The market entered December riding on a euphoria of sorts. The upbeat sentiment, as it is traditionally said, was perceived to be the Santa Rally that indicates a buying binge in the market around Christmas. But as the holidays neared, the buzz seems to have fizzled out.

The benchmark indices stayed on the downhill after scaling their all-time highs on December 1. The BSE Sensex has lost nearly 4 percent, while NSE Nifty fell over 3 percent. The indices are at their one-month lows now. The Nifty is now trading below the 20-day moving average level.

The culprits for this reversal in trend are many – more hawkish-than-expected tone of the US Fed, overvaluation of the Nifty compared to global peers, geopolitics, and profit-booking and so on.

The Federal Reserve’s updated projections for December show that most policymakers expect the terminal policy rate to exceed 5 percent in 2023. This is in contrast to the projections in September when no policymaker saw rates exceeding 5 percent in 2023.

Higher interest rates for a long period are bad for the US economy. Most analysts and economists expect the US to enter a mild recession but if the Fed keeps raising rates, the recession could be sharper than expected.

The commentary had a negative impact on markets the world over. S&P 500 has fallen over 5 percent so far, Nasdaq 100 over 6 percent, DAX 5 percent each, and Nikkei nearly 4 percent.

The ongoing slip-up in the Indian market is remarkable because even before December other markets were volatile, while Indian indices had shown resilience, and rose to their all-time high levels. Analysts attributed this to “decoupling”.

Now, the Indian market seems to have de-decoupled and fallen in tandem with the world market. What has worsened the situation is the valuation of Indian stocks that are at a large premium to other markets, and even its own valuations in the past.

The Nifty current valuation is at an 11 percent premium to the long-term average of 18.8 times, underlined, Amish Shah, Head of India Research at BofA Securities. He expects earning cuts for some crucial sectors as well.

“Based on how macro things play out, we expect the Nifty to trade in a range from 17,000-20,000. In our base case we value Nifty at 21.5 times with a target of 19,500,” Shah said.

As the West enter a recession, analysts see some negative impacts on the revenue of Indian companies. Though domestic consumption will likely be strong, the Nifty’s export earnings – which is 21 percent of its total earnings – will likely see some drawdown.

Accordingly, analysts have forecast a difficult first half of the next year.

“The Indian market could take a breather in the first half of next year due to higher relative valuation compared to other major markets,” said Deepak Jasani, Head of retail research, at HDFC Securities.

FII exodus

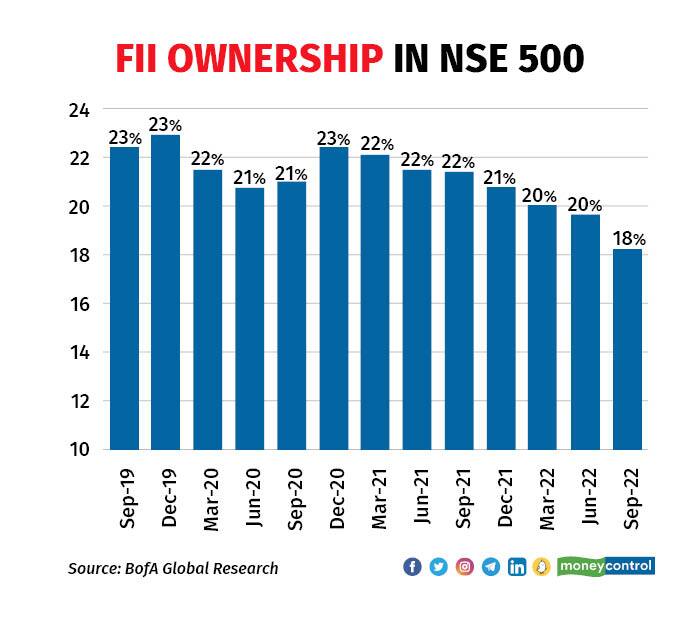

Foreign investors have been bearish on India throughout this year, barring a couple of months where there was some inflow. Data hosted at NSDL shows they have net withdrawn 1.22 lakh crore from equities so far in 2022.

Also read: Selling spree sends FII ownership in NSE50 to a multi-year low of 18%

The trend may continue next year, as well as most, do not see much net inflow to India, if any. However, this does not mean foreign money will not flow to India. It may go to debt, said analysts, which looks better suited compared to equities for next year.

Fund managers have also started aligning their portfolio accordingly. Those making investment decisions at ICICI Prudential recommended gearing the portfolio towards debt for next year. Institutional analysts at BNP Paribas also concurred.

Pecking order

Since volatility will be the mainstay of the market from hereon, analysts believe you should focus your equity investments on the domestic consumption story, especially those companies catering to higher-end customers.

Abhiram Eleswarapu, Head of Equities at BNP Paribas Securities India, said the Indian economy is seeing a K-shaped recovery where growth for low-value categories is slowing while for those selling high-value items is increasing.

“We won't touch anything related to the mass consumption story right now Because not only are they very expensive, but growth is also slowing,” he told Moneycontrol, adding that, for instance, those selling two-wheelers are ‘avoid’ while those selling cars are a ‘buy’.

Among others, money managers at ICICI Prudential AMC are bullish on manufacturing. BNP Paribas sees Railways and defence among favorable investments. BofA Securities has its eyes set on banks, insurance and financials, cement, and steel.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.