F&O Manual: Inconclusive data warrants credit strategies, say analysts

The Nifty index is neither selling off, nor it is able to break the all-time high mark

1/5

Weak Asian and European cues dampened the domestic market sentiment, as benchmarks ended mixed in a range-bound session amid selective buying in key sectoral stocks. The Nifty ended the day at 18,691.20, up 0.14 percent or 26 points. (Blue bars show volume and golden bars open interest (OI).)

2/5

The Nifty index is neither selling off, nor it is able to break the all-time high mark. “Today's candle closing for Nifty needs one more bullish candle for a morning star pattern to form on the Index. If that happens, then you can see the Index breaking the all-time high. The OI data for both the indices is inconclusive and is not showing any signs of any one-sided movement. In such cases, trading the index through credit strategies is the more prudent thing to do,” said Rahul Ghose, Founder & CEO – Hedged. (Bars reflect change in OI during the day. Red bars show call option OI and green bars show put option OI.)

3/5

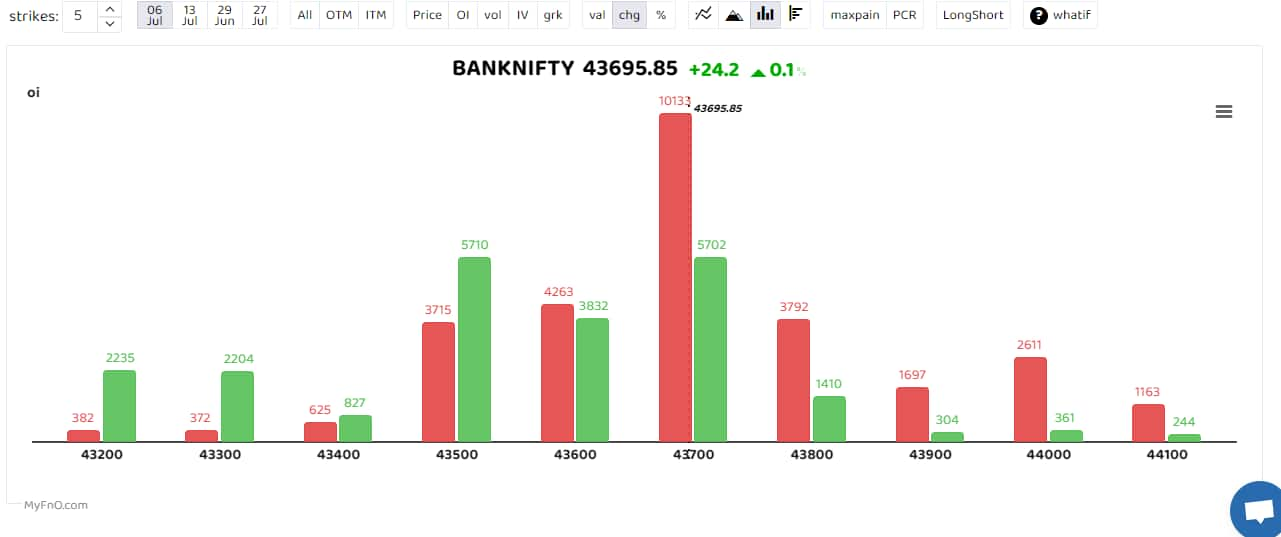

The Bank Nifty index continues to witness a battle between the bulls and bears. It has support at the 43,400 level, while the resistance is observed at 44,000, where the highest call writing is visible. “If the index breaks down below the 43,400 level, it may experience further correction toward the 42,000 mark. The overall undertone of the index remains neutral, and a break on either side of the support or resistance level will confirm a clear trend,” said Kunal Shah, Senior Technical & Derivative analyst at LKP Securities. (Bars reflect change in OI during the day. Red bars show call option OI and green bars show put option OI.)

4/5

Alkem Labs saw a long buildup with open interest rising 88 percent. A long build-up is a bullish sign that happens when open interest and volume increase with the rise in share price. MCX, Metropolis Healthcare and Torrent Pharma were others that saw a heavy long buildup. (Bars reflect change in OI during the day. Red bars show call option OI and green put option OI.)

5/5

Shree Cement was among those that saw a short buildup with open interest jumping 34 percent. The short build-up is a bearish sign that takes place when the price of a stock falls, along with high open interest and volume. (Bars reflect change in OI during the day. Red bars show call option OI and green put option OI.)

Discover the latest Business News, Budget 2025 News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!