BUSINESS

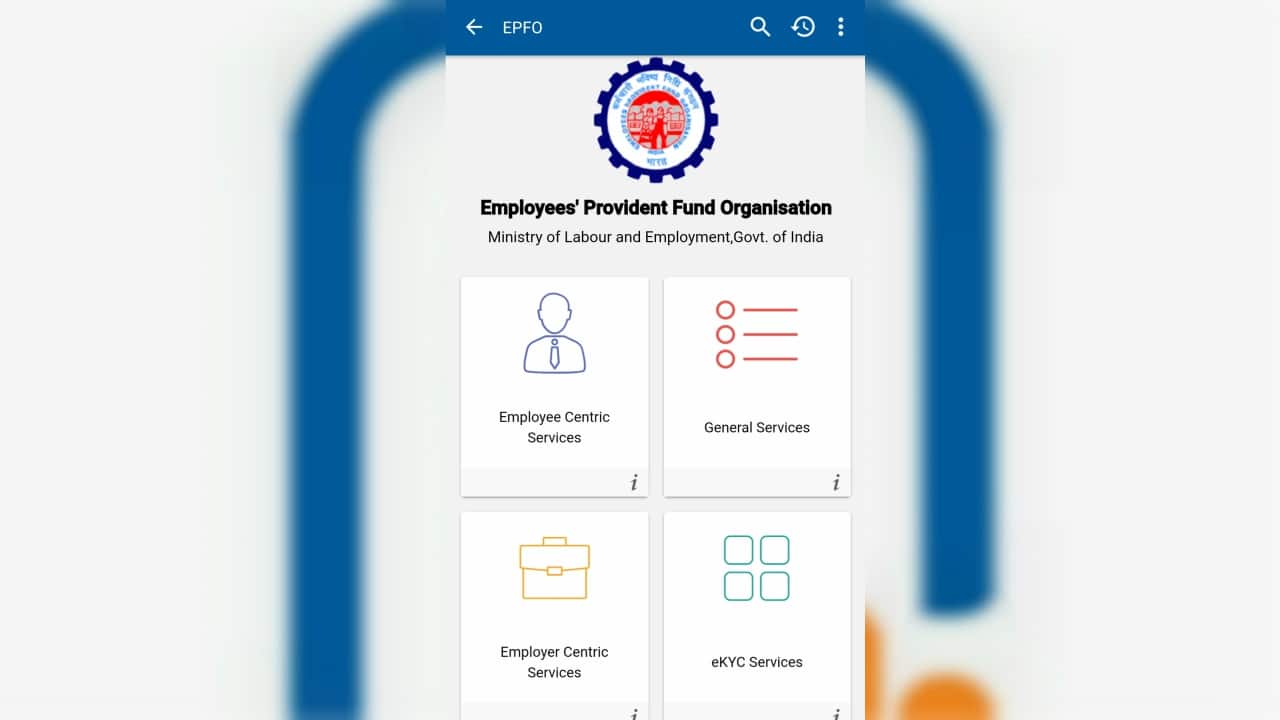

COVID-19 EPF advance 2.0: Should you withdraw your PF?

Withdrawal option allowed last year extended; will also cover those affected by Mucormycosis

BUSINESS

COVID-19: Do health policies cover tests done at private labs?

Not all such tests will be covered by your health insurance

BUSINESS

RBI’s moratorium: Don't stop your loan EMIs if you can afford to pay

Know how to make the most out of RBI’s relief package for borrowers

BUSINESS

RBI moratorium: How does the rate cut help you? 8 questions answered

Rate reductions and a three-month EMI moratorium come as big relief for borrowers in the time of coronavirus.

BUSINESS

FM Presser: Tapping your PF corpus for contingencies made easier

However, financial planners recommend using this as the last resort, only after other options have been exhausted

BUSINESS

Which tax regime? A five-step guide for you to make a choice

The ‘simpler’ tax regime comes with embedded complications, triggering confusion rather than a sense of relief

BUSINESS

Budget 2020: New tax slabs without exemptions announced

For someone earning Rs 15 lakh, the tax payable will come down from Rs 2,73,000 to Rs 1,95,000

BUSINESS

Tax benefits that come with investing in the NPS

Given the importance being accorded to the NPS by the central government, it is likely that its structure will only get friendlier in the future

BUSINESS

Uncleaned credit cobwebs of the past could muddy future loan prospects

In several instances, the borrower gets to know of the impaired credit history only while applying for a new loan

BUSINESS

The long and short of capitals gains tax

Sold your mutual fund units, gold or house property? Understand how the gains and losses are taxed

BUSINESS

IRDAI’s draft norms: Push towards clearer and standardised insurance documents

The regulator’s aim is to ensure that policyholders know what they’re getting to at the time of buying a cover.

BUSINESS

Paying a home loan EMI or staying on rent? Know the tax benefits

Just as you can claim deduction on principal repaid under section 80C, section 24(b) gives tax relief on interest paid during the year

BUSINESS

Brace for more disclosures in the I-T return forms

The income tax department has released forms ITR-1 and 4. Others could follow soon

BUSINESS

Six avenues to reduce your tax outgo

Know the various provisions that can help you optimise tax benefits on offer

BUSINESS

Do the insurance regulator’s standard health product guidelines benefit you?

From April 1, all general and health insurers will have to offer a standardised health product.

BUSINESS

Six smart money management strategies for 2020

You must chalk out a plan to deal with challenges that a weak economic environment brings in its wake

BUSINESS

Received a tax notice related to capital gains? Here is how you should respond

Taxpayers must respond online to the notice received and check the status constantly

BUSINESS

Before buying a policy, check the insurer's claims settlement ratio

At your end, ensure that you do not make any wrong declarations while filling up your proposal form

BUSINESS

Savers may fall short of retirement goals despite having financial plans: Standard Chartered Wealth Expectancy Report

A little less than a third (32 per cent) are on track to achieving more than half their goal by the age of 60

BUSINESS

Here are some lesser-known benefits of PPF

A subscriber will not have to forgo the amount invested even if other assets are repossessed by lenders or have to be liquidated to pay off dues

BUSINESS

How the new PPF rules affect your investments

While most provisions are part of the existing rule manual too, the recent notification has introduced a few modifications.