The market was moving in a narrow range in late morning trade on June 9 in what was shaping to be another volatile session. At 11.45 am, the Nifty 50 index was down 0.03 percent at 18,629.85.

The movement has been choppy, with IT and PSU banking stocks under selling pressure. Realty, too, was down but bounced back to gain 0.7 percent.

Analysts and traders expect volatility to persist as investors fear that the Federal Reserve could remain hawkish at its June 14 meeting after a surprise interest rate hike by the Bank of Canada.

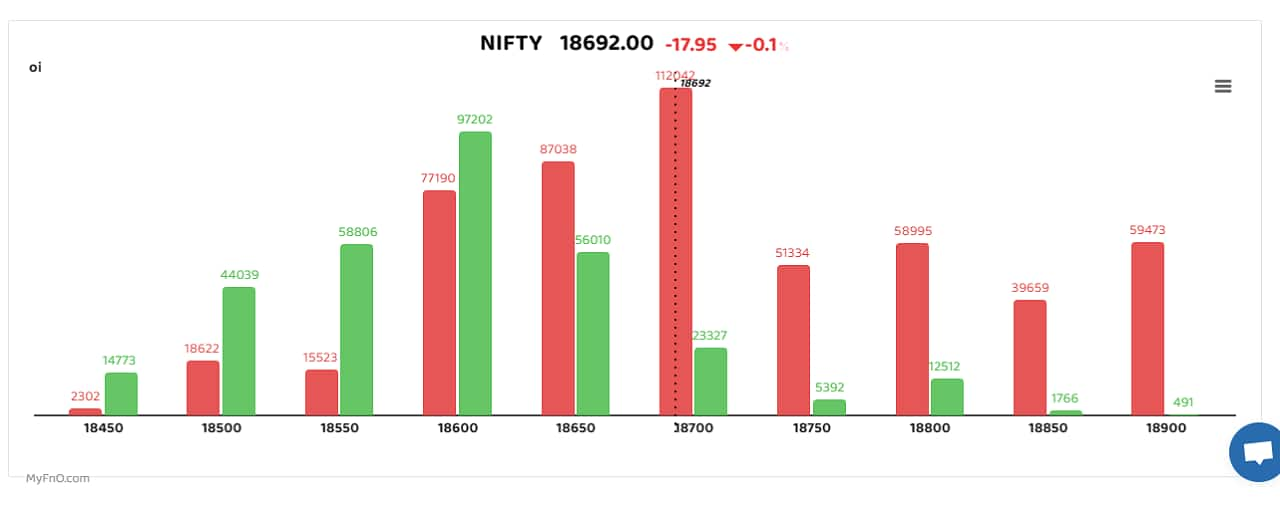

The bars reflect changes in OI during the day. The red show call option OI and the green put option OI.

The bars reflect changes in OI during the day. The red show call option OI and the green put option OI.

Option data shows trades have taken Straddle trades at 18,600. At the same time, more calls are being written at 18,700, which is the biggest hurdle right now. Some support is available at 18,500.

“Bears are likely to be at bay as long as the Nifty is above the 18,463 support, while there is a bright chance that bulls will be able to reclaim Nifty’s all-time-high at 18,888 mark,” said Prashanth Tapse, Senior VP (Research), Mehta Equities.

Among individual stocks, Indian Energy Exchange was hammered as the government is moving ahead with an unfavourable market coupling regulation that will lead to a market share loss. Traders were also seen adding bearish positions in HDFC AMC, HUL and Tata Steel.

Cement stocks continue to see bullish trend, with traders adding positions. India Cements, UltraTech Cement, Ramco Cement and JK Cement were among those that saw long trades.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.