F&O Manual: 43,700 crucial for Bank Nifty; analysts advise to be cautious

The Bank Nifty index has been trading in a sideways consolidation phase, indicating a lack of clear directional bias.

1/5

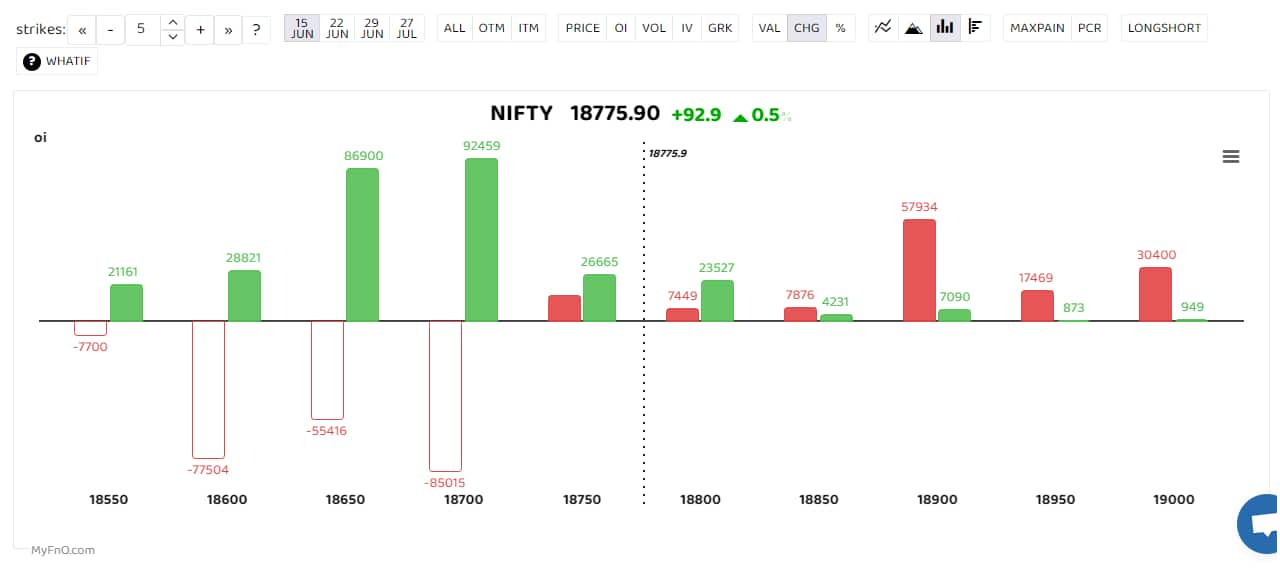

After a firm start, the Nifty oscillated in a range while maintaining positive bias and finally settled at 18,716.15 levels, up 0.62 percent or 114.62 points. All sectors, barring auto, contributed to the move wherein realty, FMCG and pharma were the top gainers. Besides, the continued outperformance of the broader indices kept the traders busy. (Blue bars show volume and golden bars open interest (OI).)

2/5

The Nifty index today has seen massive short covering in the 18600, 18650 and 18700 call options and equally large build up in the 18600 and 18700 puts of both the weekly and monthly expiry. “Participants are taking comfort from recovery in the US markets and prevailing buoyancy in midcap & smallcap space however the key is to hold 18,700 in Nifty for further surge else the move would fizzle out again. We recommend maintaining a positive tone but avoid going overboard citing the possibility of a rise in volatility ahead,” said Ajit Mishra, SVP - Technical Research, Religare Broking. (Bars reflect change in OI during the day. Red bars show call option OI and green bars show put option OI.)

3/5

The Bank Nifty index has been trading in a sideways consolidation phase, indicating a lack of clear directional bias. The immediate resistance level for the index is at 44200, which has been acting as a hurdle for further upward movement. “The only concern currently is that the Bank Nifty Index is currently forming a head and shoulder pattern that will get negated once it crosses the 44550 mark. The break of the head and shoulder will be below the 43700 mark, if and when prices breaches and closes below it. Until then, this see-saw movement is set to continue,” said Rahul Ghose, Founder & CEO – Hedged. (Bars reflect change in OI during the day. Red bars show call option OI and green bars show put option OI.)

4/5

Tata Communications saw a long buildup with open interest rising 40 percent. A long build-up is a bullish sign that happens when open interest and volume increase with the rise in share price. Dixon Technologies, OFSS and Cummins India were others that saw heavy long buildup. (Bars reflect change in OI during the day. Red bars show call option OI and green put option OI.)

5/5

Interglobe Aviation was among those that saw short buildup with open interest jumping 16 percent. The short build-up is a bearish sign that takes place when the price of a stock falls, along with high open interest and volume. (Bars reflect change in OI during the day. Red bars show call option OI and green put option OI.)

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Budget 2025 News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!