F&O Manual: Selling pressure in Bank Nifty can put Put writers in a spot, say analysts

The Nifty experienced a bearish engulfing pattern, indicating a potential reversal of its previous bullish trend.

1/5

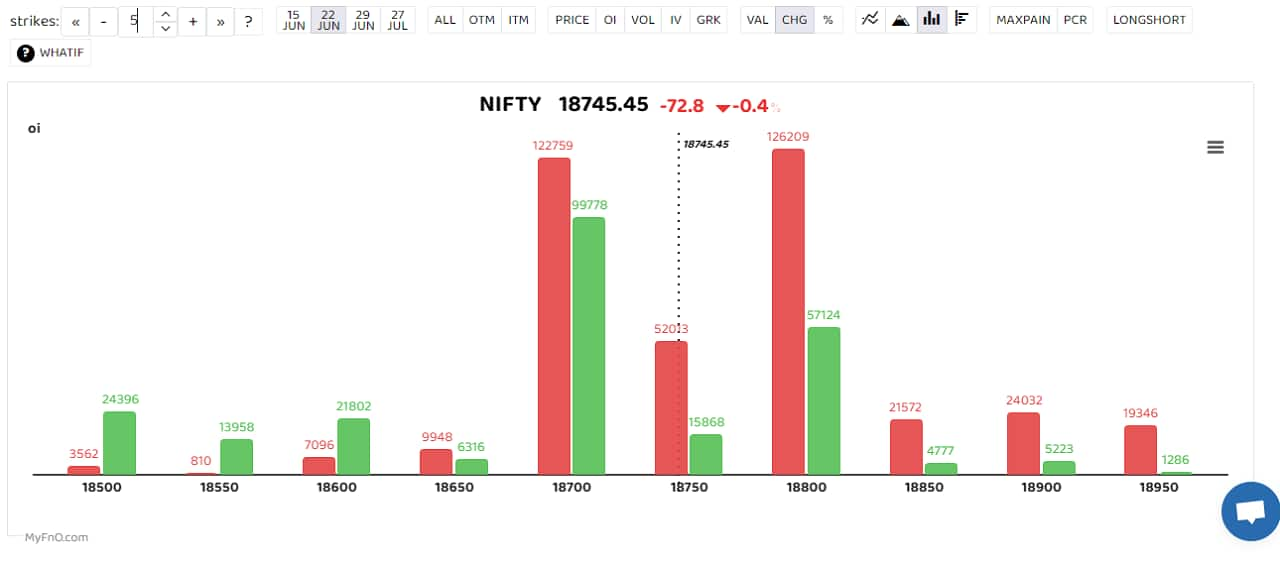

Markets traded volatile on the weekly expiry day. After the flat start, Nifty tried to inch higher but pressure in banking and IT heavyweights pushed the index half a percent lower as the day progressed. Consequently, Nifty settled closer to the day’s low at 18688.10 levels. While the majority of the sectoral indices traded in tandem and ended lower, the defensive pack viz. FMCG and pharma managed to end in the green. (Blue bars show volume and golden bars open interest (OI).)

2/5

The Nifty experienced a bearish engulfing pattern, indicating a potential reversal of its previous bullish trend. Additionally, it formed a double top on the hourly chart, which further suggests a potential downturn. However, some graders believe until and unless the index does not breach 18450 on the lower side, we can still see an all-time high in the Nifty Index in the short term. (Bars reflect change in OI during the day. Red bars show call option OI and green bars show put option OI.)

3/5

The Bank Nifty index has experienced a breakdown on the daily chart, accompanied by significant trading volumes. This suggests increased selling pressure in the index. “Even though Bank Nifty saw a slide today of more than 1 percent, the June monthly expiry still has a significant amount of put writing. Bank Nifty has confirmed a head and shoulder pattern on the daily chart and has broken down from this pattern. If Bank Nifty opens lower tomorrow, these put writers might have to run for cover or sell calls of the same magnitude to convert their sold puts into short straddles,” said Rahul Ghose, Founder & CEO – Hedged. (Bars reflect change in OI during the day. Red bars show call option OI and green bars show put option OI.)

4/5

Metropolis Healthcare saw a long buildup with open interest rising 12 percent. A long build-up is a bullish sign that happens when open interest and volume increase with the rise in share price. L&T Financial Services, Apollo Hospitals and IDFC First Bank were others that saw heavy long buildup. (Bars reflect change in OI during the day. Red bars show call option OI and green put option OI.)

5/5

Tata Chemicals was among those that saw short buildup with open interest jumping 28 percent. The short build-up is a bearish sign that takes place when the price of a stock falls, along with high open interest and volume. (Bars reflect change in OI during the day. Red bars show call option OI and green put option OI.)

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Budget 2025 News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!