The market opened flat for another day with movement likely to be range-bound January 6. The Nifty traded up nearly 0.2 percent at 18,024 and Bank Nifty was down 0.14 percent, continuing its downward slide.

Given lack of trend, traders have mostly taken non-directional trades where they have sold or bought both puts and calls. Such trades usually result in one leg of the trade delivering profit while the other a loss as long as the market remains range-bound. The aim is to minimise the loss leg and maximise the profit leg so that they can take some money home.

(Bars reflect change in OI during the day. Red bars show call option OI and green put option OI.)

(Bars reflect change in OI during the day. Red bars show call option OI and green put option OI.)

Rajesh Sriwastava, a derivative trader said, for intraday he has taken non-directional trades but overall he is on a shorter side. “Even at this time there are constant sellers lining up on the Nifty and Bank Nifty, with the former having five times more sellers than the latter,” he said.

On the weekly contracts, put writing is seen at 18,000 and 17,900 today. That means the Nifty can take support at these two levels. Call writing also took place at 18,000 and 18,100 levels.

Analysts have advised traders to stick to weekly contracts as the earnings season will induce volatility in the market from the next week which may turn into a loss when trading monthly contracts.

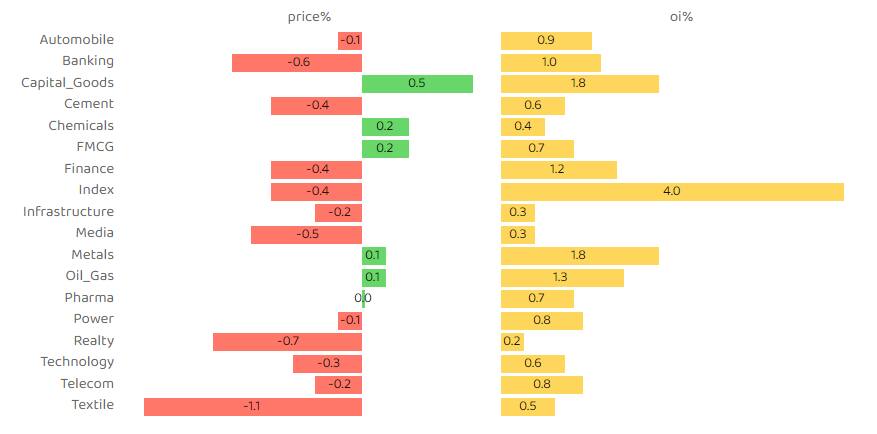

The sectoral trend was mixed. Capital goods, chemicals, FMCG and Oil and Gas saw long buildup – a bullish sign when open interest (OI) and prices rise in tandem. Others like banking, technology, textile and finance saw short buildup – a bearish sign when prices fall but OI rise.

Opportunities were present in individual stocks. Long buildup was seen in Astral, which Manish Shah, an independent trader and analyst, said can be a good intraday buy above Rs 2060. Shah also said for 4-5 day horizon, HDFC AMC and Metropolis Healthcare where there is positive setup.

Coal India was the biggest volume-led loser in the spot market. In the derivatives market as well, the stock was badly bruised with massive short building up in the counter. Short building was also seen in LIC Housing Finance, Vodafone Idea, IndusInd Bank and AU Small Finance Bank.

Disclaimer: Trading in futures and options markets is extremely risky. Traders and experts mentioned above may not be SEBI registered. Hence trades they have taken should not be construed as investment or trading advice. Please consult a financial adviser before taking any trades.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.