Billionaire Gautam Adani’s Adani Group is in advanced talks to buy cement units owned by debt-laden Jaiprakash Power Ventures, a media report suggested, potentially heralding another wave of consolidation in the sector.

The deal includes a cement grinding unit and other smaller assets from Jaiprakash Power Ventures Ltd. and Jaiprakash Associates Ltd., for value of around $606 million, or Rs. 5,000 crore, according to a Bloomberg article dated October 10, 2022.

JP Associates’ cement grinding facility in Nigrie, in the central Indian state of Madhya Pradesh, began operations in 2014.

The deal, if it goes through, would strengthen Adani Group’s presence in the cement sector. In May, the group acquired Ambuja Cements Ltd. and ACC Ltd. from Switzerland’s Holcim Ltd., becoming India’s second-largest cement maker virtually overnight with an installed production capacity of 67.5 MTPA.

On October 10, Jaypee Group’s listed companies—Jaiprakash Associates and Jaiprakash Power Ventures--informed the stock exchanges that they will divest the cement business.

The companies did not disclose the name of the potential buyer, and the size or value of the stake they plan to divest.

Adani Group and JP Group did not respond to queries from Moneycontrol. This story will be updated as and when they respond.

JP Associates’ assets, valuations

According to the annual report of Jaiprakash Associates, Jaypee Group (including Jaiprakash Power Ventures) at present has an installed cement capacity of 10.55 million tonnes per annum and 339MW of captive power.

More than 50% of Jaypee Group’s cement capacity is located in the central Indian market. Of the total cement capacity, 1.2 MTPA (in South India) is under expansion, although it has been on hold for some time.

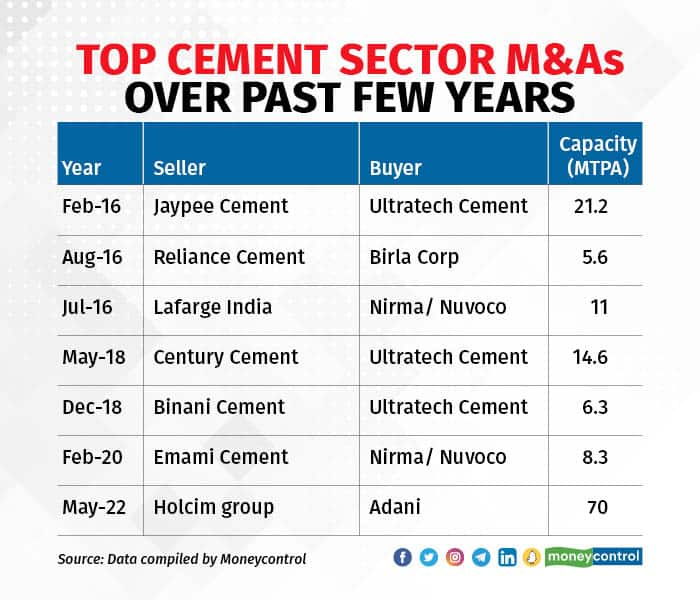

This isn’t the first time that Jaiprakash Associates is selling a cement plant. In 2016, Jaypee Cement sold a 21.2 MTPA plant to Ultratech Cement for an Enterprise Value/Tonne (EV/T) of $115.

On the face of it, the deal value of Rs 5,000 crore looks fairly decent if the company’s debt has been taken into consideration, said Ravi Sodah, analyst and senior vice president of Elara Securities.

This would take the EV/T of the deal to $58 per tonne – which is way cheaper than the ACC- Ambuja transaction. Having said that, it remains to be seen if all assets are part of the deal.

Of the total 10.5 MTPA capacity, JP Associates has 1.2 MTPA in Karnataka and 2.2 MTPA in Bhilai, which is a joint venture with Steel Authority of India Limited (SAIL), and the remaining capacity elsewhere in Central India, Sodah said.

Adani Group bought the stake in Holcim group companies at an EV/T of $162.7 per tonne.

It would potentially reinforce Adani Group’s exposure to the cement sector in central India in a big way and would not just lead to savings, but also growth.

Ritesh Shah, research analyst at Investec, said: “Acquisition of JP Associates would increase Adani’s exposure from the present 8 percent to 22-23 percent; it would add to company’s capacity in a high yielding market ... and would lead to great savings for the company. Further, if the deal were to fructify, this could also come with growth optionality and tax benefits given the plant of a debt-ridden company would have accumulated losses.”

Adani versus Ultratech Cement

Adani plans to double its cement capacity to 140 million tonnes over the next five years, i.e. by 2027, and become the country's largest cement maker by 2030. It recently completed the acquisition of Holcim's India business to become the second-largest producer in the Indian cement market.

The $10.5 billion Holcim deal put Adani, which has an acquired cement capacity of 67.5 million MTPA, just behind UltraTech in size.

Ultratech Cement has a cement production capacity of about 120 MTPA and is in the midst of an expansion plan that shall be completed by FY23. With a newly announced expansion of 22 million tonnes by FY25, the total capacity is expected to rise to 160 MTPA.

From the above expansion plans, it is clear that even if Adani aims to become the country’s largest cement maker, Ultratech Cement would continue to remain the top producer with 160 MTPA until FY2025, even in absence of any inorganic expansion.

A research analyst at Antique Stock Broking said that merger and acquisition news flow is expected to continue and may even intensify after Ambuja got shareholders’ approval to raise funds worth Rs.20,000 crore.

Cement manufacturers typically keep cash in hand when they are aggressively looking out for acquiring assets. With reports of Adani Group emerging as the potential suitor for Jaiprakash Associates’ assets, the key to its ambition is whether a deal is reached and how soon.

Ultratech Cement has been the torchbearer of the industry’s inorganic expansion. Adani is now moving aggressively if the Bloomberg report is accurate.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.