The Modi government has responded to a clamour of complaints from India’s middle class voters with a big bang outreach through tax cuts. If the last budget in July was about shoring up those constituencies where BJP saw an erosion of support in the 2024, this one is a statement of intent by a confident regime that is looking to shore up its middle class support and unleash a new consumption-based booster to the economy.

Beyond that, though, those expecting big bang economic reforms akin to what we saw in 1991, major changes to lift up the animal spirits of the economy would be disappointed.

Union Budget 2025: Live updates

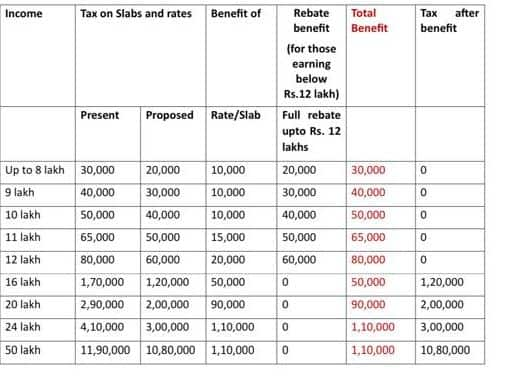

The big bang move for zero income tax for annual income of up to Rs 12 lakh is the centrepiece of this budget’s growth strategy. For context, bear in mind that about 80 percent of India’s tax-paying base falls in this bracket. Along with changes in rebate rates on income tax slabs — which have been rejigged — changes in TDS limits for senior citizens and increase in threshold for rent, this means more money in the pockets of the middle classes.

The middle class has largely been a big supporter of the Modi government for the past decade but often felt it was sidelined amid a plethora of increasing benefits for the poor and other special interest groups like farmers in the form of direct benefit transfers and various handouts. The big political message from Mr Modi for India’s middle class in 2025 is: We care for you and you now have more money in your pockets to spend.

Let’s break this down, depending on what salary you earn. If you earn up to Rs 8 lakh, you will now save Rs 30,000 in tax (in terms of tax you paid earlier but won’t any more). Similarly, if you earn Rs 9 lakh, the saving is Rs 40,000, for a salary of Rs 10 lakh it is Rs 50,000, for Rs 11 lakh you save Rs 65,000 and for those earning a salary of Rs 12 lakh, the saving is Rs 80,000. See table below for details.

This means that Indians now have about Rs. 1 lakh crore more to spend cumulatively. This is the money the government is foregoing in income tax through these changes. It is the equivalent of about 10 percent of its income tax collections in FY 25. This money will now be available with people for additional spending.

It constitutes a major shift in the Modi government’s broader approach on economic thinking. The last few years were about a focus on capex spending with an emphasis on supply-side growth. We are now seeing a much-needed big push for demand-led growth. If people have more money, they will spend more and the idea is that this will spur the economy.

This change is a policy response to the fact that India’s consumption has essentially been slowing down. The festival season saw very tepid growth. Volume growth was slow at 3 % and price growth was between 1-2%. So, the big idea in the budget is to boost spending by making your money go more.

There has been an immediate reaction to this on FMCG stocks, some of which have moved up immediately after the income tax announcements.

All in all, this is a budget for middle class voters, but a conservative one in the larger sense. With capex marginally up to Rs 11.2 lakh crore and fiscal deficit targeted at 4.4% in FY26, in a global environment that is hugely challenging and disruptive, the government’s account keepers seem to be saying ‘Let’s hold the line and be safe. Let’s keep our power dry.’ The question is, for what?

One answer could be that the government’s planners believe that economic risks for India may be even higher than anticipated and have chosen to play it safe for the moment. Never mind that the government’s own Chief Economic Advisor signalled in the Economic Survey that business-as-usual is no longer good enough. The Finance Ministry has decided to be cautious.

On balance, the budget gives the government enough to get a cheer from the middle classes. It also gambles that the grumbles from India Inc and the stock markets- which responded flatly to the Budget- make up a risk that it is okay to take for now.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!