Diwali has always been more than a festival of lights. It is a celebration of new beginnings, prosperity, and the hope of building a brighter future.

Across India, many families mark this time by making significant investments, whether in gold, vehicles, or even the long-cherished dream of a home. Real estate developers often announce festive offers, encouraging prospective buyers to take advantage of discounts. Coupled with suitable housing finance options and favourable home loan interest rates, the festival becomes an attractive time for households to take the leap into homeownership.

Yet, while the excitement of the season can inspire quick decisions, buying a home is one of the biggest financial commitments most people make. Careful preparation is vital to ensure that the joy of the occasion is not overshadowed later.

That is why many people find it helpful to use a home loan EMI calculator to map out the impact of the loan on their monthly budget.

If you are planning to buy your dream home this Diwali, exploring how a home loan calculator works can make planning simpler and help keep the festival’s happiness free from financial worries.

Understanding the Advantages of a Home Loan EMI CalculatorA home loan EMI calculator is a simple online tool that helps you estimate the monthly instalments payable towards your housing loan. By entering a few details such as loan amount, interest rate, and tenure, you can instantly see how much you would need to pay every month.

Reputed lenders like SMFG Grihashakti provide a home loan EMI calculator online, completely free of cost. It is designed to be user-friendly, offering quick results with just a few clicks.

Let’s understand exactly how the tool works using the SMFG Grihashakti home loan calculator.

For example, if you’re planning to take a home loan of INR 50 lakhs for 30 years (360 months) at an interest rate of 10% per annum, the EMI works out to be approximately INR 43,879.

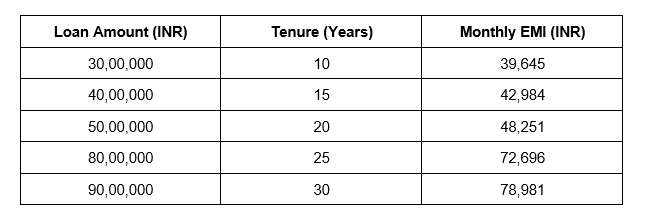

Here’s a quick look at EMIs for different loan amounts and tenures, assuming a constant interest rate of 10% p.a.

.

.As you can see, the EMI calculator for a home loan makes it easy to compare different repayment scenarios and make informed choices before committing.

*The above examples are for illustrative purposes only. The actual EMI amount will depend on several factors, including the lender’s policy at the time of loan application.

How a Housing Loan EMI Calculator Simplifies Festive Home PlanningFestivals like Diwali often bring a mix of joy and expenses. From gifts and celebrations to décor and travel, families find their budgets stretched more than usual. For someone planning to buy a home during this time, the additional responsibility of future EMIs needs careful thought.

As festive seasons come with tempting limited-time offers, it can be easy to make quick decisions in the excitement. While these opportunities may be genuine, it is important to evaluate them calmly. Using an EMI calculator gives you that pause. By showing you a realistic picture of monthly instalments, it helps you decide whether the loan amount you are considering is manageable alongside your current lifestyle and festive spending.

Consider two buyers looking at a similar property during Diwali.

One of them uses the home loan EMI calculator online before committing. By checking the impact of different tenures and interest rates, they decide on a loan amount that keeps EMIs manageable while leaving enough room in their budget for other household expenses. The festive investment becomes a source of joy without added pressure.

The other buyer commits quickly, swayed by festive discounts. Only later do they realise the EMI consumes a larger portion of their income than expected, limiting flexibility for other expenses and turning celebration into financial worry.

Therefore, it is crucial to use the EMI calculator prudently to plan with clarity, enjoy the season’s offers, and still keep your long-term financial health in check.

Step Closer to Your Dream Home This Diwali with Smart PlanningDiwali is a time for lighting diyas, sharing joy, and embracing new beginnings. For many families, it also marks the first step towards long-cherished dreams, such as owning a home. Yet, alongside the festive spirit, it is important to bring clarity to the financial decisions that will shape the years ahead.

A home loan EMI calculator plays a small but meaningful role in this journey. By showing how different loan amounts, interest rates, and tenures affect both your monthly instalments and the overall repayment, it helps you make informed choices that balance aspiration with responsibility.

As you plan for homeownership this Diwali, take a few moments to use the calculator. It’s a simple step that can show you what truly fits your budget, and bring you closer to a home that lights up your future.

*T&C apply. Loan eligibility, loan terms, and loan disbursement processes are subject to the lender’s policy at the time of loan application.

Moneycontrol journalists were not involved in the creation of the article.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.