Money is important. And the start of a new year is generally a good time to make some solid resolutions to manage your finances. While you need not take any giant leaps, you must start with some simple steps to manage your money well. Here are six simple measures.

Continue to invest systematically

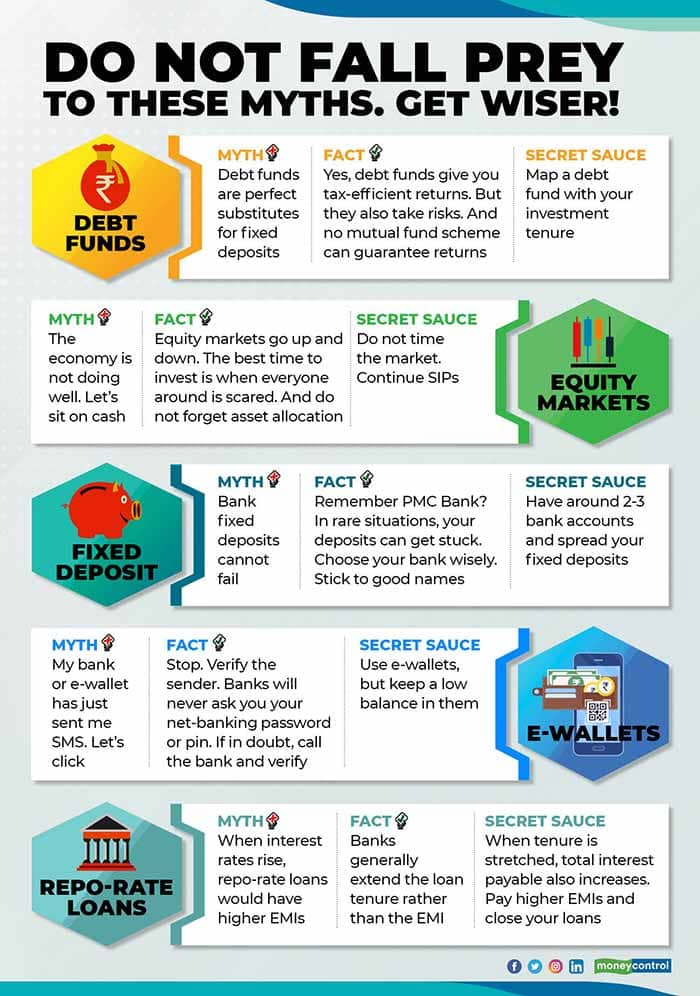

Markets have been volatile. In 2019, the S&P BSE Sensex delivered around 14 percent, but the BSE Midcap index lost two percent and the BSE Small Cap index fell six percent. In fact, just 15 of the Sensex’s 30 stocks contributed meaningfully; the rest of the companies’ shares gave mediocre returns or lost money in 2019. These are slim pickings and, quite naturally, our fund managers have been facing challenging times.

But here’s some good news. According to a recent Association of Mutual Funds in India (AMFI)-CRISIL study, the chance of your investments earning negative returns is nil if the holding period is five years. On the other hand, it is as high as 25 per cent if the horizon is just one year. It is always recommended that investors opt for equity mutual funds through systematic investment plans (SIP) with a horizon of five to seven years.

Fortunately, investors understand this. In 2019, despite volatile markets, investors have continued with their SIPs. Monthly contributions through the SIP route stood at Rs 8,273 crore in November 2019, marginally up from Rs 8,246 crore in October.

“There is no reason, especially for salaried employees with monthly cash inflows, to stop SIPs. If the money stays put in your savings account, it will not fetch returns capable of beating inflation,” says Amol Joshi, Founder, PlanRupee, a financial planning firm. If your equity SIPs are linked to long-term goals, then stopping SIPs would mean setting your financial plan back by years.

Continue your SIPs in 2020 as well.

Choose your bank wisely, diversify

The logic of opening a bank account just because the branch is at the ground floor of your residential apartment or right next to your society, has gone a toss. Most customers of Punjab and Maharashtra Co-operative (PMC) Bank had opened accounts in the bank because the branches were conveniently located and the staff served them with a smile over the years. The bank’s books, however, were allegedly cooked over the years and sadly the customers didn’t smell the stench till the bubble burst.

The Reserve Bank of India (RBI) suspended the troubled bank’s operations, leaving lakhs of depositors in a lurch. Though it has eased restrictions on withdrawals over time, many depositors’ funds continue to be stuck. The biggest lesson of 2019: banks can also go bust.

While we can agree that not many banks have gone bust over the years, the reality is that there are no guarantees. “For one, do not be swayed merely by the additional half or one percentage point interest rate. The financial strength of the bank should be the primary factor,” advises VN Kulkarni, former banker and financial counsellor. You could also look at spreading out your deposits across two or three banks. This will provide protection against a PMC Bank-like crisis, where the deposit insurance cover cannot be invoked at the moment as the bank is not facing liquidation yet.

Switch to repo rate-linked loans

The State Bank of India’s new retail floating-rate loan borrowers will start the year with lower interest burden. The public sector bank has reduced its repo-linked lending rate (RLLR) by 25 basis points with effect from January 1, 2020, following RBI’s repo rate cut in October. A basis point is one-hundredth of a percentage point. Retail borrowers who took floating rate loans after October 1 will benefit from SBI’s rate revision.

The likes of Union Bank of India and Bank of Baroda (BoB) had already slashed rates in November, in line with the central bank’s move. If you plan to take a fresh loan in 2020, the interest rate will be automatically tied to an external benchmark – as mandated by the RBI.

While most banks have picked the repo rate as their external benchmark, Citibank has chosen Treasury Bill yields. If you had borrowed prior to October 1, 2019 (the date on which the repo-rate loan was made compulsory for new borrowers) and are servicing Base Rate or Marginal Cost of Funds-based Lending Rate (MCLR), you should switch to RLLR, even if it means shelling out a one-time administration charge. “The new mechanism ensures transparency, which was lacking in the earlier interest rate regimes,” says Kulkarni.

Get ready for your loan rates to move dynamically. A word of advice: if your loan rates go up, it’s best to pay a higher EMI and pay off your loan soon. Keeping the EMI constant and increasing your tenure (your bank could offer this choice) is false comfort. In the end, you will end up paying a higher amount as interest.

Create a larger emergency corpus

The collapse of Jet Airways this year rendered thousands of staffers unemployed. While many were absorbed by other corporates, several others continue to grapple with loss of income. From leading comfortable lifestyles – and spending beyond their means in quite a few of these cases – they had to take to the streets and demand their unpaid salaries.

A weak economic period such as the one we’re going through at the moment could throw some more shocks. And it pays to be prepared. In 2020, you must chalk out a plan to deal with such challenges. As a thumb rule, you must set aside at least six months’ household expenses in a secure, liquid instrument. This year, however, you could look at building a bigger contingency kitty. “Review your current situation, including health situation in the family, job scenario in your sector and goals that are approaching and increase the threshold, if required,” says Rohit Shah, CEO and Founder, Getting You Rich.

The amount can be parked in fixed deposits or ultra-short-term debt funds. It must be capable of paying your monthly bills, EMIs, insurance premiums, mutual fund SIPs and children’s school fees for up to 9-12 months. “However, you need to take your personal situation into account. A double-income family can do without such a large kitty. However, if you are also taking care of your elderly parents, you need to create a dedicated emergency fund to cover their household as well as routine medical expenses,” says Pankaj Mathpal, Founder, Optima Money Managers.

Buy adequate health insurance

Insulating your family against financial shocks that medical emergencies can bring about is yet another resolution you ought to make. Given the rising cost of healthcare expenses, a Rs 3-5 lakh health cover may not suffice. “A coronary bypass surgery can set an individual back by at least Rs 5-10 lakh, depending on the hospital and his medical conditions. The cost of cancer treatment will fall in the same range,” points out Nikhil Apte, Chief Product Officer, Royal Sundaram General Insurance. Many assume that their employers’ group scheme and a basic independent cover of Rs 3-5 lakh are adequate. “Many believe they will need higher covers only when they age and that they can enhance their sum insured later. What they do not realise is they will develop health issues as they age, making it difficult to increase the cover then,” he adds. It is best to buy a large cover when you are young and healthy.

However, do not buy a single, large cover. Instead, opt for a base sum insured of Rs 5 lakh and add a top-up cover of Rs 10 lakh to your portfolio. You can look at critical illness covers too. The latter, typically, are fixed benefit plans where a pre-agreed sum is handed out upon diagnosis of the illness. It can be used to cover recuperation costs as also expenses not covered by your base policy. Critical illness policies that cover 10-15 ailments offer more comprehensive protection than disease-specific covers that take care of merely two-three ailments such as cancer, cardiac and renal failures.

Protect yourself against frauds

As more people take to their mobile phones for money transactions, the chances of digital frauds increase. Some end up paying money to scammers through their bank UPI app when, in fact, they are meant to be the recipients. Then, there are others who unwittingly share their bank account or card details and PIN to swindlers posing as banking officials. Phishing emails masquerading as official emails from banks or the income tax department also lured many into divulging such details.

In 2020, resolve to be more vigilant. Never share your bank, card, CVV, OTP and PIN with anyone. Shun unsecure links, emails and calls seeking such details, even if they seem authentic.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!