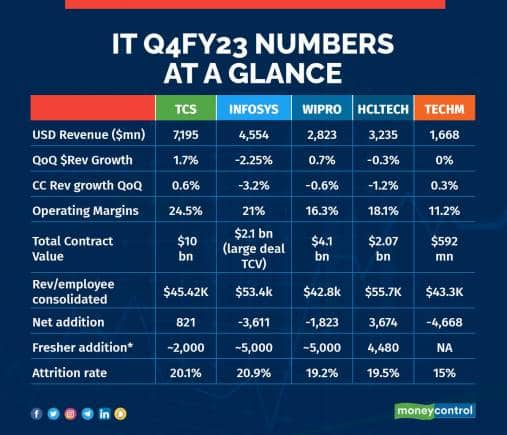

Highlighting company-specific concerns, Wang said Tata Consultancy Services (TCS) reported its slowest revenue growth in 11 quarters, with a number of projects deferred to the new quarter.

Infosys reported weaker-than-expected Q4 numbers that missed analyst estimates and HCL Technologies, Wang said, showed “some sales finesse in winning 13 large deals.”

Wipro, Wang said, was “doing better with large deals and the horizontal realignment strategy to service cloud, data and analytics, bio, product engineering, infrastructure services and consulting.”

Tech Mahindra, which reported a drop from 12 percent in Q3 to 9.6 percent in Q4 margins, is in the midst of a crisis, Wang said.

“They have had a tough time retaining talent and keeping clients. The company really needs the big deal expertise of [CEO designate] Mohit [Joshi] as well as his diplomatic skill in working with clients and inspiring the staff,” he said.

In a tough spot

Leadership teams at all IT companies have sounded a note of caution, some more than others, as the stress becomes evident. Deal ramp downs have been seen across the board as well as delays in decision-making by clients.

Fersht told Moneycontrol: “We’re seeing customers aiming to slim down their providers massively. Some of these large deals (on vendor consolidation) are very resource-demanding, especially in the first couple of years. They can be very complex, and it’s hard to envisage exactly what’s needed during the RFP [request for proposal] process,” he said

.

Wang said that the macro conditions were part of a temporary three-to-six-month slowdown to pause general IT spending.

“However, projects that are related to optimisation, regulatory compliance and modernisation are still being prioritized. Pressure on Europe and APAC (Asia-Pacific) continues to hamper growth. Middle East remains a highlight along with the ANZA (Australia and New Zealand) and the Indian market. North America is slowing down, but continues to be a growth market,” Wang said.

Guidance for year ahead

Guidance by companies such as Infosys, Wipro and HCLTech hasn’t been promising. For FY24, Infosys has guided for revenue growth of 4-7 percent in constant currency. And HCLTech has guided for revenue growth of 6-8 percent in constant currency terms, down from 12-14 percent in FY23.

Wipro, on the other hand, which guides for the following quarter, has guided for a -3 to -1 percent decline in revenue in constant currency terms.

CEO Thierry Delaporte told the press that the macro environment remains challenging looking ahead. “Our clients, our industry, and many sectors are impacted by the prolonged uncertainty in the economic environment. These headwinds are impacting our business and projections as well,” he said.

CFO Jatin Dalal, on the other hand, had told analysts hopes are that growth picks up in the second half, but the environment is still uncertain.

Experts have differed on a likely pick-up in demand in the second half of the year.

Nirmal Bang Institutional Equities said its view is that “the worst on the macro front is ahead of us and not behind us, and hence we think a 2HFY24 recovery in growth seems quite unlikely.”

Digital journey

Kotak Institutional Equities took a different approach. While macro uncertainties and the banking crisis in the US have impacted client sentiment on tech spending, leading to limited visibility on near-term demand, digital transformation is an ongoing journey “with most enterprises still in early stages,” it said.

According to Kotak, depending on the client-specific situation and the outlook of the industry segment they operate in, client priorities on spending would differ.

“Clients in the impacted verticals and those focusing on survival would prioritize lowering their cost base. On the other hand, the set of clients focused on strengthening their competitive positioning vis-à-vis peers would look to continue spending on transformation programs,” it said.

“In addition, given the current uncertain macro scenario, enterprises might also favour to bundle upfront cost-takeout mandates, followed by transformation into larger engagement while also consolidating the set of vendors they work with,” Kotak added in a note.

According to HFS’ Fersht, increased focus on Artificial Intelligence (AI) and automation will take centre stage in FY24 and believes some ambitious mid-sized providers can fare well because they can be nimble.

“The Tier 1s have to be wary of large vendor consolidation deals that could prove unprofitable and resource-draining,” he said. According to him, these mega deals created “huge resource headaches for service providers in many ways.”

Wang concurs on the AI front and says automation and AI were working hand-in-hand.

Reducing human interaction

“Every customer is finding ways to automate and reduce human interaction and also find exponential opportunities with AI,” he said. The focus is on contract negotiations, cloud optimization, code refactoring, and in some cases a move back to on-premises workloads.

“Customers are asking vendors to renegotiate deals with software vendors and services firms. A focus is on consolidating software vendors and optimizing overall IT service spend,” he said.

On the way forward, Wang says we can expect the slowdown to continue for the first two quarters, before picking up in late Q3. “Companies have many projects in cloud, analytics, automation, AI, and cybersecurity that must be completed in order to achieve operational efficiency and exponential growth,” he said.

UnearthInsight founder Gaurav Vasu says that in FY24, deal wins in areas such as cloud transformation, digital transformation and AI and verticals such as pharma, healthcare and life sciences will continue.

“We will still continue to see a few large deals. In FY24, a lot of deal renewals are coming up. These renewals will be a big push for the industry. You will see selective large companies offering end-to-end solutions will continue to win large deals. But overall, in FY24 and Q1FY25, deals will mostly be small. Weakness in BFSI will continue for some time. Growth overall in FY24 will be slower,” Vasu said.

Supply-side

The dwindling net headcount addition numbers have already given an indication of the times to come. Analysts expect hiring to be under pressure.

Vasu says that both gross hiring and net headcount additions are expected to return to their pre-pandemic levels.

He anticipates that companies will go back to pre-pandemic behaviour of internally rotating and fulfilling roles.

“New tech-skills-based roles will require backfilling and new hiring. For some of the companies, given the huge hikes being paid out to new employees and large scale hiring, employee cost was about 65-70 percent of the wage bills of some of the IT companies; that’s getting normalised,” he said.

In FY24, he added, IT services companies will look to normalise the big cost element and look to quality hiring.

“We estimate the IT services industry will hire close to 8,00,000-9,00,000 on a gross basis and the entire industry will hire between 2,00,000-2,12,000 people in FY24,” he said.

According to Unearthinsight, in FY23, the gross hiring that also included people jumping from one company to another was around 7,50,000 to 9,00,000.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.