Budget 2024 has made the new, income-tax (I-T) regime sweeter by rejigging slabs and rates, hiking standard deduction and also deduction on employers’ contribution to employees’ National Pension System (NPS). But the old I-T regime (with deductions) continues as does its appeal to those who take the benefit of tax deductions.

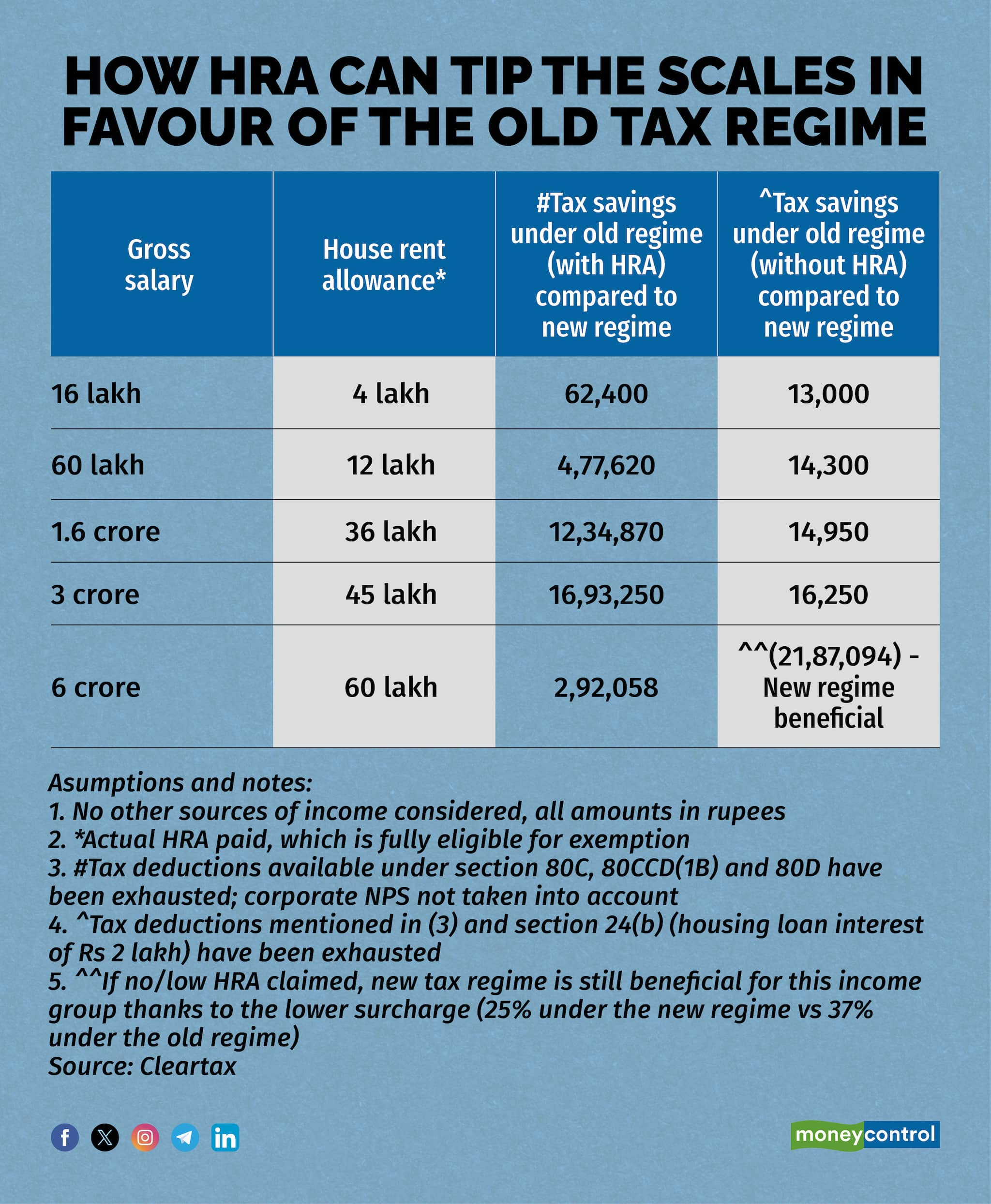

But back-of-the-envelope calculations show that although old regime is still beneficial for those who claim tax deductions beyond the equaliser (or break-even level in tax parlance) threshold, tax savings compared to the new regime will be in the region of Rs 13,000-16,250 for mid-to-high income brackets (see graphic).

This is assuming that the tax-payer exhausts popular tax breaks under sections 80C (Rs 1.5 lakh), 80D (Rs 75,000 for self and parents’ health insurance premiums), 80CCD(1B) (NPS contribution of Rs 50,000) and 24(b) (Rs 2 lakh on housing loan interest). “While the old regime may still offer some tax savings for those with significant deductions, its overall benefit has reduced, making it less advantageous for a broader population of taxpayers,” says Avinash Polepally, Consumer Business Head, Cleartax. For lower income groups, too, new regime has become friendlier over the years.

Also read: How Budget 2024 will reduce taxes under the new, minimal exemptions tax regime

HRA, the primary needle-mover for high income earners?However, there is one key tax benefit that will ensure that the old tax regime scores handsomely over the new regime even for higher income brackets — house rent allowance (HRA) exemption, if you live on rent. “HRA exemption might indeed be the only tax break that could provide a compelling reason to stick to the old regime, particularly if it is large enough to outweigh the benefits of the new regime’s lower tax rates,” he adds.

This is primarily because unlike other usual tax deductions, the tax rules do not impose any absolute cap on HRA exemption. Instead, the exemption allowed is the lowest of: actual HRA received, 50 per cent (40 per cent in the case of non-metros) of your basic salary and actual rent paid minus 10 per cent of basic salary.

Across most income brackets, if you claim higher deductions, the old tax regime turns out to be beneficial, if not, then you can save more under the new regime.

For example, if your gross salary is Rs 60 lakh and you claim deductions worth over Rs 4.33 lakh (plus standard deduction of Rs 50,000 under the old regime), your tax liability will be lower under the old regime. So, if you are eligible for deductions worth Rs 4.5 lakh (plus standard deduction of Rs 50,000), your tax payable will be lower under the old regime by around Rs 5,720.

However, if you were to also claim HRA exemption of, say, Rs 12 lakh besides other deductions under section 80C, 80CCD(1B) and 80D, then your tax savings will shoot up to Rs 4,77,620 (see graphic). The calculations do not take into account HRA when tax break on home loan interest is claimed and vice-versa.

“Going forward, for most salaried tax-payers, HRA will be the turning point in making a decision on choosing between the two income tax regimes. So, despite the new regime becoming more attractive, such tax-payers could continue to find the old regime to be more beneficial. For example, government employees will benefit from HRA. Likewise, younger individuals can avail of HRA exemption by paying rent to their parents. So, certain categories of individuals can optimise HRA tax breaks to save on taxes under the old tax regime,” says Mumbai-based chartered accountant Chirag Chauhan.

Also read: Opting for the new tax regime? Here’s how you can increase your tax savings

For high networth executives earning over Rs 5 crore, the new regime is typically beneficial as the highest surcharge applicable is 25 per cent versus 37 per cent under the old tax regime. However, even in such cases, HRA could come in handy if such individuals are deputed to cities where they have to lease out premium apartments with steep rentals.

For example, the tax outgo of someone with a salary of Rs 6 crore and rent of Rs 5 lakh a month will be lowered by Rs 2.92 lakh under the old regime. However, if the taxpayer does not live on rent and claim HRA, then the new regime is favourable as the tax outgo will be lower by close to Rs 22 lakh (see graphic).

“If an employee is in a higher tax bracket, the new tax regime will be beneficial for him even if he forgoes the deductions under sections 24, 80C, 80D, and 80CCD(1B). However, the old tax regime will give him more benefits if he is eligible to claim the exemption for the HRA along with other deductions as mentioned before. Even a nominal exemption will make him a net saver in the old tax regime,” says Naveen Wadhwa, vice-president, Taxmann, a tax consultancy firm.

Lower tax savings, an incentive to switch to new regimeIf the deductions are lower and savings under the old regime are minimal, tax-payers are bound to switch to the new regime, which allows limited tax benefits but eliminates the need to maintain investment or other tax-saver proofs and brings down the compliance burden. “The approach varies from person to person. Even when there was just one regime in place, many tax-payers would not make the effort to maintain all the receipts needed to claim deductions. Many do not want to deal with such administration hassles. So, if the difference in tax outgo under both the regimes is not significant, they might prefer the new one,” says Aarti Raote, Partner, Deloitte India.

For instance, younger employees may not want to make tax-saver investments to avoid the paperwork. If they live with parents, they can pay rent and claim HRA benefits, but this is a potential grey area that could invite scrutiny. “In such cases, it is essential to have a rent agreement in place, preserve rent receipts and parents must disclose the rental income in their income tax returns,” says Raote.

Relatively less-frequently-used deductions matter tooHowever, while HRA could be the exemption that makes all the difference for many tax-payers, some less popular deductions, too, could tip the scales in favour of the old tax regime. “It will finally boil down to your total deductions. Even if 80C, 80D, 24(b) etc are not enough, some salaried tax-payers would be eligible for tax deduction under section 80E on interest on education loan taken, sections 80DD or 80U (Rs 75,000-1.25 lakh), 80DDB (Rs 40,000-1 lakh) and so on,” says Raote.

For instance, the entire interest paid on education loan is allowed as a deduction, which could be substantial for domestic post-graduate and international undergraduate and postgraduate courses. “Every taxpayer will have to carefully calculate income, deductions and tax-saving before arriving at a decision on the choice of regime,” adds Raote.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.