2024, which draws to a close next week, was the year of big bang changes in direct taxation — for instance, rejigged income tax (I-T) slabs under the new regime and the revised capital gains tax structure — and not all of them brought cheer to tax-payers.

The widespread changes effected by Union Budget 2024 to the capital gains tax framework caused considerable heartburn and made headlines for several days after the announcements were made on July 23, 2024.

Here are the top five tax changes that impacted your wallet this year:

Tax slabs and rates under the new, simplified regime rejigged

Finance Minister Nirmala Sitharaman sweetened the deal further for tax-payers contemplating a switch to the new, minimal exemptions structure. Budget 2024 liberalised I-T slabs under the new simplified regime further, incentivising a shift away from the old, with-exemptions tax regime.

These are the I-T slabs and effective tax rates for 2024-25 under the new tax regime:

Since the revisions, only those who claim significantly higher tax benefits, for example, home loan interest deduction under section 24(b) of up to Rs 2 lakh or large HRA (house rent allowance), will find the old regime more beneficial. Without either of the two, the old tax regime doesn't make much sense.

Also read: Old vs new (simplified): Which income tax regime will help you save more on tax outgo?

The big change: revised capital gains tax structure

More than the changes in new regime slab rates, it’s the 'rationalisation' of capital gains tax rates that attracted more attention after the Budget announcements. So, from financial year (FY)2024-25, all financial and non-financial assets attract a long-term capital gains (LTCG) tax at 12.5 per cent (up from 10 per cent in the case of equities), while short-term capital gains (STCG) tax on some assets, for instance equities, would be 20 per cent.

Moreover, the exemption limit for computing LTCG tax on stocks and equity mutual funds was increased from Rs 1 lakh to Rs 1.25 lakh. The Budget also announced that listed financial assets held for more than a year would be classified as long-term assets.

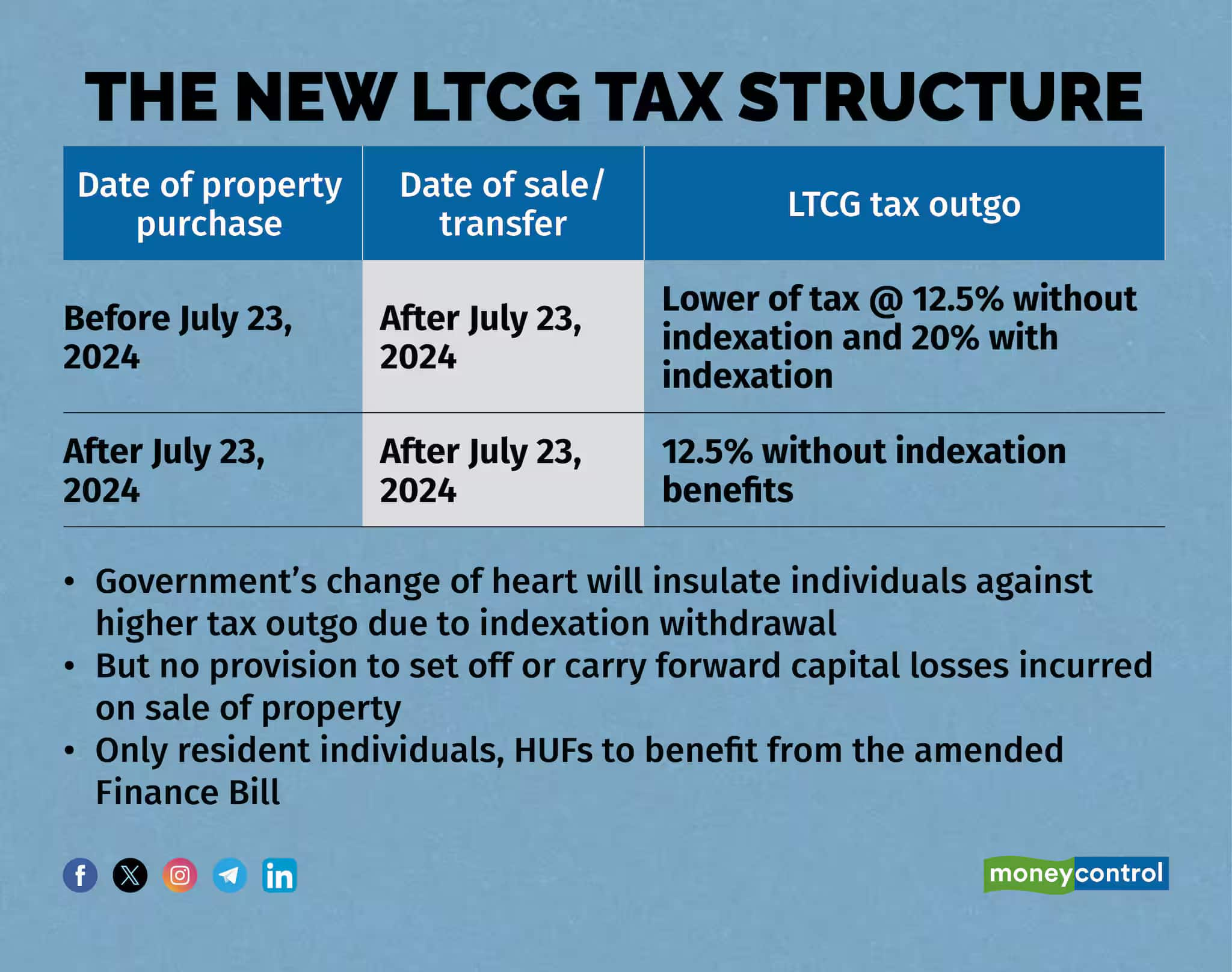

On July 23, the finance minister had reduced the LTCG tax rate on the sale of real estate assets to 12.5 per cent from 20 per cent, but had also withdrawn the indexation benefits for properties purchased after April 1, 2001.

For many property-owners who had not seen significant appreciation in prices, this would have resulted in higher tax outgo. After the uproar over the withdrawal of indexation benefits to properties acquired before Budget 2024, the government came up with a solution to soften the tax blow for such individuals.

“The logic of the budgetary proposal on capital gains is that the structure has to be simplified…and to treat all asset classes equally. [Now, after the amendment to the finance bill] tax on the sale of assets purchased before July 23, 2024, can be computed under the old scheme with indexation or the new scheme… and (property sellers can) pay lower tax,” Sitharaman had said on August 7, explaining the rationale behind the original decision as well as the ‘rollback’.

Hike in standard deduction

There was clamour for hike in standard deduction — a tax concession that salaried individuals and pensioners can avail of, irrespective of their income — prior to the Budget announcements on July 23. The finance minister did pay heed to the suggestion, but confined the benefit to only the new tax regime. So, the standard deduction under the new regime has gone up from Rs 50,000 to Rs 75,000 for FY2024-25, while it remains unchanged at Rs 50,000 under the old regime.

Tax sop on employers’ NPS contribution raised to 14%

From FY 2024-25, non-government salaried employees who opt for the new tax regime and sign up for corporate national pension scheme (NPS) stand to gain more. Employers’ contribution to employees’ basic salaries of up to 14 per cent will be eligible for deduction, up from 10 per cent earlier.

Government and state government employees are already eligible for the 14-percent-deduction under both the regimes. Under the old tax regime, this limit will be unchanged at 10 per cent for private sector employees. For non-government employees, NPS is a voluntary scheme; they can contribute on their own through the all-citizens’-model as also under the corporate NPS scheme with some help from their employers.

Also read: Opting for the new tax regime? Here’s how you can increase your tax savings

Relief for MNC employees with ESOPs, foreign assets

Indian employees working with multinational companies and deputed abroad for assignments get employee stock ownership plans (ESOPs) from such companies and often have to open bank accounts and enrol into social security schemes abroad.

Under the current rules, an inaccurate disclosure or failure to report such foreign assets in I-T returns can result in penalty of up to Rs 10 lakh under the Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act, 2015. From FY2024-25, not reporting low-value financial assets (worth up to Rs 20 lakh) will not invite any penalty.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!