With less than five days to go for Budget 2025, speculations are rife over the possible income tax announcements that Finance Minister Nirmala Sitharaman could unveil on February 1.

These include a hike in the basic exemption limit to Rs 10 lakh and the introduction of a new tax slab of 25 percent under the new, minimal exemptions regime. Then, there are expectations that the standard deduction will be raised to Rs 1 lakh.

Since its introduction in 2020, the new regime is being incentivised as the government wants to encourage taxpayers to switch to the new, minimal exemptions and compliance regime.

Now, the clamour for making it more taxpayer friendly is growing and it remains to be seen if the finance minister yields to the suggestions and demands from individual taxpayers as well as corporates. If Budget 2025 allows further tax concessions in the new tax regime, taxpayers will have to, once again, choose between the two regimes.

The new tax regime has indeed become more appealing over the years, but many taxpayers still find that their tax outgo is lower under the old tax regime for the financial year 2024-25.

Also read: Top five changes in income tax rules in 2024

Here’s how the two tax structures stack up at present:

The simpler, sweetened new tax regime

On July 23, 2024, finance minister Nirmala Sitharaman sweetened the deal further for taxpayers contemplating a switch to the new tax structure. Budget 2024 liberalised I-T slabs under the new simplified regime further, incentivising a shift away from the old, with-exemptions tax regime.

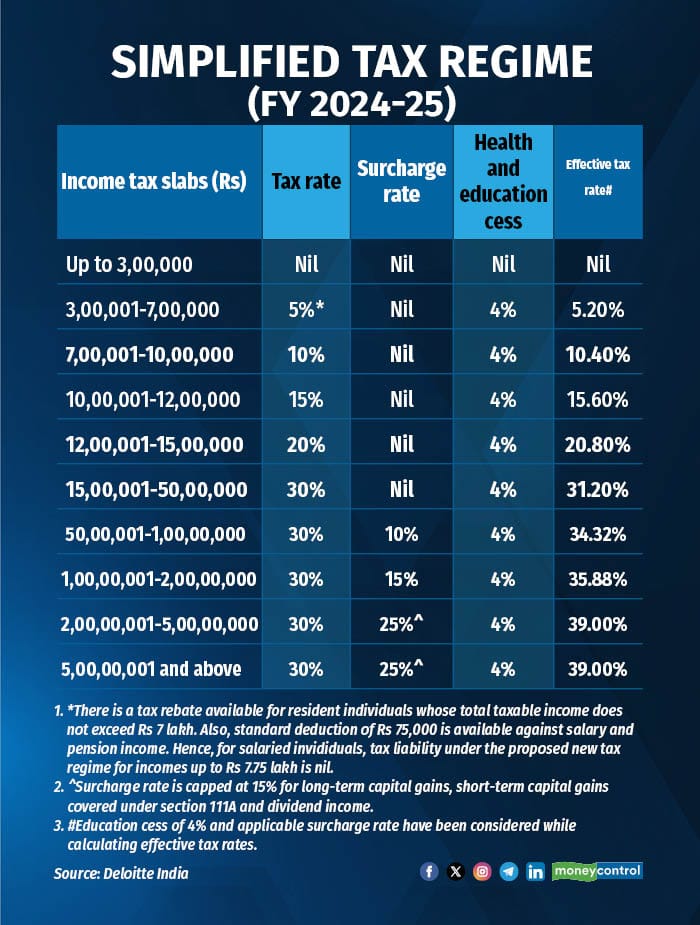

These are the I-T slabs and effective tax rates for 2024-25 under the new tax regime:

The old tax regime slabs and rates, on the other hand, were left unchanged.

Also read: Investment declaration to employers: Five tax-saving hacks that can reduce your outgo in 2025

Old versus new tax regime – Which to pick

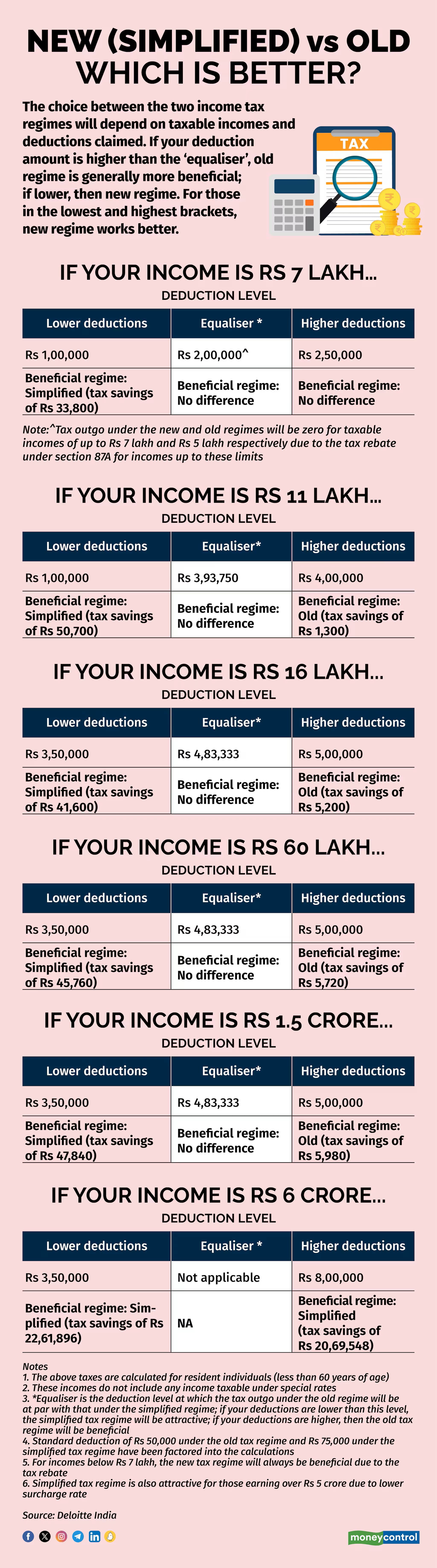

According to the finance ministry’s data, close to 72 percent of income taxpayers chose the new regime in the financial year 2023-24. However, the old structure will continue to yield higher tax savings for many taxpayers. That is, for those who claim multiple tax benefits under sections 80C, 80D, 24B, 10(13A) and so on.

Put simply, if your income is over Rs 15 lakh and you claim tax deductions worth at least Rs 4.33 lakh (plus standard deduction of Rs 50,000 under the old structure) or more, you will save more under the old regime. However, if you do not claim either the deduction on home loan interest paid under section 24b (up to Rs 2 lakh) or exemption for house rent allowance (HRA), you might be better off with the new regime.

HRA a key determinant?

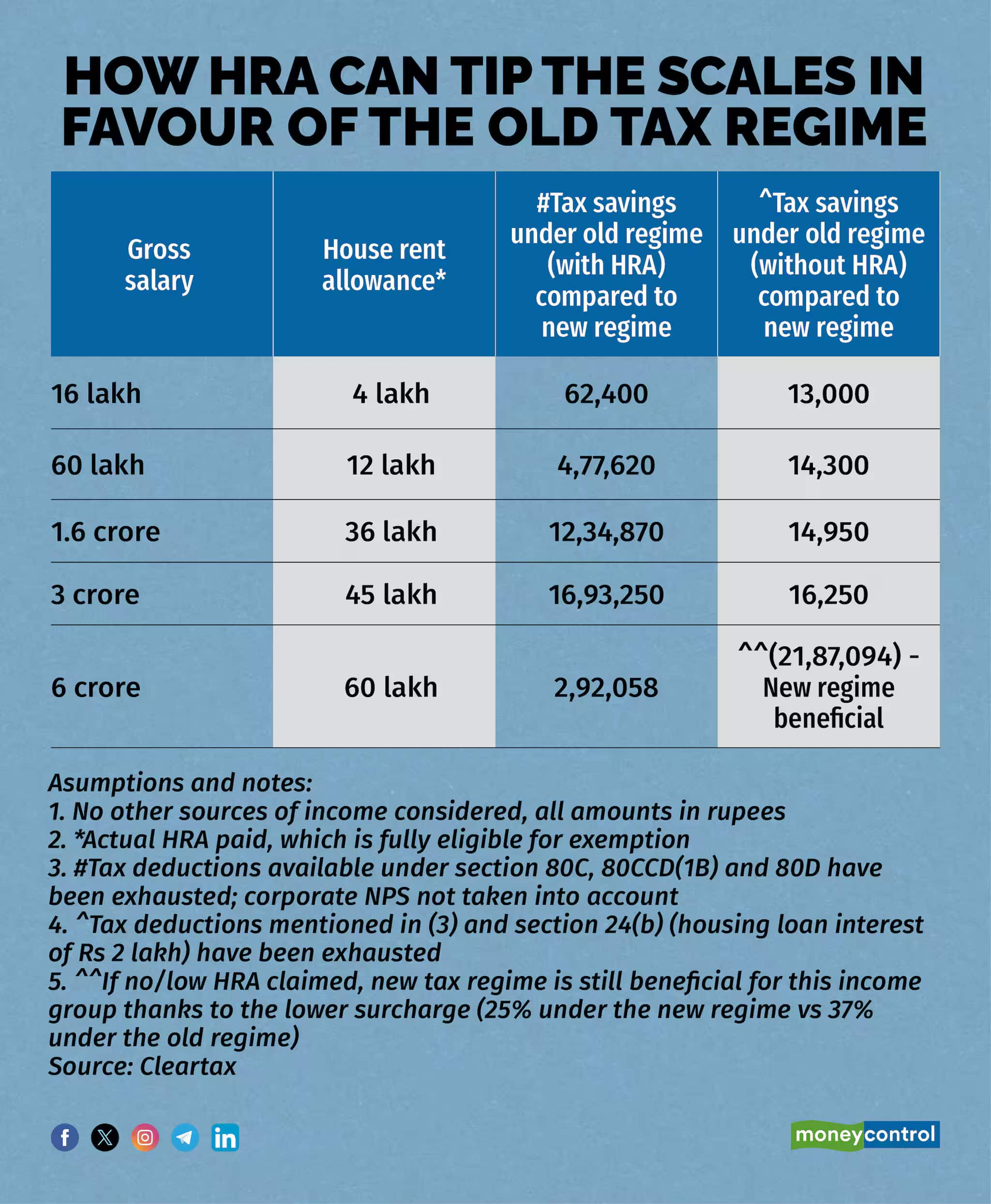

In fact, it’s primarily HRA that will tilt the scales in favour of the old tax regime, even for higher income brackets.

This is because unlike other usual tax deductions, the tax rules do not impose any absolute cap on HRA exemption. Instead, the exemption allowed is the lowest of: actual HRA received, 50 percent (40 percent in the case of non-metros) of your basic salary and actual rent paid minus 10 percent of basic salary.

As per Cleartax calculations, if your gross salary is Rs 60 lakh and you claim deductions worth over Rs 4.33 lakh (plus standard deduction of Rs 50,000 under the old regime), your tax liability will be lower under the old regime. So, if you are eligible for deductions worth Rs 4.5 lakh (plus standard deduction of Rs 50,000), your tax payable will be lower under the old regime by around Rs 5,720.

However, if you were to also claim HRA exemption of, say, Rs 12 lakh annually, besides other deductions under sections 80C, 80CCD(1B) and 80D, then your tax savings will shoot up to Rs 4,77,620 (see graphic).

The calculations do not take into account HRA when a tax break on home loan interest is claimed and vice-versa.

These significantly higher tax savings can make the record keeping and paperwork needed to claim such deductions under the old tax regime worthwhile for taxpayers.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.