BUSINESS

Just 15 days after listing, this SME stock’s valuation is drawing comparisons with Adani cos

The stock, which is backed by Shankar Sharma, has delivered over 300 percent returns, quadrupling shareholders’ value of holding in just 15-odd days, leaving many who missed the opportunity during the initial public offer (IPO) disappointed.

BUSINESS

F&O Manual: Traders continue with sell-on-rise strategy as trend remains negative

The sectoral trend is mixed. Auto, metals and power are seeing a long buildup, while banks, telecom and technology are seeing a short buildup

BUSINESS

F&O Manual: Despite market rally, setup still negative, say traders; IT stocks shine

Traders are unimpressed with the bounce in the market and believe the setup is still negative for the Nifty

BUSINESS

F&O Manual | Traders continue with directionless trades as market shows no signs of breakout

Such trades usually result in one leg of the trade delivering profit while other a loss as long as the market remains range bound.

BUSINESS

Trader’s Edge: A low maintenance trading strategy that can bump up your income

How often have you thought of having a supplementary source of income that doesn’t demand too much time? Well, help is at hand. But it is not devoid of risk. So tread gently.

BUSINESS

17,000% return in 10 years but this market segment is a tough play

SME stocks are India’s best-performing market segment, which may give the impression that making money is easy but lack of insight, excessive froth and scarce liquidity mean it is anything but true

BUSINESS

F&O Manual: Exasperation as volatility spoils trades; opportunity in individual stocks

Traders are also being cautious ahead of the earnings season where any surprise will induce volatility. Analysts have warned traders against risky trades in monthly contracts and suggested weekly contracts, if they have the appetite.

BUSINESS

IT Sector Preview: EBIT margin to look up but lack of growth, flat deal wins to weigh

IT companies, which generate most of their revenue from export of services, are likely to be impacted due to recessionary pressure in the US – their biggest market – and other western nations.

BUSINESS

Blackrock has 3 investment lessons for 2023 to stay a step ahead of the market

The fund house is seeing technology decoupling between the US and China as both focus on boosting self-reliance, reducing vulnerabilities. This is the topmost risk to markets, it believes.

BUSINESS

F&O manual: Market lacks direction, traders find it harder to do business

TCS will announce its Q3 results on Monday next week, followed by other companies. This may indicate volatile moves if numbers surprise the market

BUSINESS

F&O manual: Second half likely to be better for market; bullish set-up in IT stocks

Post Christmas, FII activity had come down significantly which is a usual phenomenon. However, the activity picks up in the new year.

BUSINESS

Trader’s Edge: A trading strategy that lets you own an asset for free

Many traders who entered the market in recent years can find familiarity in Sharath’s journey in the stock market. He has committed the same mistakes that many others have and learned from them.

BUSINESS

Trader's Edge: A trading strategy sans technical indicators for creating wealth

The trick is to unclutter your trading screen ― eliminating all technical indicators and paying attention to perhaps the most important indicators: price and volume.

BUSINESS

Sula Vineyard will take time to kick in. Bow out now or raise a toast for long term

Sula Vineyards IPO: Analysts made it clear that the stock is not a short term investment. Hence those expecting short term gains should find other opportunities.

MARKETS

Santa rally fizzles out even before the market could say 'Ho, Ho, Ho'

The Indian market seems to have de-decoupled and fallen in tandem with the world market. What has worsened the situation is the valuation of Indian stocks that are at a large premium to other markets, and even its own valuations in the past

BUSINESS

Trader’s Edge | A former teacher is utilising market trend and momentum to make a killing

This PhD-holder's guide to trade in the stock market is as simple as they come.

MARKETS

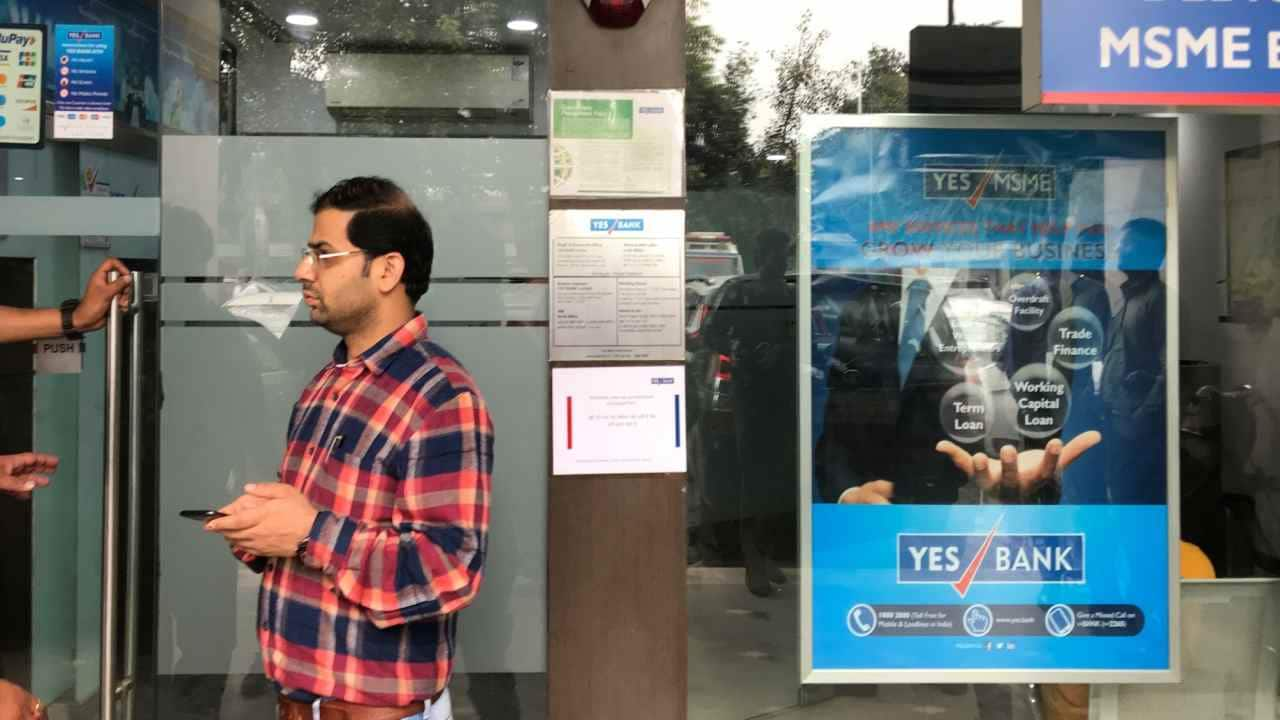

YES Bank shares crumble as analysts see limited reasons for gains to sustain

Shares of Yes Bank are in demand recently amid an improved outlook for banking stocks owing to strong credit growth.

BUSINESS

NHAI’s debt woes will hinder road capex, warrant rejig in stock allocation: analysts

While NHAI has done creditable work to increase road construction across the country, it has incurred heavy debt to drive that activity.

BUSINESS

F&O report: Buy on dips best strategy for now; buy Nifty 18,500 call options tomorrow

The short-term trend remains positive, as the Nifty closed above its 20-day EMA. The index has to break the range on either side for trending moves that may be seen after the Fed policy announcement on Wednesday.

BUSINESS

Manufacturing, allied sectors the best investment opportunity: Anand Shah, ICICI Pru AMC

ICICI Pru AMC is overweight on banking, said Shah, and believes metals prices will recover in FY23 and continue to perform well in FY24 and beyond. The sector's sluggish growth benefits intermediate metal customers like automakers and engineering firms, he added

MUTUAL-FUNDS

Rupee still overvalued relatively; short duration funds attractive: Manish Banthia of ICICI Pru MF

Debt funds are more attractive than equity at this time, says the Deputy Chief Investment Officer for Fixed Income at ICICI Prudential AMC

BUSINESS

Expect Nifty to deliver 10-15% returns in the next one year: Rahul Jain, Edelweiss Wealth

Sectors in which we are investing right now or we should look at, are banking, auto and auto ancillary, IT and capital goods.

BUSINESS

MC Explains: What is confidential IPO filing and why do companies do it?

As the name suggests, details filed about the business are kept confidential, unlike the normal route when the entire draft red herring prospectus (DRHP) is publicly available

BUSINESS

Up and coming competitors are not a worry for Asian Paints, says Saurabh Mukherjea

In the last few years, a number of new players have announced their entry into the paints industry including big pocketed players like JSW Group and Grasim Industries.