For some, trading comes as their first love, while for others it becomes their last ― both have their own charm. If the former is characterised by innocence, the latter is perhaps a sign of maturity.

Seema Jain (@seemajain2017), a Gurugram-based teacher turned trader, falls in the second bracket. She confesses that she became a trader pretty late in her career ― in her early 40s ― and has been fascinated by it ever since. Now, for the last 15 years, she’s been a full-time trader.

Jain, who is among a small community of active women traders in the country, has a PhD in Physics from IIT-Delhi. Even after tasting blood on Dalal Street, the teacher in her refuses to let go. Thus, earlier while she used to coach students for competitive exams, now she coaches budding traders to make it big in the stock market.

Best of both worlds

Jain has not just found success in trading, but has also identified a number of multi-baggers during her journey in the stock market. The 56-year-old is also a Securities and Exchange Board of India (SEBI)-registered research analyst.

Jain said Adani Total Gas (recommended at Rs 390), Aavas Financiers (recommended at Rs 650), and Tata Elxsi (recommended at Rs 1,900) are some of her recent multi-bagger picks.

Even when trading, she has not confined herself to a single style. She actively pursues both swing trading, where she takes positional trades, and intraday trading, where she makes a quick buck from small moves in prices. She does not stick to a single scrip or index but trades wherever there is opportunity to make money.

Keep it simple, silly

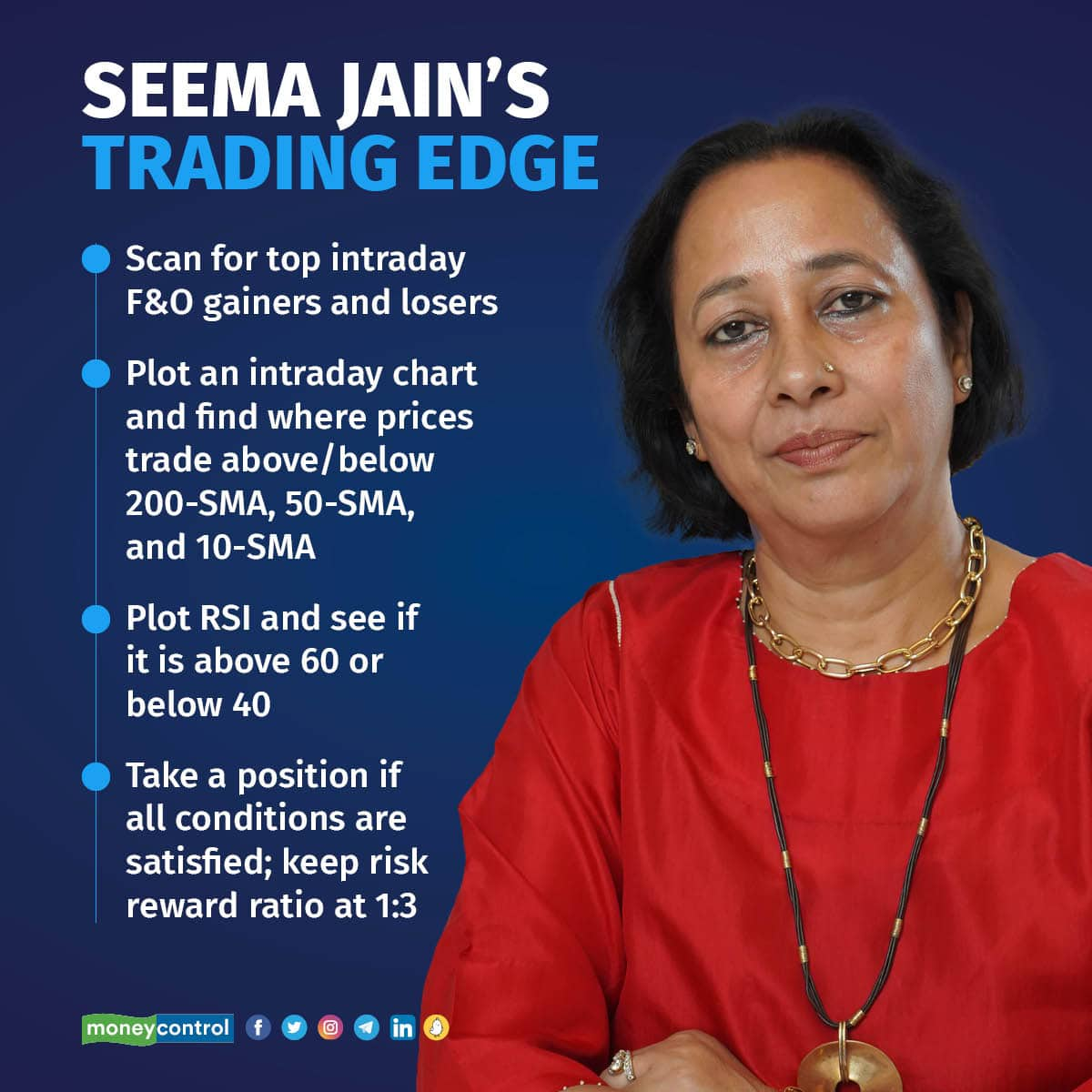

Her trading strategy is very simple and the set-up she uses has just two indicators ― simple moving average (SMA), and relative strength index (RSI). SMA is an indicator that shows the ongoing trend in the market, while RSI is a momentum indicator used by traders and technical analysts.

Jain confesses that her trading style has not changed much since she started her trading career. It is the same as what she learned initially. Her style of trading utilises trend (signalled by SMA) and momentum (signalled by RSI). The 56-year old proclaims: if trend is a trader's friend, momentum is a bigger friend.

Her set-up for intraday trades is as follows:

Step 1: Scan top intraday F&O gainers and losers of the day on the NSE website.

Step 2: Start from the top of either list and plot an intraday chart with candle size at 5 minutes.

Step 3: Find where prices are trading above (or below) 200-SMA and 50-SMA, and have just crossed above (or below) 10-SMA.

Step 4: Plot RSI and see if it is above 60 (for buy trade) or below 40 (for sell trade). Avoid trading if RSI is between 40 and 60, and move to another stock.

Step 5: If all conditions are satisfied, take a position with an intraday target at 1-1.5 percent of the securities' price (for example, if a stock is trading at Rs 1,000, target should be 10 or 15 points above the point of entry). Stop loss should be 0.5 percent of the price.

Step 6: Exit the trade when the price hits either stop loss or target.

Set-up for swing trades

Step 1: Go through the scanner provided at this link. Or you can also set up your own scanner using a similar concept.

Step 2: Start loading charts for the stocks this filter throws up.

Step 3: If prices are trading above or below all three SMAs, make sure RSI also trades above 60 or below 40, respectively, on monthly, weekly and daily timeframes (readymade filter here). Avoid trading if RSI is between 40 and 60.

Step 4: If all conditions are satisfied, take a long or short position with a target at 10 percent of the securities' price and stop loss at 5 percent of the price. You can adjust stop loss if your risk-reward ratio is lower.

Step 5: Exit trade when either stop loss or target is hit.

Unlike some traders who prefer to trade during opening or closing hours to make the best of volatility, Jain prefers to trade between 10 am and 11 am, when the market has already set a tone. Her intention is to make the best use of the tone of the market.

Risk management

Jain usually trades with a risk-reward ratio of 1:2 or 1:3. This means for every assumed risk of Re 1, the trade needs to deliver profit of Rs 2 or Rs 3.

She said, in a day she takes 2-3 trades. The number can go higher if earlier trades go in her favour.

She believes in keeping expectations low, and achieve high. Thus, her expected monthly returns from the intraday set-up explained above is 10-15 percent.

She advises to keep the position size low ― one to three lots ― in case the market is trading sideways. But if the market is trending, you can take bigger positions.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.