BUSINESS

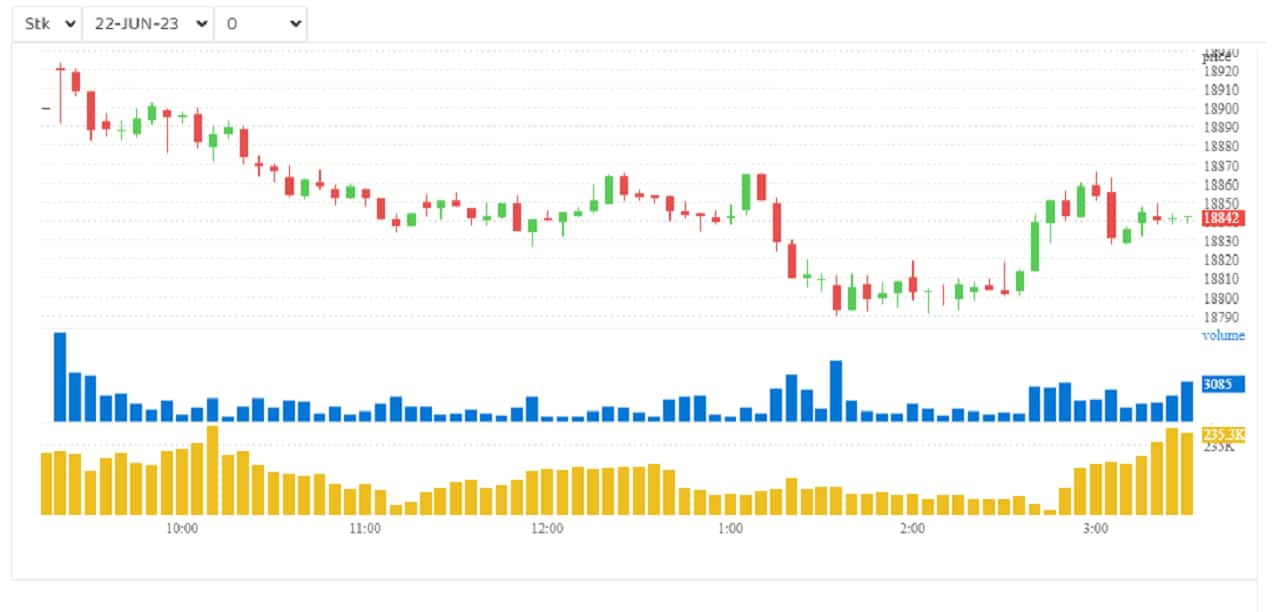

F&O Manual | Nifty crosses the bar but supply at top, tepid Bank Nifty keep hopes in check

The market has moved higher on short covering momentum, potentially triggered by the last minute shifting of Bakrid holiday and expiry day.

BUSINESS

Nifty's way beyond all-time highs looks foggy as traders go cautious

For each of the peaks attained in October 2021, December 2022 and June 2023, the Nifty rose 36 percent, 23 percent and 10 percent from their respective previous bottom. This signals that gains before each respective highs are lessening with time.

BUSINESS

F&O Manual: All eyes on all time highs as massive short covering lifts mood

Analysts said the shift in expiry from Thursday to Wednesday may have triggered short covering in the Index today leading to rapid movement in it, post the announcement.

BUSINESS

Cyient DLM IPO opens for bidding. Should you subscribe?

Cyient DLM is an integrated manufacturing services provider, serving highly regulated industries with high entry barriers.

BUSINESS

F&O Manual: Inconclusive data warrants credit strategies, say analysts

The Nifty index is neither selling off, nor it is able to break the all-time high mark

BUSINESS

IdeaForge IPO opens today. Will it soar or come a cropper?

IdeaForge IPO: Analysts highlight the company’s leadership position, strong financial growth and relationship with customers among key strengths. Negative cash flow and working capital gap remain a worry

BUSINESS

F&O Manual: Nifty faces stiff resistance as wait for all time high gets longer

In terms of price levels, not much has changed, and the immediate support zone remains at 18,700 - 18,600. On the upside, 18,940 - 19,000 can be considered as immediate resistance for the weekly expiry session.

BUSINESS

Bank Nifty raining on Nifty parade. How should traders position themselves?

In the past month, Bank Nifty has gone nowhere. In the past six months of choppy trade, it has gained only 3 percent, which is lower than the Nifty's 4 percent gain

BUSINESS

F&O Manual: Struggle continues for Nifty amid profit-booking, traders see day's bottom

The weekly option data shows call writers continue to dominate trade as they push index lower.

BUSINESS

HMA Agro Industries IPO opens for bidding. Should you subscribe?

HMA Agro Industries ltd IPO: At present, HMA Agro Industries is one of the largest exporters of frozen buffalo meat products from India and accounts for more than 10 percent of India’s total export of frozen buffalo meat.

BUSINESS

F&O Manual: Employ collar strategy to play rapidly changing market conditions

Call writers were a dominant force today as they pushed the index lower, a stark difference from last week.

BUSINESS

F&O Manual: Traders gear up for recovery trades after Nifty faces stiff resistance

FIIs have continued to infuse funds in local equities and India's improving economic situation – these are two positive catalysts that have been keeping bulls afloat in the India market.

BUSINESS

IKIO Lighting shines D-Street on debut: Should you invest now?

The listing gains for the LED maker was in line with expectations while further gains are working as a cherry on cake for investors. Though, some selling pressure at top has been observed that may cap the upsides in coming days.

BUSINESS

F&O Manual: Bulls make another dash towards all time high but stumble at hurdles

Bank Nifty has also seen long trades with puts being written at 43500 through 43800. However, the index will make a red weekly candle.

BUSINESS

Buzzing Stocks: IKIO Lighting, BHEL, TVS Motor, Pitti Engg, Natco Pharma & others in focus

Stocks to Watch: Check out the companies making headlines before the opening bell today.

BUSINESS

IKIO Lighting IPO | Expect strong listing, can book partial profits, say analysts

Among the key strengths of the company, analysts highlight, are long-term relationships with leading industry customers, strong focus on R&D, established infrastructure with backward integration along with strong and consistent financial performance.

BUSINESS

F&O Manual: Selling pressure in Bank Nifty can put Put writers in a spot, say analysts

The Nifty experienced a bearish engulfing pattern, indicating a potential reversal of its previous bullish trend.

BUSINESS

F&O Manual: Nifty consolidates, all-time high still elusive

The weekly options data for the next series shows straddled trades at 18,80, which is a neutral strategy. Along with put and call activity at 18,700, the expectations is that the index will move in a narrow range

BUSINESS

60 MF schemes to hold Rs 5,000 crore worth HDFC Bank shares beyond Sebi limit post merger

Of the 60 funds, the largest excess exposure, to the tune of Rs 1,231 crore, will be held by Mirae Asset Large Cap Fund-Reg(G) post HDFC-HDFC Bank merger

BUSINESS

F&O Manual: Initiate bull call spreads for next week's expiry to play upside in Nifty

The Bank Nifty index continues to see open call writing positions for tomorrow's expiry as well as the June monthly expiry. Even if there is a short covering rally in this Index, the 44,500 and 45,000 calls for the June monthly expiry still have significant call writing present, underlined an analyst.

BUSINESS

F&O Manual: 43,700 crucial for Bank Nifty; analysts advise to be cautious

The Bank Nifty index has been trading in a sideways consolidation phase, indicating a lack of clear directional bias.

BUSINESS

F&O Manual: Struggle for Nifty, still can't get past 18,700

Traders took long position in PI Industries and REC, while Balrampur Chini Mills, SRF and McDowell's saw a short buildup

BUSINESS

Mutual funds lose Rs 342 cr in just two sessions as bears plunder IEX shares

The biggest loser seems to be Mirae Asset Mutual Fund, which held the stock in eight of its schemes, losing Rs 176 crore worth of value – half of the value lost by the all mutual funds.

MARKETS

F&O Manual: Nifty still away from 18,700; cement stocks solid

Analysts and traders expect intra-day volatility to persist as investors fear that the Federal Reserve could remain hawkish at its June 14 meeting after a surprise rate hike by the Bank of Canada